VeChain Blockchain Gains Traction as VET Hits Kraken

- VET is currently live on Kraken, which increases access to the world and increases liquidity.

- The Kraken listing enhances market accessibility of VET, where trading is already possible.

VeChain’s native token VET has gone live for trading on Kraken, expanding access to one of the market’s longest-running enterprise blockchain networks. The listing places VET on a major U.S.-based exchange at a time when the token is showing signs of renewed trading activity.

In a blog post, Kraken confirmed that VET funding and trading came into effect on January 2, 2026. Users can deposit the token via supported networks, and trading is enabled on the platform’s standard interface. Access through the Kraken App and Instant Buy features is subject to liquidity and regional eligibility. Even so, the addition reinforces VET’s exposure to the global market participants and institutional-grade infrastructure.

Kraken Listing Expands Access to VeChain’s Enterprise Network

The Kraken listing is another step in VeChain’s effort to reach a broader market. VET is used to make transactions and transact business in the VeChainThor network as a value transfer, staking, and in governance and applications. The Kraken listing will allow traders and ecosystem users to access and use the token more easily.

It is worth noting that VeChain has continued to invest in its technical stack. As we previously reported, the recent launch of VeChain Kit v2 introduced a redesigned software development kit specifically designed for frontend dApp builders. The update features a revamped user interface, token swapping integration, and expanded wallet support, including WalletConnect and VeWorld.

These improvements lower friction for developers building consumer-facing applications on VeChainThor. In addition, customizable interface components allow teams to tailor user experiences without rebuilding core functionality.

VET Price Gains

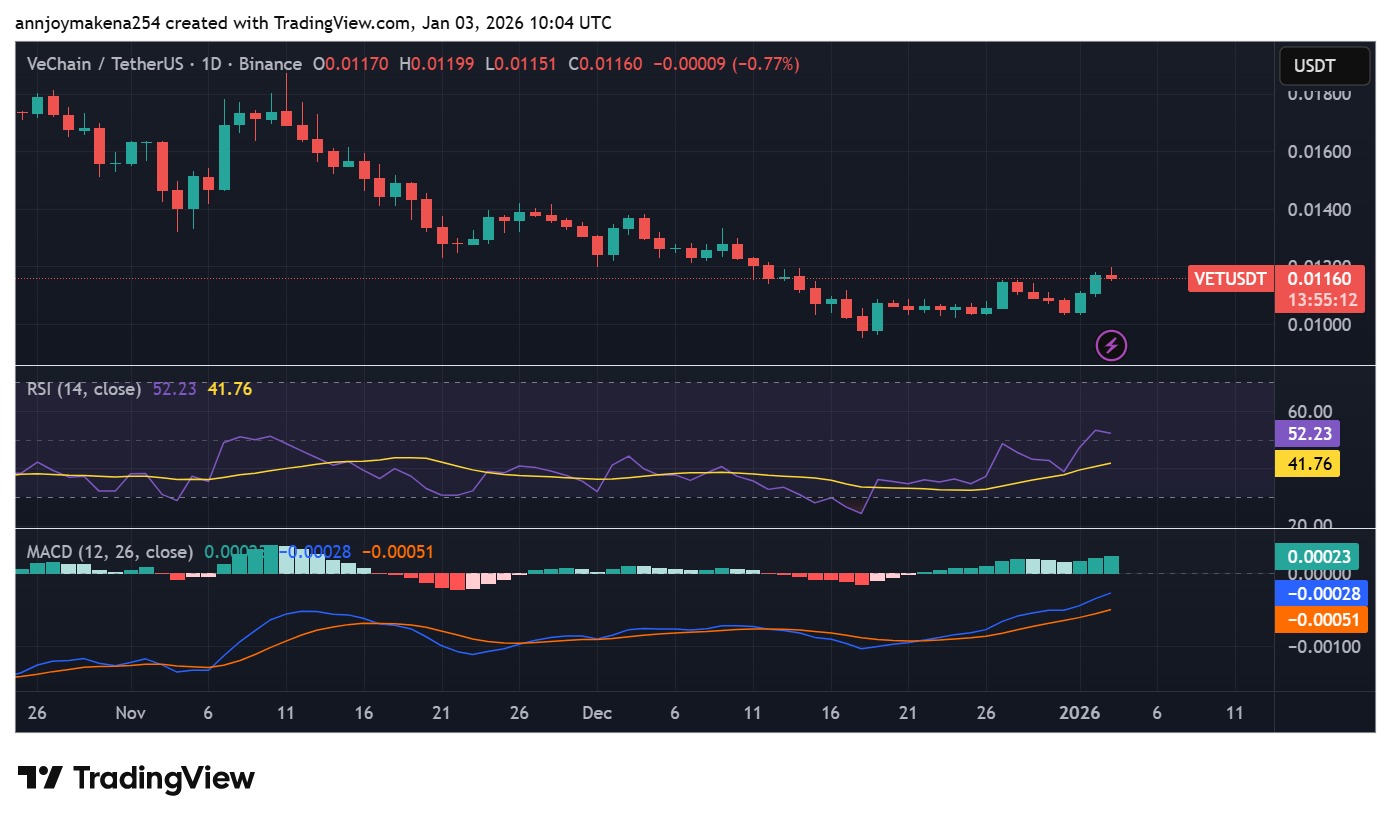

Market data indicates that VET has made modest gains after the Kraken listing and broader updates to the ecosystem. The token was trading near $0.0116, up around 4.5% daily, after rebounding from an intraday low of close to $0.01095. Price action briefly touched the area just below $0.0120 before consolidating. The trading volume rose to more than 40%, indicating a higher level of involvement compared to liquidity action.

