Why Bitcoin, Ethereum & XRP Prices are Going Down Now?

The post Why Bitcoin, Ethereum & XRP Prices are Going Down Now? appeared first on Coinpedia Fintech News

Why are Bitcoin, Ethereum, and XRP Prices going down at the same time? Every trader is currently looking for this answer, as the tokens dropped suddenly in the times when they were believed to maintain a bullish continuation. After a strong start to the year, the crypto market has turned defensive, with the BTC price slipping below recent highs and dragging major altcoins lower. Ethereum & XRP prices are also facing a notable pullback that raises concerns over the next price action.

The synchronised pullback has raised questions about whether this is simple profit-taking or a broader shift in market positioning.

What Just Happened Across the Crypto Market

The latest pullback was broad, fast, and coordinated across the crypto market. Within a short window, Bitcoin slipped below $91,000, dragging the ETH price and XRP prices below $3200 and $2.2, respectively. A clear shift is seen in the short-term market control, which has erased billions of dollars in value, reversing a meaningful portion of gains recorded earlier this week.

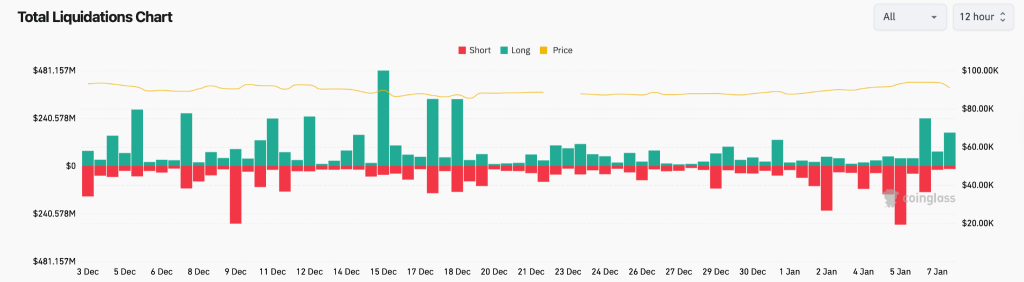

Derivative data confirms the intensity of the move. The Coinglass data shows the long liquidations being carried out over the past few days, which could have kept the bearish strength alive. Nearly $250 million in longs were liquidated after a $280 million long during the past trading day. Bitcoin and Ethereum account for nearly $92 million in long liquidation each, and when multiple large-cap drops occur together, it typically signals systemic de-risking rather than asset-specific weakness.

Bitcoin Is Leading the Pullback

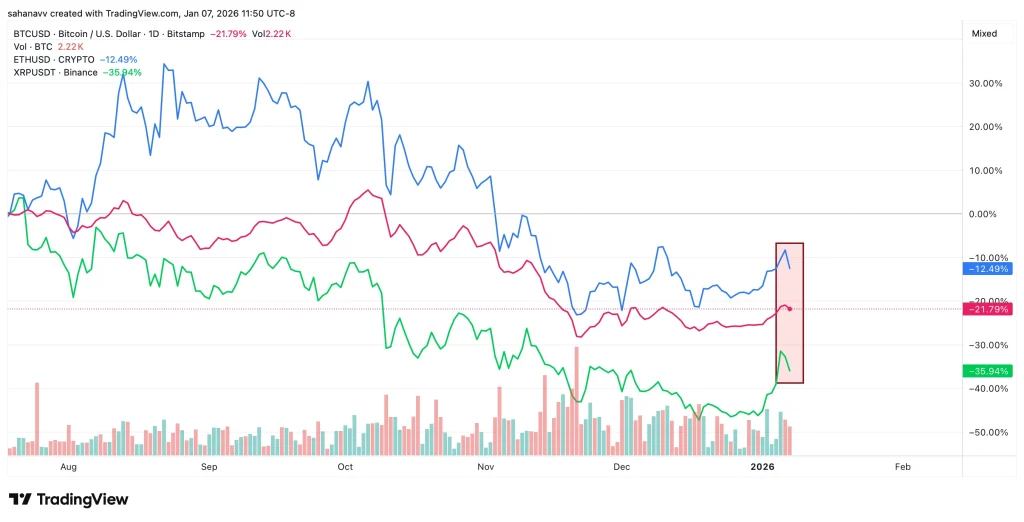

After the recent bullish action, the Bitcoin price is trying extremely hard to rise and secure the pivotal resistance around $95,000. However, the bearish influence continues to hover over the token as the price remains consolidated within a range. However, BTC, ETH & XRP prices all have displayed a strong bearish divergence that could point towards an upcoming bearish action.

The above chart is a comparison of the prices of BTC, ETH & XRP, showing a clear shift in the trend. As Bitcoin remains the market liquidity anchor, the recent rejection near the key resistance zone has set the tone for the entire market. Therefore, without Bitcoin reclaiming strength, sustained upside in major altcoins is extremely difficult.

What Traders Should Watch Next?

The synchronised pullback across Bitcoin, Ethereum, and XRP reflects a market-wide liquidity reset, not isolated weakness. With leverage flushed and momentum waning, the next move will depend on how the price behaves at key support zones, rather than short-term volatility. Traders should closely watch volume expansion, funding rate shifts, and open interest changes for confirmation. A stable base could signal consolidation, while renewed selling pressure would increase the risk of a deeper corrective phase.

You May Also Like

Golden Trump statue holding Bitcoin appears outside U.S. Capitol