American Bitcoin now holds 5,427 BTC worth over $508.5 million

American Bitcoin Corp. purchased an additional 329 BTC on Monday as part of its Bitcoin accumulation strategy. The latest purchase increased its total Bitcoin reserve to over 5,427 BTC, worth more than $508.5 million at current BTC prices.

The Trump family-backed firm currently ranks as the 19th-largest publicly traded Bitcoin treasury company by holdings, ahead of KindlyMd and below Next Technology Holding.

Eric Trump, Chief Strategy Officer of ABTC, acknowledged that the firm has grown and surpassed a flurry of Bitcoin treasury companies in just over three months. At the time of publication, ABTC’s market capitalization stands at $1.65 billion.

ABTC sees a surge in BTC Yield

The Trump-backed company added its Bitcoin holdings amid a combination of mining operations and strategic purchases. ABTC stated that the initiative follows an agreement with Bitmain, which includes BTC held in custody or pledged for miner purchases.

ABTC recently unveiled its Bitcoin yield metric to boost its existing Satoshis Per Share (SPS) disclosure. The Bitcoin yield gauge measures the percentage change in SPS over defined periods.

The Trump family-backed firm reported a surge in its SPS to 556. Since the company’s Nasdaq debut on September 4, 2025, through January 2, 2026, American Bitcoin has achieved a BTC Yield of approximately 105%. The firm also promised to regularly update its users on its website and social media about its BTC holdings, SPS, Bitcoin Yield, and other performance metrics.

American Bitcoin’s stock is trading at $2.05 at the time of writing, up 14.8% for the day. The Bitcoin mining firm’s share price has also surged nearly 16.5% in the past 5 days.

Data from Quiver Quantitative revealed that ABTC insiders have traded the firm’s stock on the open market five times since July 2025. Two traders made purchases, while the remaining three made sales.

The analytics firm also noted that LENDING CA, LLC, Anchorage, made no purchases and three sales of 2,534,490 shares for approximately $20,189,718. RICHARD BUSCH only bought 276,000 shares of ABTC for around $490,480. Quiver Quantitative noted that approximately 59 institutional investors added shares of ABTC stock to their portfolios, with no sales in Q4 2025.

A flurry of Bitcoin mining companies also posted positive gains in their stocks on Monday, including Bitfirms, which surged nearly 10% to $2.86. Mara Holdings added 4.89% to $10.40, and Hut 8 Corp’s share price increased by 13.2% to $58.03.

Other digital asset treasury companies (DATs) posted positive advances late last year, including Strive. The company added another 101.8 BTC in the last quarter of 2025, increasing its total BTC holding to approximately 7,696 BTC, valued at around $708 million.

ABTC’s Bitcoin purchase follows BTC’s rally above $93K

ABTC’s initiative to purchase additional BTC comes as Bitcoin’s price pushes above $93,000. The digital asset is currently trading at around $93,688, up more than 7% in the past 7 days. The surge in BTC prices comes as traders brace for the mix of geopolitical developments and early-year positioning across the markets.

There’s a notable rebound in U.S. demand, evident in the surge of the Coinbase Bitcoin Premium in the first week of this year. The metric had dropped to its lowest level in 9 months on Thursday, recording a negative 0.018% amid BTC trading at around $88,000. The metric has improved to-0.03%, signaling a return of U.S. capital flows into the markets.

As the overall crypto market recovers in the first week of 2026, traders are eyeing the $95,000 level for continued momentum. Head of OTC at Wintermute, Jake Ostrovskis, argued that it’s worth waiting for the U.S. market session to confirm or reject the move. He pointed to the late-2025 reverse pattern or U.S. selling, noting that BTC plummeted by 5.45% during U.S. trading hours, but gained 10% during APAC hours.

Get seen where it counts. Advertise in Cryptopolitan Research and reach crypto’s sharpest investors and builders.

