Stablecoin adoption on Arbitrum mainnet is at an all-time high

Arbitrum is quickly becoming one of the favored blockchains for stablecoins, which are rapidly expanding.

Arbitrum (ARB) stablecoin adoption is growing rapidly. On Monday, July 7, the total stablecoin market cap of the chain reached an all-time high, surpassing $6.8 billion in value. The figure includes both natively minted stablecoins and bridged stablecoins.

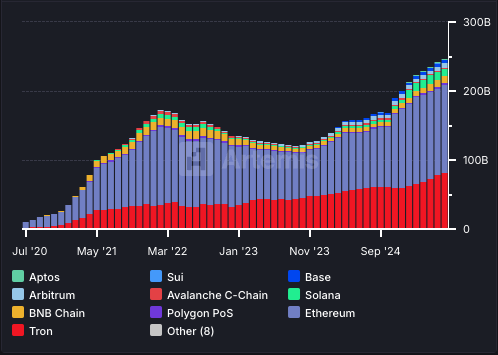

This figure puts Arbitrum in fifth place among blockchains. Ethereum (ETH) still dominates, with $127 billion, while Tron (TRX) is in second place at $81 billion. BNB Chain (BNB) and Solana (SOL) follow in third and fourth place, at around $10 billion.

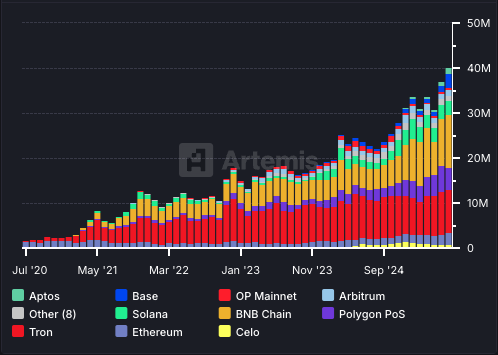

In the past few weeks, Arbitrum has seen significant stablecoin inflows. For the week ending on June 2, Arbitrum recorded $381 million in stablecoin inflows, more than any other chain. At the same time, Ethereum saw $374 million in outflows.

Arbitrum has over 1 million stablecoin wallets

Out of the total $249.8 billion in stablecoin supply, Arbitrum now controls 2.6%. What’s more, as of June 25, Arbitrum had 1.3 million active addresses that hold stablecoins. In this metric, BNB leads with 11.8 million, followed by Tron with 9.6 million.

It is important to note that the stablecoin supply can be calculated in different ways. For example, Artemis measures this figure by combining all stablecoin balances on the chain, including those deployed in DeFi liquidity pools, derivatives, etc. DeFiLlama tracks just stablecoin wallet balances, which stand at $3.465 billion. Notably, 61.14% of these balances are in USDC.

Despite significant stablecoin adoption, Arbitrum’s price has been trending downward. Over the last 30 days, ARB has fallen from a high of $0.4255 to its current value of $0.3284. This is despite the latest partnership with the trading app Robinhood, in what is likely a “buy the rumor, sell the news” trend.

You May Also Like

SEC approves generic listing standards, paving way for rapid crypto ETF launches