ASTER Price on Roll After Stock & RWA Perps Fee Structure Update

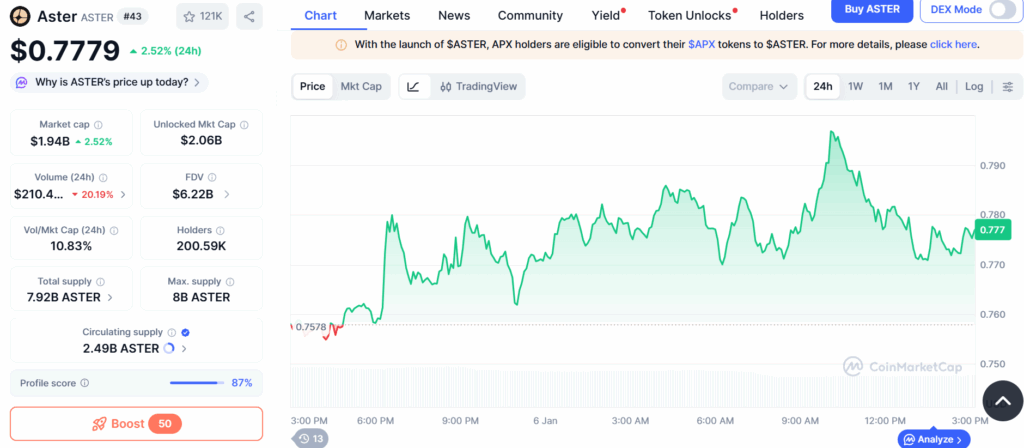

- ASTER price is up by 2.52% over the last 24 hours.

- Aster DEX has announced Stock & RWA Perps Fee Structure Update.

- The token is now testing critical support and resistance levels.

ASTER price has surged considerably since the announcement about stock and RWA Perps fee structure update. The announcement further sheds light on eligibility and discount application. Meanwhile, ASTER is testing critical support and resistance margins.

Aster Update

Aster announced Stock & RWA Perps Fee Structure Update. It conveyed the community about changes in stock and RWA perpetuals. Per the announcement, these will align with its standard fee rates for maker and taker, which are 0.005% and 0.04%, respectively. The update is scheduled to go into effect on January 07, 2026, at 09:00 AM UTC.

The announcement has briefly explained the update by underlining what it means. For starters, stock and RWA perps will earn Stage 5 points like other perpetual contracts. Second, they will be eligible for Crystal Weekly Drops based on the fulfillment of $10k notional minimum for Other Pairs. Lastly, fees paid with ASTER will automatically adjust a 5% discount.

Impact on ASTER Price

With 2.49 billion in circulation, the token has reached a peak of $0.7779 when the article is being drafted. ASTER price is up by 2.52% over the last 24 hours, and has significantly surged by 11.58% in a week. The token noted an ATL of $0.08439 on September 17, 2025, almost a week before recording an ATH of $2.42 on September 24, 2025.

Source: CoinMarketCap

Source: CoinMarketCap

The impact on price also comes hours after the platform reported over 200k on-chain ASTER holders. This is credited partly to the launch of Shield Mode, a protected trading feature for on-chain traders. The weekly price chart of ASTER now shows an ascent filled with green trades since around January 01, 2026.

ASTER Testing Price Levels

The early months of 2026 estimate the token to undergo a maximum correction of 23.41%. Thereby taking its value to around $0.5944 in the next 3 months. ASTER price prediction, however, anticipates reaching the $5 milestone by the end of 2026. Needless to say, the crypto market is volatile, and the token can swing either way.

Its volatility is currently very high at 13.58%. The token is testing support levels of $0.7546 and $0.7018. Resistance levels have been drawn at $0.8074 and $0.8602 when the article is being drafted.

Highlighted Crypto News Today:

Strategy Adds 1,287 BTC, Pushing Total Holdings to 673,783 as Bitcoin Rises

You May Also Like

South Korea Launches Innovative Stablecoin Initiative

Trump-Linked World Liberty Financial Seeks National Trust Bank Charter for USD1 Stablecoin