Revealed: Bybit’s Impressive December Reserve Ratios Prove Unwavering Security Commitment

BitcoinWorld

Revealed: Bybit’s Impressive December Reserve Ratios Prove Unwavering Security Commitment

In the often turbulent world of cryptocurrency, trust is the most valuable asset. Bybit, a leading global crypto exchange, has just reinforced that trust by publicly announcing its December reserve ratios. The latest data reveals a powerful story of security and stability, showing the platform maintains significant over-collateralization across dozens of major cryptocurrencies. For users concerned about the safety of their digital assets, this transparency is not just reassuring—it’s essential.

What Do Bybit’s Reserve Ratios Actually Mean?

Simply put, a reserve ratio shows how much cryptocurrency an exchange holds in its reserves compared to what its users have deposited. A ratio of 100% means the exchange holds one unit of an asset for every unit its users own. Therefore, when Bybit announces reserve ratios ranging from 100% to 160%, it confirms the platform holds all user funds, plus an extra safety buffer in many cases. This practice, known as over-collateralization, is a cornerstone of financial security in the crypto space.

Breaking Down Bybit’s Key Reserve Figures

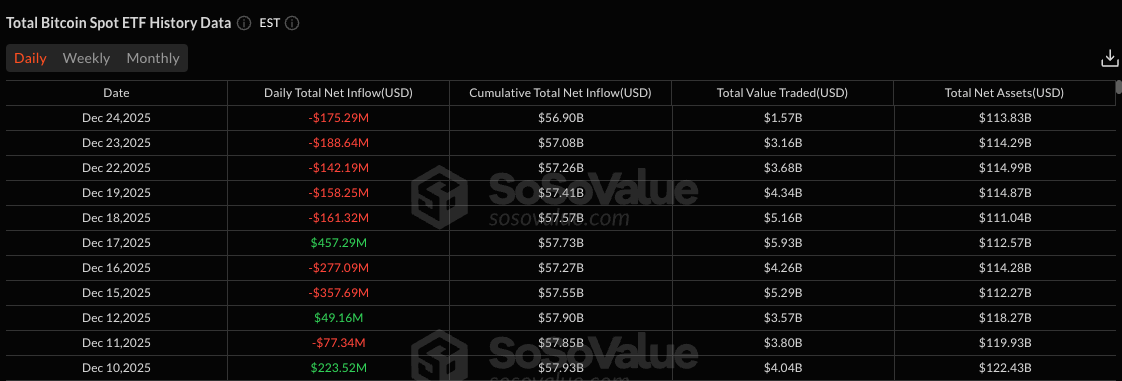

The data snapshot from December 17th provides clear evidence of Bybit’s robust financial health. Let’s examine the reserve ratios for some of the most prominent assets:

- Bitcoin (BTC): 105%

- Ethereum (ETH): 101%

- XRP: 101%

- Solana (SOL): 103%

- Tether (USDT): 102%

- USD Coin (USDC): 112%

These figures are not just numbers on a page. They represent a tangible commitment. For instance, the 105% Bybit reserve ratio for Bitcoin means that for every 1 BTC a user holds on the platform, Bybit safeguards 1.05 BTC in its reserves. This extra 5% acts as a critical financial cushion.

Why Should Crypto Traders Care About Over-Collateralization?

Transparency around Bybit reserve ratios directly addresses one of the central anxieties in cryptocurrency: counterparty risk. History has shown that exchanges operating without sufficient reserves can face catastrophic failures, potentially locking users out of their funds. Bybit’s consistent publication of these ratios, verified through Merkle Tree proofs, allows users to independently verify the platform’s solvency. This builds a foundation of trust that is vital for a healthy trading environment.

Furthermore, this practice demonstrates responsible financial management. Maintaining reserves above 100%, especially for stablecoins like USDC at 112%, shows proactive risk management. It prepares the exchange to handle potential market volatility or sudden withdrawal requests without compromising user assets.

How Do Bybit’s Reserve Ratios Compare to Industry Standards?

Following the collapse of several major platforms, the industry has moved toward a new standard of proof-of-reserves and transparency. Bybit is positioning itself at the forefront of this movement. While many exchanges now provide some form of attestation, the consistent publication of detailed, asset-specific Bybit reserve ratios sets a high bar. It goes beyond a simple “yes, we have the funds” to show exactly how much extra protection exists for each cryptocurrency.

The Bigger Picture: Security Beyond Just Reserves

It’s important to remember that strong Bybit reserve ratios are one part of a comprehensive security framework. Users should also consider an exchange’s track record, regulatory compliance, and technological safeguards like cold storage and insurance. However, transparent reserve data is arguably the most direct indicator of an exchange’s financial integrity and its commitment to protecting user capital above all else.

Conclusion: A Benchmark for Trust and Transparency

Bybit’s December reserve report does more than just share statistics. It sends a powerful message about the exchange’s operational philosophy. In a sector where trust must be earned daily, this level of transparency is a significant competitive advantage. For traders and investors, it provides peace of mind, knowing their assets are not only present but protected by a substantial financial buffer. As the crypto industry matures, this practice of regular, detailed reserve disclosure will likely become the non-negotiable standard that all legitimate platforms must meet.

Frequently Asked Questions (FAQs)

What is a reserve ratio in cryptocurrency?

A reserve ratio is the percentage of user deposits that an exchange holds in its secure reserves. A ratio of 100% or higher means the exchange holds all user funds (and possibly more), ensuring it can fulfill all withdrawal requests.

How often does Bybit publish its reserve ratios?

Bybit publishes updated reserve ratio data regularly. The latest announcement covers the snapshot from December 17th, continuing their commitment to periodic transparency updates.

Why is USDC’s reserve ratio (112%) higher than others?

A higher ratio for a stablecoin like USDC may indicate a more conservative approach to managing that specific, high-volume asset. It provides an additional safety net to manage liquidity and redemption requests smoothly.

Can users verify Bybit’s reserve claims?

Yes. Bybit uses Merkle Tree proofs, a cryptographic method that allows users to independently verify that their funds are included in the total reserves published by the exchange.

Does a 100% reserve ratio guarantee complete safety?

While a 100% or higher ratio is a critical indicator of solvency, overall platform safety also depends on other factors like cybersecurity, operational controls, and regulatory standing.

What happens if an exchange’s reserve ratio falls below 100%?

A ratio below 100% would mean the exchange does not hold enough assets to cover all user deposits, posing a significant risk of insolvency and potential loss of user funds if many withdrawals occur.

Found this breakdown of Bybit’s financial health helpful? Share this article with fellow crypto enthusiasts on Twitter, LinkedIn, or Telegram to spread awareness about the importance of exchange transparency and reserve security. Knowledge is power in the digital asset space!

To learn more about the latest trends in cryptocurrency exchange security and regulation, explore our article on key developments shaping institutional adoption and user protection standards.

This post Revealed: Bybit’s Impressive December Reserve Ratios Prove Unwavering Security Commitment first appeared on BitcoinWorld.

You May Also Like

My Furnace is Making a Strange Noise. A Modesto HVAC Diagnostic Guide

The Importance of a Carbon Monoxide Check During a Furnace Repair in Abingdon, VA