According to technical indicators, the RSI-14 hovered around 52, positioning the momentum on the neutral side of the positive side, allowing for further rise. Meanwhile, the MACD-12,26 indicator turned positive, the histogram moved above zero, and signal lines converged upwards. Although the shift is still moderate, it is often enough a sign of improving medium-term movement after a long decline.

Source: Trading View

Source: Trading View

However, resistance is still in the $0.0120-0.0122 range. Sustained closes above this zone would be required to confirm a wider bullish breakout. Until that time, the charts predict prudent optimism with a positive trend momentum, but the confirmation of the longer-term trend is pending.

]]>You May Also Like

JANCTION Forges Alliance with AltLayer to Enhance Blockchain Interoperability

SAP Proposes Dividend of €2.50 per Share

Investors Pull Millions from Bitcoin and Ethereum ETFs Ahead of Powell’s Speech

Highlights: Investors withdrew millions from Bitcoin and Ethereum ETFs ahead of Powell’s speech. Bitcoin trades near $113,000 support, while Ethereum holds just above $4,200 levels. Analysts see mixed trends, citing liquidity sell-offs and weakening on-chain profitability signals. A few hours before Fed Chair Jerome Powell spoke at 11:30 a.m. ET, investors pulled large amounts from Bitcoin and Ethereum ETFs. This showed caution in the market. Bitcoin is trading near key support levels, and Powell’s speech could decide its next direction. Bitcoin ETFs See Major Outflows On September 22, neither spot Bitcoin ETFs nor Ethereum ETFs had any new inflows, reflecting a risk-off mood among investors. Bitcoin ETFs posted a total net outflow of $363.17 million, led by Fidelity’s FBTC with $276.68 million. Ark & 21Shares followed with $52.30 million, Grayscale’s GBTC withdrew $24.65 million, and VanEck’s HOLD had a small sale of $9.54 million. Overall trading reached $3.43 billion, with total net assets at $148.09 billion, showing strong user activity and growing confidence in the asset. This represents 6.59% of the total Bitcoin market capitalization. Ethereum ETFs Face $76 Million Outflow On the other hand, Ethereum ETFs recorded a total net outflow of $75.95 million on Monday. Fidelity’s FETH led with $33.12 million, followed by Bitwise ETHW and Grayscale ETH at $22.30 million and $5.4 million, respectively. BlackRock’s ETHA withdrew $15.07 million. None of the nine ETFs saw any inflows that day. The total trading value of Ethereum ETFs reached $2.06 billion, showing steady market activity and a strong industry position. Net assets stood at $27.52 billion, representing 5.45% of Ethereum’s total market capitalization. The outflows follow a pattern of ups and downs seen earlier this year. Ethereum ETFs saw a change in investor interest. Fidelity and Bitwise led most of the withdrawals. BlackRock’s iShares Ethereum ETF had some inflows that partially balanced the trend. Since their launch in July last year, spot Ethereum ETFs have gathered more than $13 billion in total net inflows. Meanwhile, Grayscale’s legacy trust experienced outflows exceeding $4.5 billion, as investors shifted to newer, lower-fee options. Outflows often happen when Bitcoin’s price becomes volatile. Investors usually pull funds if the price drops below key support levels. On September 22, spot Bitcoin ETFs recorded total net outflows of $363 million, with none of the 12 funds seeing inflows. Spot Ethereum ETFs saw total net outflows of $75.95 million, with all nine funds posting no inflows.https://t.co/Hj2Gs49bWa pic.twitter.com/YqCrJSMnIg — Wu Blockchain (@WuBlockchain) September 23, 2025 Fed’s Recent Rate Cut and Market Impact Today’s speech follows the Fed’s recent rate cut. The quarter-point cut lowered rates to 4.00%-4.25%. Powell said the move was for risk management, not aggressive easing. He added that risks to jobs have increased. The Fed decided to take another step toward a neutral policy. Markets are waiting to see if the Fed will stay cautious or signal more rate cuts. This decision could guide Bitcoin’s next move. BTC is trading around $113,000, with support near $111,000. Ethereum is just above $4,200. The Fear & Greed Index is at 40, showing neutral sentiment. Analysts have different views. Joao Wedson from Alphractal says BTC’s cycle “is losing momentum” as on-chain profits fall. Michaël van de Poppe refers to the drop as a “classic liquidity sell-off” which could trigger a rebound. Altcoins now come into view for some analysts as the next opportunity. The altcoin-season index last reached a record high since last year with rising rotation. Bitcoin is already showing signs of cycle exhaustion — and very few are seeing it. The SOPR Trend Signal is excellent at signaling when blockchain profitability is drying up.Never in Bitcoin’s history have investors accumulated BTC so late and at such high prices.Maybe only… pic.twitter.com/I1GBdEJH03 — Joao Wedson (@joao_wedson) September 22, 2025 eToro Platform Best Crypto Exchange Over 90 top cryptos to trade Regulated by top-tier entities User-friendly trading app 30+ million users 9.9 Visit eToro eToro is a multi-asset investment platform. The value of your investments may go up or down. Your capital is at risk. Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong.