Will Bitcoin Reach $2.9M? VanEck’s 25-Year Forecast Explained

The post Will Bitcoin Reach $2.9M? VanEck’s 25-Year Forecast Explained appeared first on Coinpedia Fintech News

Asset manager VanEck just dropped a 25-year Bitcoin forecast that has the crypto community talking. The firm projects BTC could hit $2.9 million per coin by 2050, assuming a 15% annual growth rate from today’s prices.

Matthew Sigel, VanEck’s head of digital assets research, and senior analyst Patrick Bush published the outlook on Wednesday. The price target is built on specific assumptions about how Bitcoin fits into the global financial system over the next two decades.

How Does Bitcoin Get to $2.9 Million?

VanEck’s model rests on two big shifts.

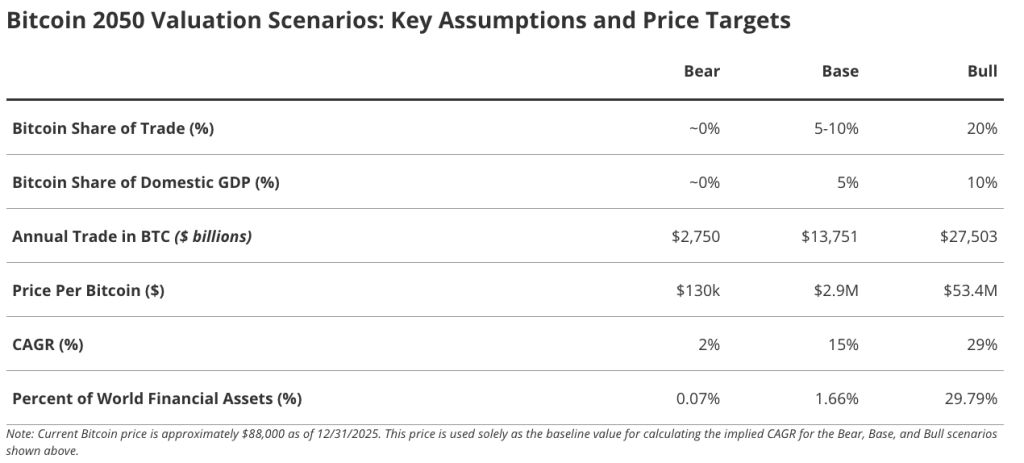

First, they expect Bitcoin to settle 5-10% of global international trade and 5% of domestic trade by 2050. To put that in context, the British pound currently handles about 7.4% of international payments. Bitcoin would need to reach similar territory.

Second, the firm projects central banks will hold 2.5% of their reserves in Bitcoin as trust in government debt erodes.

Three Scenarios, One Takeaway

VanEck mapped out bear, base, and bull cases.

The bear case lands at $130,000 with a 2% annual return. The base case hits $2.9 million at 15%. And a bull scenario pushes to $53.4 million at 29% annual growth, though that would require Bitcoin to rival gold as a global reserve asset.

Here’s the interesting part: even VanEck’s worst-case scenario sits above Bitcoin’s current price of roughly $88,000.

What This Means for Investors

VanEck suggests putting 1-3% of a diversified portfolio into Bitcoin. Their data shows a 3% allocation to a traditional 60/40 portfolio historically produced the best risk-adjusted returns.

Worth noting: this 15% growth assumption is actually down from VanEck’s December 2024 projection, which used 25%.

You May Also Like

US Jobs Miss Fails to Stop Bitcoin Erasing Its $74,000 Breakout Attempt

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon