Will Ethereum Hit $3K Following Tom Lee’s $1B ETH Stake Ahead of Trump-Zelensky Meeting?

The Ethereum price edged up a fraction of a percentage in the past 24 hours to trade at $2,939 as of 01:49 a.m. EST, with trading volume dropping 44% to $7.9 billion.

ETH continues to flirt with the $3,000 zone as big financial institutions bet big on the altcoin king.

Tom Lee’s BitMine Immersion Technologies has intensified its bullish sentiment for the price of Ethereum and its ETH strategy, after staking a total of 342,560 ETH, valued at around $1 billion.

BitMine is one of the largest digital asset treasury companies, which has set a target of holding around 5% of Ethereum’s supply. The company currently holds over 4 million ETH tokens, which is approximately 3.4% of the Ethereum total supply.

The crypto market is watching certain global developments which are likely to shape the market sentiment this week, which could in turn affect the price of the second-largest crypto by market capitalization, one being the Zelensky-Trump meeting.

Russian forces hit Ukraine’s capital and key energy facilities with a massive airstrike on the eve of talks between Ukrainian President Zelensky, and US President Trump.

The meeting on Sunday is set to take place in Palm Beach, Florida, in pursuit of a deal to end Russia’s nearly four-year invasion.

Ethereum Price Faces Indecision Within a Consolidation Zone

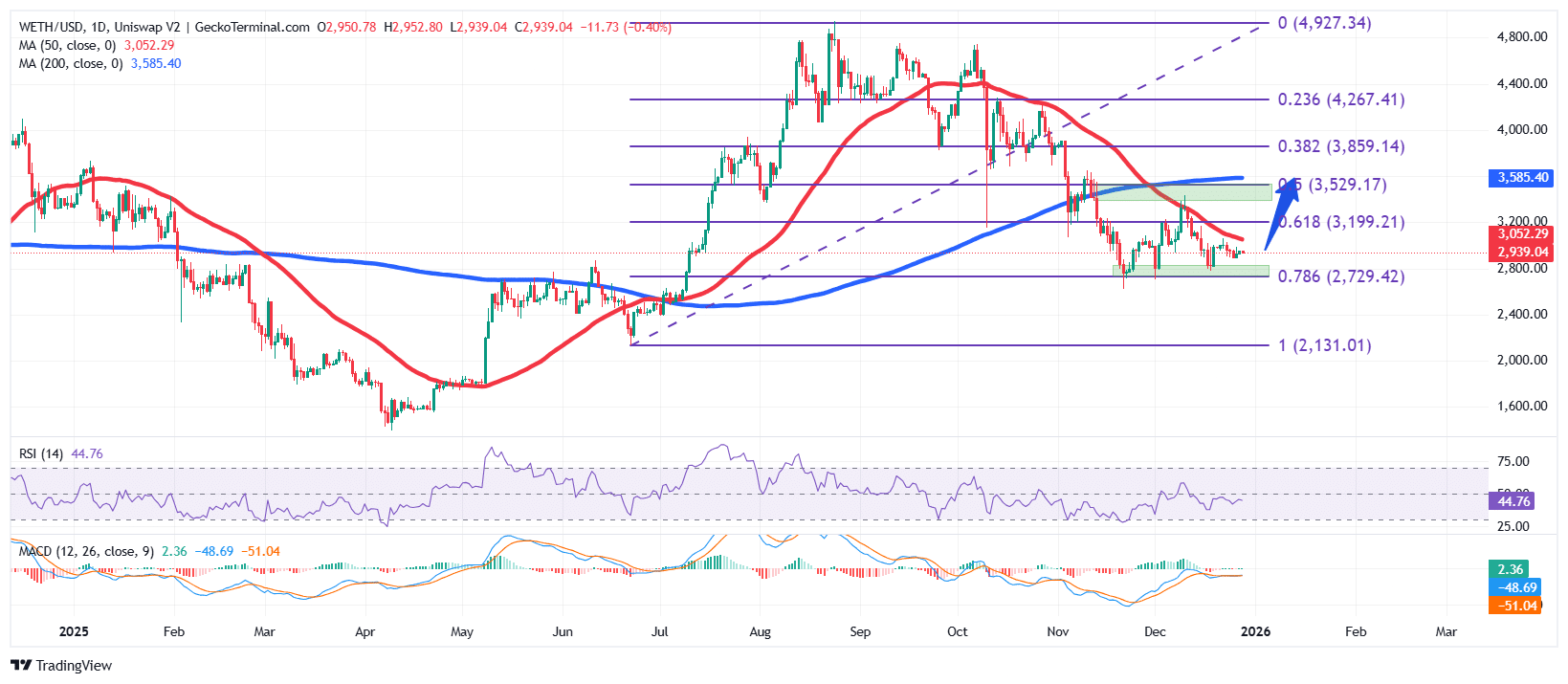

The ETH price bulls are currently showing indecision after ETH formed a rounded top structure earlier in the year, having reached a cycle high near $4,927 before losing momentum.

Following the rejection from this high, Ethereum underwent a prolonged correction, completing the rounded top pattern and declining sharply toward the $2,700 support zone, which aligns with the 0.786 Fibonacci retracement level.

This support region has since acted as a strong demand area, keeping the Ethereum price action compressed within a sideways consolidation range, while upside attempts have been capped below the $3,300 resistance zone.

ETH remains under bearish pressure after forming a death cross earlier in the decline, with price still trading below both the 50-day Simple Moving Average (SMA) ($3,052) and the 200-day SMA ($3,585).

Moreover, the Relative Strength Index (RSI) on the daily timeframe is currently around 44, having moved slightly higher from recent lows.

This suggests momentum is stabilizing but remains below the neutral 50 level, indicating the price of ETH is still trading within a neutral-to-bearish zone rather than a confirmed bullish sentiment.

ETH/USD Chart Analysis Source: GeckoTerminal

ETH/USD Chart Analysis Source: GeckoTerminal

ETH Price Prediction

According to the ETH/USD daily chart analysis, the ETH price is currently trading within a consolidation phase following a broader bearish correction.

If bulls successfully defend the $2,700 support area and build sustained demand, Ethereum could attempt a relief rally toward the $3,300 resistance, with a higher upside target near $3,550–$3,585, where the 200-day SMA and the 0.5 Fibonacci retracement converge.

However, if bearish pressure persists and the Ethereum price records a decisive daily close below $2,700, the next significant downside support lies near the $2,200 region, a prior support.

Related News:

You May Also Like

Why 2026 Could Be a Dream Year for Investors: And Where Bitcoin Fits In?

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC