Bitcoin Price Rally: The Compelling Historical Pattern of Rebound After Annual Losses

BitcoinWorld

Bitcoin Price Rally: The Compelling Historical Pattern of Rebound After Annual Losses

January 2025 — A compelling historical pattern within Bitcoin’s volatile price history suggests the cryptocurrency may be poised for a significant Bitcoin price rally. Analysis of past market cycles reveals a consistent tendency for powerful rebounds in the years immediately following an annual price decline. This pattern, highlighted by industry experts, provides crucial context for investors navigating the current market landscape.

Bitcoin Price Rally: A Historical Blueprint for Recovery

Bitcoin’s journey since its inception has been marked by extreme volatility. However, within this volatility, analysts identify a recurring sequence. Specifically, years that conclude with negative annual returns have consistently preceded periods of substantial price appreciation. Jesse Myers, Head of Bitcoin Strategy at Smarter Web Company, recently quantified this phenomenon. His analysis, cited by CoinDesk, points to a clear historical trend of recovery.

According to the data, Bitcoin recorded negative annual returns in 2014, 2018, and 2022. Subsequently, the cryptocurrency staged impressive comebacks. The year following each decline saw a powerful Bitcoin price rally. For instance, after the 2014 decline, Bitcoin rebounded with a 35% gain. Following the 2018 downturn, the recovery was a dramatic 95%. Most recently, after 2022’s bear market, Bitcoin surged by an astonishing 156%.

Consequently, the average recovery rate across these three historical instances stands at approximately 95%. This figure provides a quantitative benchmark for potential market movements. The pattern underscores Bitcoin’s historical resilience. It demonstrates an ability to absorb significant downward pressure before embarking on a new upward trajectory.

Analyzing the Cryptocurrency Recovery Cycle

Understanding this cycle requires examining the market mechanics behind each period. The annual losses typically coincide with major macroeconomic events or internal market shocks. For example, the 2014 decline followed the Mt. Gox exchange collapse. Similarly, the 2018 downturn ended a speculative bubble. Finally, the 2022 bear market reacted to aggressive global monetary tightening.

Each event, while different, catalyzed a prolonged period of pessimism and capitulation. This process often resets market leverage and washes out weak hands. Subsequently, it creates a stronger foundation for the next growth phase. The subsequent cryptocurrency recovery, therefore, is not random. It often aligns with improving fundamentals, renewed institutional interest, or broader macroeconomic shifts.

Key drivers historically fueling post-loss rallies include:

- Halving Events: Bitcoin’s programmed supply reductions have preceded major bull markets.

- Institutional Adoption: Increased investment from corporations and funds provides new capital inflows.

- Macroeconomic Conditions: Shifts toward loose monetary policy can boost risk assets like Bitcoin.

- Technological Advancements: Network upgrades and layer-2 solutions improve utility and perception.

Expert Insight on Current Market Parallels

Jesse Myers suggests the established pattern could repeat. Following a reported annual loss in 2025, a similar upward trend may resume. This projection is not a guarantee but a observation based on historical precedent. Myers’ role at Smarter Web Company involves strategic blockchain analysis, lending authority to his assessment.

It is crucial to contextualize this analysis within the 2025 market environment. Current factors differ from past cycles. Regulatory frameworks are more defined. Institutional custody solutions are robust. Furthermore, Bitcoin’s correlation with traditional markets continues to evolve. These new variables mean any future Bitcoin price rally may unfold differently. However, the core psychological and cyclical drivers may remain consistent.

The table below summarizes the historical data underpinning this analysis:

| Year of Annual Loss | Following Year Rally | Potential Catalysts |

|---|---|---|

| 2014 | +35% | Market maturation post-Mt. Gox |

| 2018 | +95% | Institutional interest begins, futures markets |

| 2022 | +156% | Spot ETF approvals, macro pivot expectations |

| Average | ~95% | N/A |

Broader Implications for Digital Asset Investment

This historical pattern holds significant implications for portfolio strategy. It highlights the importance of a long-term perspective in cryptocurrency investing. Reacting solely to short-term annual losses can lead to missed opportunities. The data suggests that periods of maximum pessimism have often been optimal entry points. Of course, past performance never guarantees future results.

Investors must also consider risk management. A potential 95% average recovery follows a 100% loss of value from all-time highs. The volatility cuts both ways. Therefore, any strategy based on this pattern should account for substantial drawdowns. Diversification and position sizing remain paramount principles.

Moreover, this analysis reinforces Bitcoin’s unique position as a cyclical asset. Its fixed supply and growing adoption create a push-pull dynamic with market sentiment. The historical tendency for a strong Bitcoin price rally after downturns reflects this fundamental tension. It shows a market that learns, adapts, and ultimately grows through each cycle.

Conclusion

Historical data presents a compelling narrative for Bitcoin investors. The cryptocurrency has demonstrated a repeated capacity for a powerful Bitcoin price rally in the years following an annual loss. With an average historical rebound of 95%, this pattern offers a framework for understanding market cycles. While 2025 presents a new set of challenges and variables, the cyclical nature of the asset class suggests observers should watch for signs of a similar recovery phase. As always, thorough research and measured risk assessment are essential when navigating these volatile markets.

FAQs

Q1: How many times has Bitcoin had a negative annual return?

Based on the cited analysis, Bitcoin has recorded negative annual returns in at least four instances: 2014, 2018, 2022, and reportedly 2025.

Q2: What was the strongest rally after an annual loss?

The strongest documented rally followed the 2022 annual loss, with Bitcoin’s price increasing by approximately 156% in the subsequent period.

Q3: Does this pattern guarantee Bitcoin will go up after a down year?

No. Historical patterns do not guarantee future performance. They provide context and identify trends, but many external factors can influence price.

Q4: What is the average recovery rate after a Bitcoin annual loss?

According to the analysis of the 2014, 2018, and 2022 cycles, the average recovery rate in the following year is approximately 95%.

Q5: Who provided this analysis on Bitcoin’s historical performance?

The analysis was cited by CoinDesk and attributed to Jesse Myers, Head of Bitcoin Strategy at Smarter Web Company.

This post Bitcoin Price Rally: The Compelling Historical Pattern of Rebound After Annual Losses first appeared on BitcoinWorld.

You May Also Like

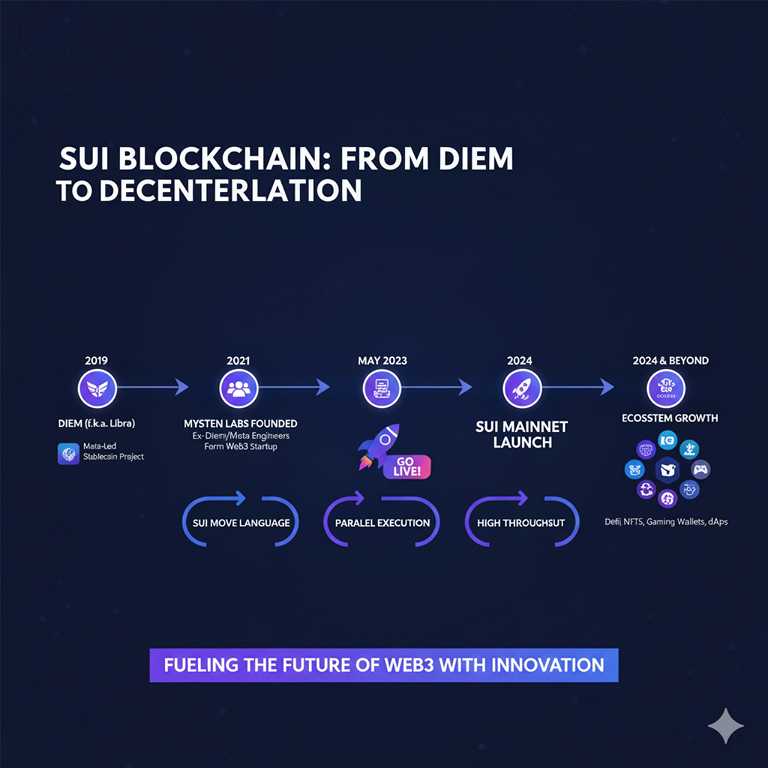

Sui Blockchain Explained (2025): Move Language, High-Speed Layer-1 & The Future of Web3

In an era of agent explosion, how should we cope with AI anxiety?