Russia’s biggest state-backed bank sees no use for CBDC, so why push ahead anyway?

Even as Russia gears up to launch its digital ruble, some of the country’s top bankers still aren’t sold on the idea.

As Russia moves closer to launching its own digital currency, questions are starting to grow louder about whether the country really needs a central bank digital currency. And most importantly, these concerns are coming not from critics abroad, but from within the country’s own financial system.

One of those questions is now being raised by one of the most influential bankers in Russia.

German Gref, the CEO of Russia’s largest state-controlled lender Sberbank, reportedly told reporters on the sidelines of the Bank of Russia’s annual Financial Congress that he didn’t see any scenario where the digital ruble would lead to a large-scale transformation of the economy.

Gref’s comments stand out not only because he leads Sberbank — what might be viewed as major indicator of Russia’s financial health given that it has over 100 million clients alone, or nearly 69% of the country’s population — but also because the bank is expected to play a central role in launching the digital ruble.

The Bank of Russia, however, sees things differently. It argues that the digital ruble — as a third form of national currency alongside cash and cashless money — could bring huge benefits over time.

In its recent research report on the digital ruble pilot, the central bank highlighted several potential benefits: faster, more transparent, and more secure financial transactions. However, these advantages appear to serve authorities more than ordinary citizens, as the digital ruble primarily offers new tools for state-level financial management and expanding financial inclusion.

Russia already has a solid digital payment setup, with its own versions of Visa/Mastercard plus some pretty advanced mobile banking apps. So, from a user’s point of view, it’s still not clear why anyone would really care to switch to a new payment method.

Cashbacks, but for lenders

Still, the Bank of Russia continues to highlight what it sees as long-term benefits. It plans to begin mass adoption of the digital ruble on September 1, 2026, and expects the system to become a regular part of financial life within five to seven years.

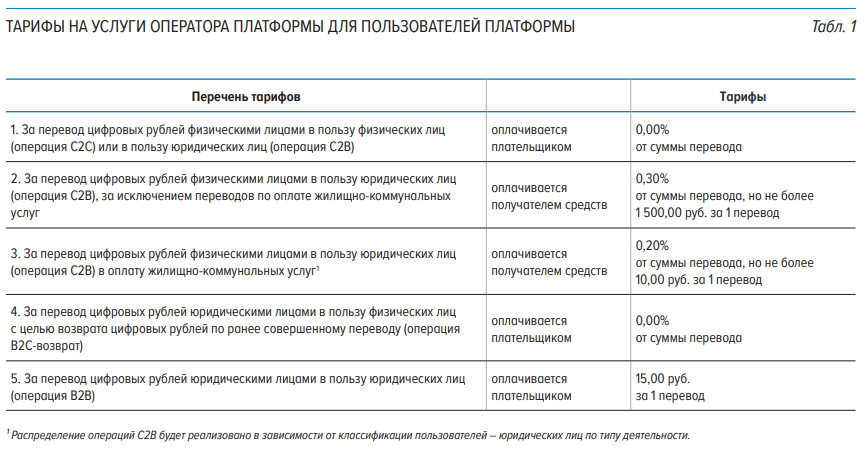

To make the digital ruble more appealing — especially for everyday users — the central bank is waiving all fees on transfers between individuals. Businesses still have to pay commissions, but they’re lower than what current payment systems or card services charge.

For example, sending money from a private user to a business comes with a max fee of 1,500 rubles (around $19) or 0.3% of the transfer amount. Utility payments cost even less, capped at 10 rubles or 0.2%.

The central bank also offers incentives to banks and other participants helping to operate the digital ruble platform. These partners will receive small commissions for facilitating various types of transactions, although the amounts are tightly regulated. Payments are made in digital rubles and handled directly through the platform’s centralized accounting system.

Long shot

The Bank of Russia insists this is about the future. The digital ruble isn’t just another payment tool, the central bank says, emphasizing that it’s a step toward a more modern and flexible financial system. Officials believe the platform could make government payments more efficient, help track public funds more transparently, and even pave the way for new types of smart contracts and automation in finance.

But the Sberbank CEO isn’t convinced, at least not yet. There’s still time for the picture to shift.

The pilot phase for the digital ruble has been ongoing since August 2023, and more functionality is being tested gradually. Some might suggest that the real value of the digital ruble may only become apparent as international payment systems become more fragmented, and Russia seeks new tools to bypass sanctions and simplify trade with select foreign partners.

In that scenario, the digital ruble might not change everyday life for most Russians, but could still become a useful instrument for the state. One way or another, the Bank of Russia appears determined to stay the course, even as some of the country’s most powerful bankers openly question what it’s all for.

You May Also Like

How to earn from cloud mining: IeByte’s upgraded auto-cloud mining platform unlocks genuine passive earnings

Ripple Buying PayPal? Pundit Breaks Down Numbers & Red Tape