David Beckham’s Prenetics Stops All Bitcoin Purchases, Pivots Money to Wellness Brand

Bitcoin Magazine

David Beckham’s Prenetics Stops All Bitcoin Purchases, Pivots Money to Wellness Brand

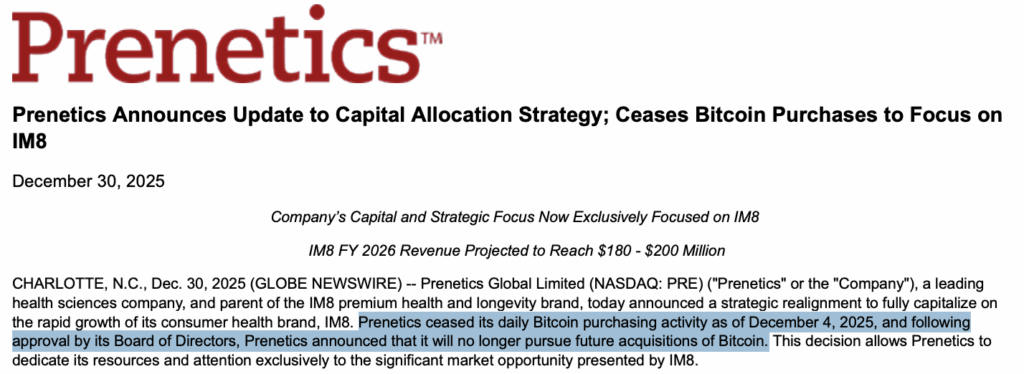

Prenetics Global Limited said it has ended its bitcoin purchasing program and will redirect its capital and strategic focus entirely toward IM8, its fast-growing consumer health and longevity brand co-founded with David Beckham.

The Nasdaq-listed health sciences company said it ceased daily bitcoin purchases on Dec. 4, following approval from its board of directors, and will not pursue future acquisitions of the cryptocurrency.

Prenetics will retain its existing holdings of 510 bitcoin as a treasury reserve asset but has committed not to allocate any new or existing capital toward expanding that position.

The move marks a clear shift away from a strategy the company adopted earlier this year, when several public firms began accumulating bitcoin as a treasury asset during a rising market. That trend has slowed in recent months as cryptocurrency prices weakened and investor focus returned to core operating businesses.

Prenetics said the decision reflects the rapid growth of IM8, which it described as the fastest-growing supplement brand in the industry’s history.

The company said IM8 surpassed $100 million in annualized recurring revenue within 11 months of launch and is projected to generate between $180 million and $200 million in revenue in fiscal year 2026.

“The phenomenal success of IM8 has exceeded all expectations and scaled much faster than our original expectations,” said Danny Yeung, Prenetics’ chief executive officer and co-founder. He said management and the board agreed that concentrating resources on IM8 offered the clearest path to long-term shareholder value.

Prenetics said it remains in a strong financial position, with more than $70 million in cash and cash equivalents, zero debt, and its existing bitcoin holdings intact. The company said that balance sheet strength gives it flexibility to fund IM8’s next phase of growth without relying on external financing.

Under the revised capital allocation strategy, Prenetics said funds will be directed exclusively toward IM8’s operations and expansion.

That includes product development, brand marketing, talent acquisition, working capital, and international growth initiatives. The company framed the shift as an effort to sharpen strategic clarity and reinforce disciplined governance.

IM8 markets an all-in-one nutritional supplement aimed at simplifying daily health routines. The brand has been promoted by Beckham and tennis world number one Aryna Sabalenka, and Prenetics has leaned heavily into celebrity-backed branding as it scales the business globally.

Prenetics’ decision comes as bitcoin struggles

The decision to halt bitcoin purchases comes as the digital asset market faces a period of weaker sentiment.

Bitcoin has struggled to regain momentum after a sharp downturn earlier in the year, and several companies that adopted crypto-heavy treasury strategies have seen their share prices come under pressure.

Against that backdrop, Prenetics’ move stands out as a reversion toward a more traditional operating focus.

When the company announced its bitcoin accumulation strategy in June, Yeung spoke about the potential overlap between healthcare innovation and blockchain technology.

Six months later, the company’s tone has shifted, with management emphasizing execution, revenue growth, and consumer demand.

Prenetics said it believes the updated strategy aligns the company more closely with shareholder priorities as IM8 continues to scale. While bitcoin will remain on the balance sheet, the company made clear it will no longer play a central role in its capital deployment plans.

Shares of Prenetics were little changed following the announcement. At time of writing, shares were at $16.42 a share.

Bitcoin is currently trading at $88,626, up 1% over the past 24 hours on $39 billion in volume, with a market cap of about $1.77 trillion.

The price sits near the top of its weekly range, roughly 1% below the seven-day high and 2% above the seven-day low, with nearly 19.97 million BTC currently in circulation.

This post David Beckham’s Prenetics Stops All Bitcoin Purchases, Pivots Money to Wellness Brand first appeared on Bitcoin Magazine and is written by Micah Zimmerman.

You May Also Like

Trump Media & Crypto.com Partner For Shareholder Token Airdrop

Tria’s $20m beta surge: How a self-custodial neobank is redefining onchain finance