Bitcoin price remains range-bound as liquidity builds: Breakout near?

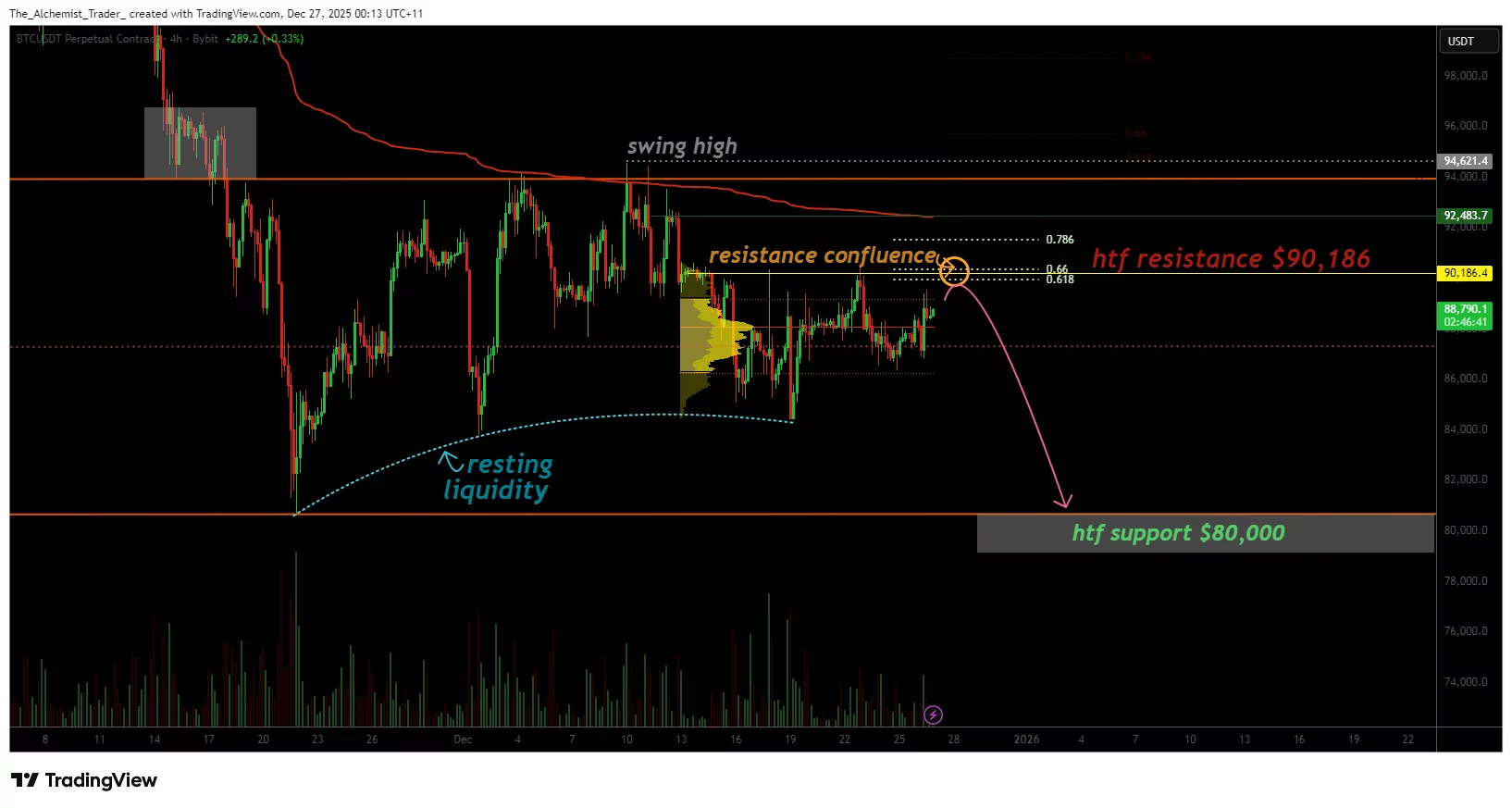

Bitcoin price remains locked in a tight range between $80,000 and $90,000 as liquidity builds on both sides, increasing the likelihood of a sharp breakout once the balance breaks.

