Pepe price on the verge of a deeper dive as whales dump 70 million coins

Pepe price has been in a free fall over the past few months, moving from the year-to-date high of $0.00002800 to the current $0.0000041.

- Pepe Coin price has dived sharply in the last few months.

- Whales have continued dumping their tokens, a sign that they expect it to retreat.

- The coin has formed a head-and-shoulders pattern on the weekly chart.

Pepe (PEPE), the fourth-largest meme coin in the crypto industry, has plunged and erased over $8.33 billion in value. Its market capitalization has declined from an all-time high of over $10 billion to $1.7 billion.

The decline has coincided with the ongoing crypto market crash that has affected meme coins particularly hard. Data indicate that the market capitalization of all these tokens has declined from over $100 billion earlier this year to $42 billion today.

The Pepe Coin price has also declined, with third-party data indicating weak demand. Data compiled by CoinGecko indicates that spot market volume has decreased to $195 million.

The same has occurred with futures open interest, which has declined sharply over the past few months. It moved from the year-to-date high of nearly $1 billion to the current $240 million.

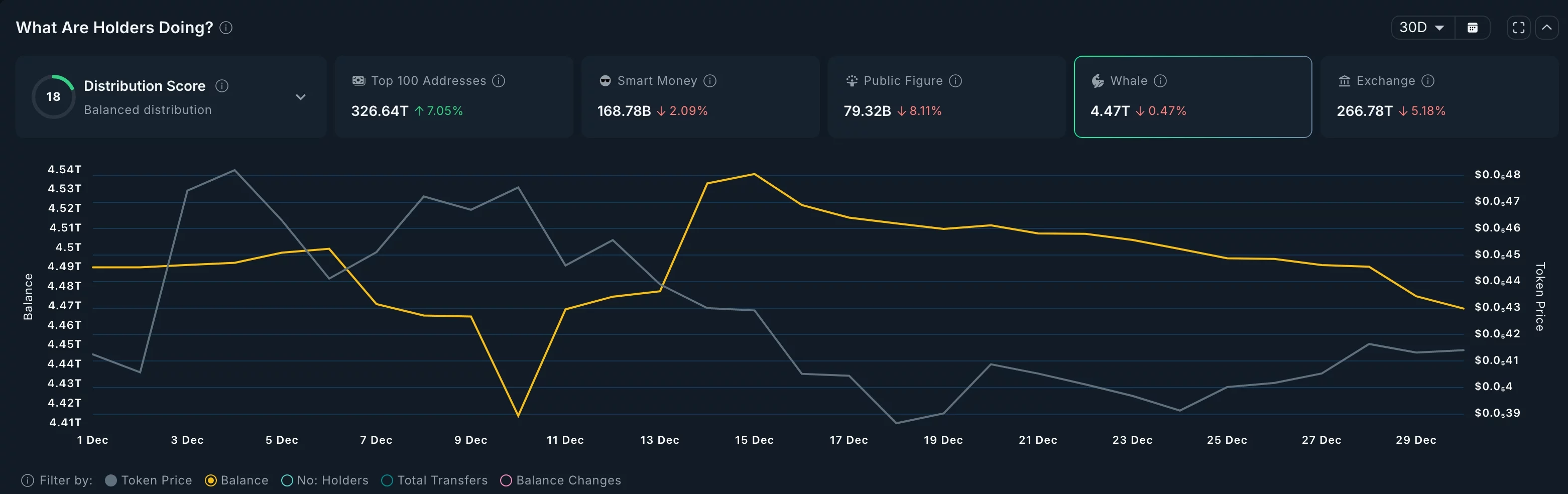

Meanwhile, whale investors have continued dumping the token in the past few weeks. Whale accounts now hold 4.47 trillion tokens, down by over 70 billion from this month’s high of 4.54 trillion.

Similarly, smart money investors have continued dumping their tokens. They now hold 168.78 billion tokens, down significantly from this month’s high of 172 billion.

Pepe price technical analysis

The weekly chart shows that the Pepe Coin price has crashed from the year-to-date high of $0.000028 to the current $0.00000415. It has moved below the 50-week moving average, while the Average Directional Index has jumped to 27. A rising ADX indicates that the downtrend is gaining strength.

The token has formed a head-and-shoulders pattern. It has already moved below the neckline at $0.000005610. Therefore, this pattern indicates further downside in the near term. The first main target for the token is $0.000002835, its lowest level in October.

A move below that level will indicate further downside, potentially to the support at $0.0000020.

You May Also Like

Trump Media received 260 BTC from Coinbase, worth $21 million.

Sei Enhances Market Infrastructure with Real-Time Data and Transparency