Bitcoin price surged into the new year, supported by renewed optimism and strong spot ETF inflows. The crypto king pushed higher despite geopolitical tension following the US strike on Venezuela.

Markets remained resilient, suggesting investors prioritized liquidity trends and institutional demand over short-term macro uncertainty.

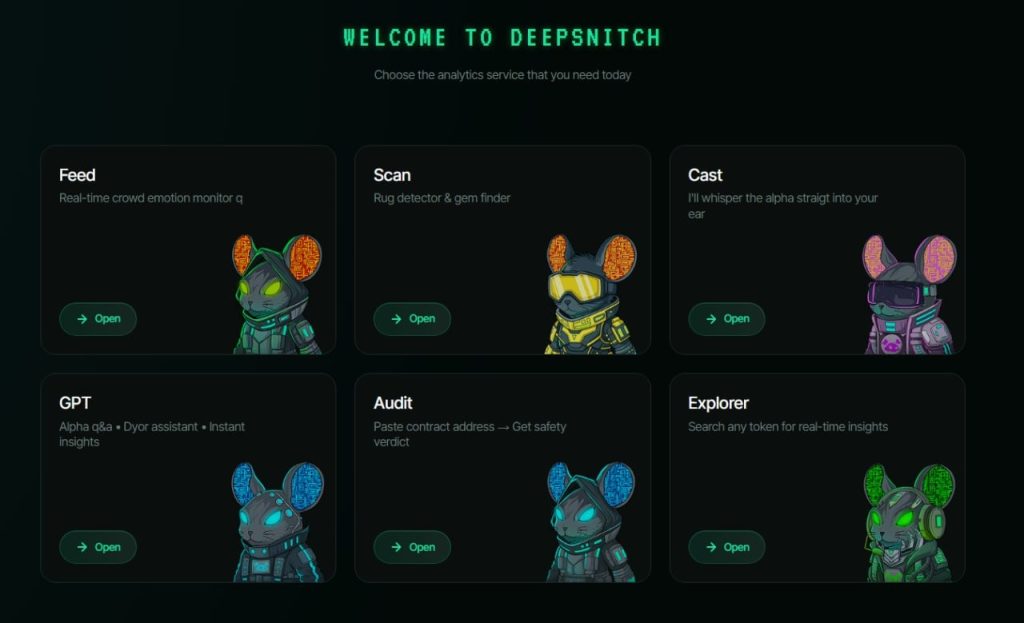

Sponsored

Bitcoin Whales Change Stance

Whale behavior shifted noticeably over the past day. Addresses holding between 10,000 and 100,000 BTC had sold roughly 50,000 BTC between December 29 and January 3. That distribution phase reflected caution as Bitcoin consolidated below major resistance.

Over the last 24 hours, those same whale wallets reversed course. They accumulated about 10,000 BTC, valued at $912 million, after Bitcoin crossed the $90,000 level. This renewed accumulation signals confidence among large holders and may help absorb near-term selling pressure.

Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter here.

Bitcoin Whale Holding. Source: SantimentWhales often act as liquidity anchors during volatile periods. Their return to buying suggests expectations of higher prices ahead. If accumulation continues, it could reinforce support levels and stabilize Bitcoin’s advance during early 2026.

Sponsored

Are Bitcoin Miners a Concern?

Miner behavior introduces a counterweight to bullish sentiment. The miner net position change shows selling has increased sharply over the past 24 hours. Outflows rose from 55 BTC to 604 BTC, reflecting miners capitalizing on higher prices to realize profits.

While the volume remains modest relative to total market supply, miner selling still affects short-term dynamics. Increased issuance entering the market can dampen upside momentum, especially if demand growth slows. This selling may limit the pace of Bitcoin’s climb rather than reverse it outright.

Bitcoin Miner Position. Source: GlassnodeMiners typically sell during strength to fund operations. Their activity does not necessarily signal bearish conviction. However, combined with broader profit-taking, it can delay breakouts until fresh demand absorbs the added supply.

Sponsored

BTC Price Breakout Awaits A Confirmation

Bitcoin broke out of a six-week descending wedge over the past 24 hours, trading near $91,327 at the time of writing. This technical escape suggests momentum is improving.

To sustain the breakout, Bitcoin must secure $92,031 as support, which would open a path toward $95,000.

Bitcoin Price Analysis. Source: TradingViewSponsored

Bullish confirmation requires reclaiming key moving averages. The 50-day EMA near $91,554 and the 365-day EMA around $97,403 currently act as resistance.

Flipping these levels into support would signal a stronger trend reversal and improve the odds of a move back above $100,000.

Bitcoin EMAs. Source: TradingViewShort-term risks remain tied to macro reactions. Global markets will respond to the US action in Venezuela when trading resumes on Monday.

A negative risk-off response could pressure Bitcoin, pushing the price back toward $90,000 or lower and invalidating the immediate bullish thesis.

Source: https://beincrypto.com/bitcoin-price-breaks-free-but-confirmation-awaits/