- BTC continues to consolidate between high-time-frame support at $80,000 and heavy resistance near $90,000.

- Failed breakouts at resistance and untapped resting liquidity suggest a rotation within the range, setting the stage for a larger move once liquidity is cleared.

- A sustained move above $90,000 with volume would signal bullish continuation.

Bitcoin (BTC) price continues to trade in a clearly defined range, with price action compressing between high-time-frame support at $80,000 and high-time-frame resistance at $90,000. Despite multiple attempts to push higher, Bitcoin has failed to break through resistance, keeping the market in a state of balance.

This prolonged consolidation suggests that liquidity is building, a condition that often precedes a significant directional move.

Bitcoin price key technical points

- Strong resistance cluster near $90,000, reinforced by multiple technical confluences.

- Range support holds at $80,000, where resting liquidity remains untested.

- Liquidity buildup increases breakout potential, though direction remains undecided.

Bitcoin’s current range-bound behavior is defined by a dense resistance confluence near $90,000. This zone combines the VWAP, a key daily resistance level, and the 0.618 Fibonacci retracement, creating a technically heavy area that has repeatedly rejected price. Such confluence zones often act as reversal points, particularly when price approaches them without strong volume or momentum.

Over the past several sessions, Bitcoin has tested this resistance region multiple times, only to be rejected on each attempt. These failures indicate that sellers remain active at higher levels and that buyers have yet to demonstrate the conviction needed to push price into a higher value area. As a result, price continues to rotate lower after each rejection, reinforcing the broader consolidation structure.

Below current price, a series of swing lows has formed, creating pockets of resting liquidity. Resting liquidity refers to areas where stop orders and unfilled orders remain, often acting as magnets for price. In Bitcoin’s case, much of this liquidity sits closer to the $80,000 support level, which has not yet been fully tested during the current range.

This imbalance between heavy resistance overhead and relatively untapped liquidity below increases the probability of a rotation back toward range support. Markets often move toward areas where liquidity is concentrated, particularly when attempts to break resistance fail repeatedly. A move toward $80,000 would allow Bitcoin to clear this resting liquidity and maintain the integrity of the broader range.

From a market auction perspective, Bitcoin is currently in a state of balance. Buyers and sellers are largely matched, resulting in sideways price action rather than directional movement. This balance, however, is unlikely to persist indefinitely, especially as Bitcoin bulls face a critical test through Lugano’s real-world payments push, while price continues to compress within the range, volatility contracts, and pressure builds.

Importantly, range-bound conditions often lead to false breakouts before a sustained move develops. Short-term breakouts above or below resistance may occur as liquidity is tested, but without follow-through and acceptance, these moves can quickly reverse. This dynamic is common in mature consolidation phases where market participants are positioned on both sides of the range.

A decisive breakout will require acceptance outside of the range. On the upside, this would mean Bitcoin reclaiming and holding above the $90,000 resistance zone on a closing basis, supported by strong volume. Such a move would indicate that buyers have absorbed sell-side pressure and that price is ready to explore higher levels.

On the downside, a clean break below $80,000 would signal acceptance at lower prices and likely accelerate selling as resting liquidity is taken out. Until one of these scenarios unfolds, Bitcoin’s price action is expected to remain rotational.

What to expect in the coming price action

Bitcoin is likely to remain range-bound between $80,000 and $90,000 as long as resistance holds and support remains intact. Continued liquidity buildup increases the probability of a breakout, but traders should remain cautious of short-term false moves until price establishes acceptance beyond the current range.

You May Also Like

Fed Decides On Interest Rates Today—Here’s What To Watch For

Markets await Fed’s first 2025 cut, experts bet “this bull market is not even close to over”