You May Also Like

Why Following Sui Crypto News Gives Early Insight Into Cross-Chain and Interoperability Trends

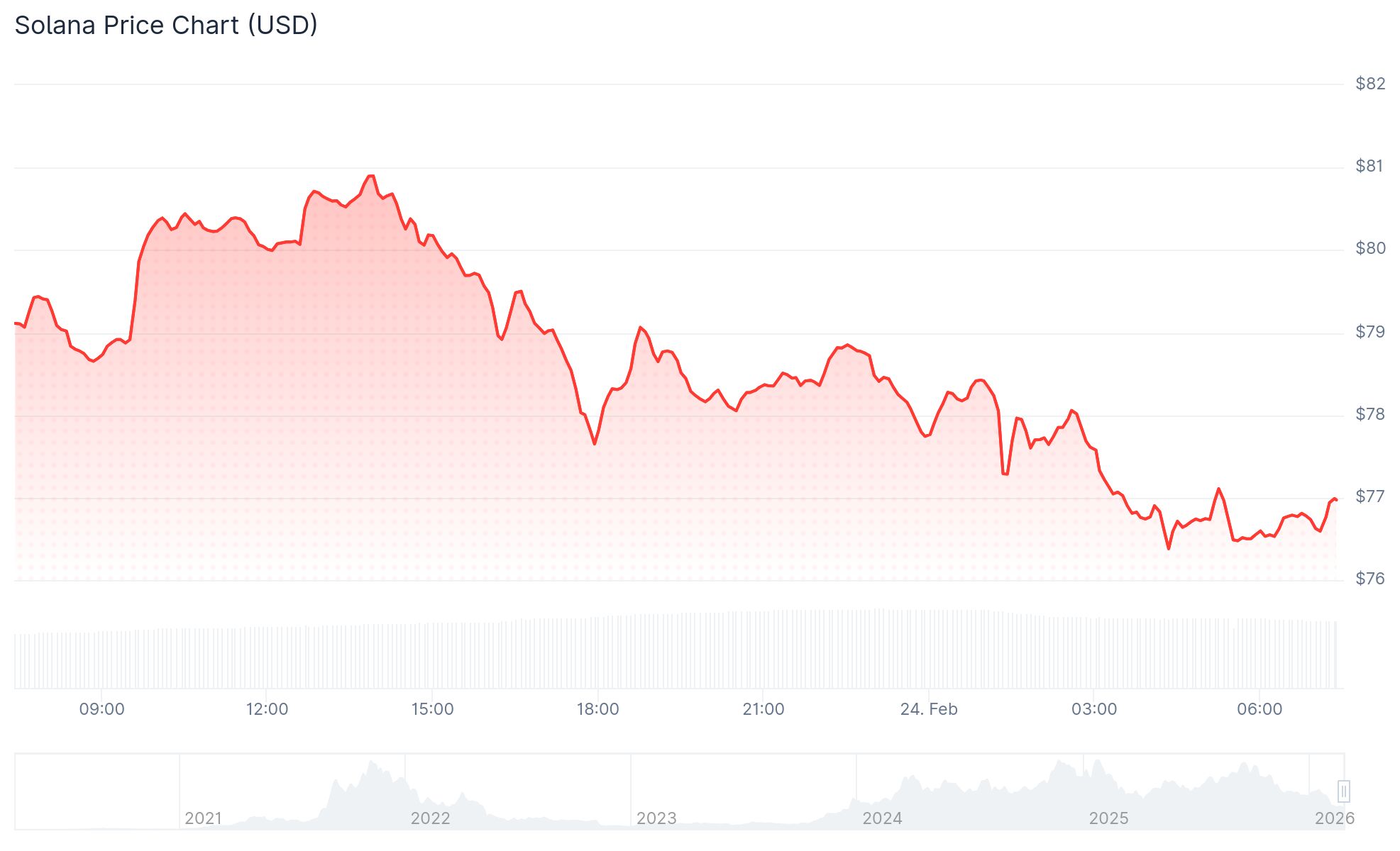

Solana (SOL) Price: Most SOL Holders Are Underwater as Token Drops to $76