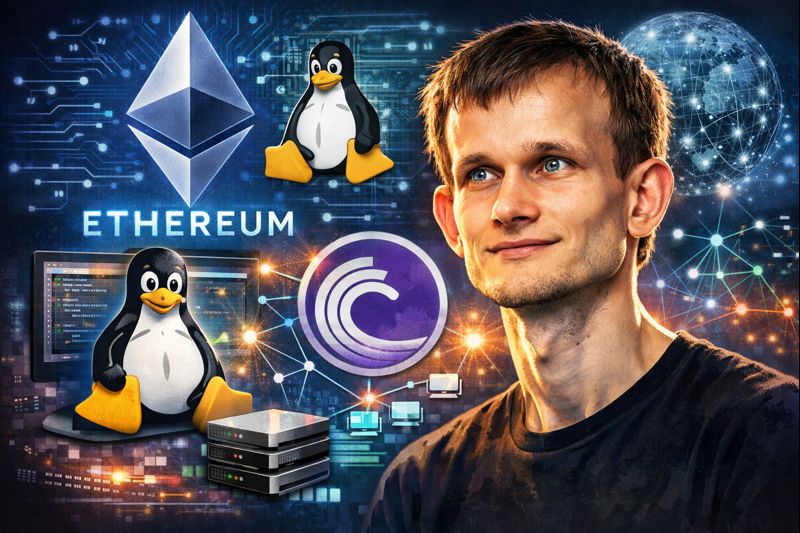

Vitalik Buterin Says Ethereum Is Modeled After Linux and BitTorrent

Vitalik Buterin has offered new clarity on Ethereum’s true design model, drawing a direct comparison to BitTorrent and Linux. The Ethereum cofounder emphasized that these platforms provide a clearer lens through which to understand the architecture and purpose of Ethereum, moving away from conventional crypto-focused interpretations.

Buterin noted that Ethereum, like BitTorrent, operates without central servers. BitTorrent’s success in distributing large files globally without intermediaries demonstrates how peer-to-peer systems can scale efficiently. According to Buterin, Ethereum follows a similar model but with the movement of value rather than data files. He highlighted that even state institutions rely on BitTorrent due to its resilience and scalability, characteristics he believes Ethereum shares.

Linux’s open infrastructure serves as Ethereum’s blueprint

The analogy extended further with Linux, the open-source operating system that underpins much of modern digital infrastructure. Buterin explained that Ethereum’s base layer is being structured to perform a similar role. It aims to support essential applications such as identity, governance, and coordination, enabling systems to function autonomously without relying on third parties.

Buterin suggested that Ethereum is increasingly relevant for entities outside the crypto ecosystem. While decentralized finance users may prioritize trustlessness, enterprises focus on minimizing risk. Ethereum’s design, based on secure and open frameworks like Linux, provides value in both contexts. Buterin implied that Ethereum’s evolution positions it more as infrastructure than as a speculative asset platform.

Ethereum’s role is shifting toward global infrastructure

The key message from Buterin’s remarks is that Ethereum is transitioning from a cryptocurrency product into a public infrastructure. Drawing on the dependability of BitTorrent and the flexibility of Linux, Ethereum is designed to scale without control by centralized bodies. Buterin’s statements suggest Ethereum’s identity is shifting toward foundational technology that powers applications well beyond the crypto space.

This article was originally published as Vitalik Buterin Says Ethereum Is Modeled After Linux and BitTorrent on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

You May Also Like

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

Trump's allegation against Noem would constitute a federal crime: analyst