RENDER Price Surges 74% in 7 Days as AI Token Gains Traders Attention

RENDER RENDER $2.23 24h volatility: 16.5% Market cap: $1.16 B Vol. 24h: $253.03 M posted a 74% gain over seven days, rising from $1.28 to $2.23 as trading activity increased across AI-related tokens.

The token’s 24-hour trading volume reached $260.42 million, up 29.5% from the previous day, according to CoinGecko data. RENDER hit a seven-day high of $2.23 and currently trades near that level.

The rally still leaves RENDER well below its all-time high of $13.53, set in March 2024. The token’s market capitalization currently stands at $1.15 billion, ranking 96th on CoinGecko.

RENDER price 4H | Source: TradingView

Render Network operates as a decentralized GPU rendering network that connects creators to unused computing power worldwide.

What Analysts Are Saying About RENDER

Analyst @DamiDefi observed that RENDER outperformed most AI-sector tokens over five days. The analyst stated the gains exceeded what many comparable tokens achieved throughout the previous year.

Trader @seth_fin noted a 67% gain from a recent entry point. The trader also referenced past real-world adoption of the network, citing a Vegas Sphere concert produced using Render Network’s distributed GPU infrastructure as an example of commercial applications.

Broader Market Conditions

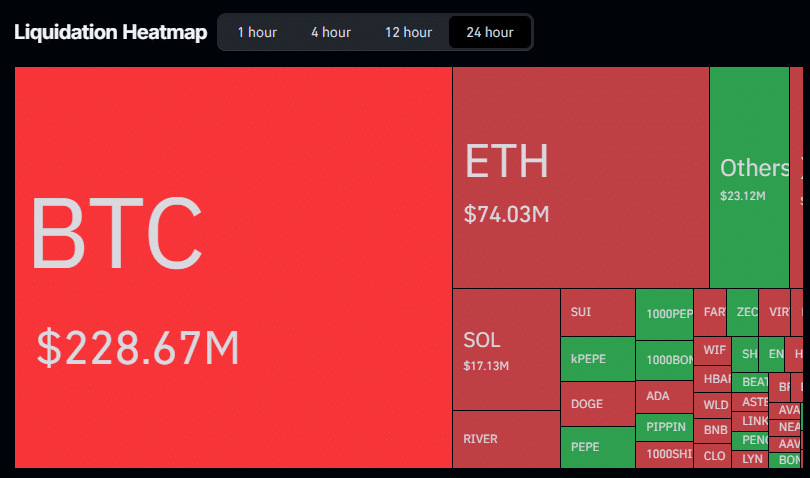

Derivatives data from Coinglass showed total market liquidations reached $298.5 million over 24 hours. Shorts accounted for $215.57 million of liquidations, suggesting bearish traders were caught off guard by price rallies. Liquidations occur when exchanges automatically close traders’ positions after prices move against their leveraged bets.

Crypto market liquidations | Source: CoinGlass

The Fear & Greed Index registered 26, indicating fear in the market, up slightly from 25 the previous day. The broader market added 1.83% to total market capitalization, which reached $3.27 trillion. Bitcoin BTC $94 097 24h volatility: 3.2% Market cap: $1.88 T Vol. 24h: $58.65 B gained 2.46% over 24 hours and 6.87% over seven days.

nextThe post RENDER Price Surges 74% in 7 Days as AI Token Gains Traders Attention appeared first on Coinspeaker.

You May Also Like

Trump-Linked World Liberty Financial Seeks National Trust Bank Charter for USD1 Stablecoin

Whales Dump 200 Million XRP in Just 2 Weeks – Is XRP’s Price on the Verge of Collapse?