Bitwise Chainlink ETF Approved, Set to Trade on NYSE Arca as CLNK

This article was first published on The Bit Journal.

Bitwise Chainlink ETF has been cleared for listing on NYSE Arca after regulatory approval. The product is designed to give investors exposure to Chainlink through a brokerage account.

It aims to remove the need for investors to buy, store, or manage tokens themselves. The Bitwise Chainlink ETF could begin trading as early as tomorrow, according to reports.

The fund is expected to trade under the ticker CLNK on NYSE Arca. It will directly hold Chainlink and track its spot price performance.

The management fee is set at 0.34% per year. Bitwise will waive the sponsor fee for the first three months on the first $500 million in assets.

No Staking at Launch as U.S. Spot ETFs Expand Into Altcoins

The product will not include staking at launch. Bitwise said it may seek regulatory approval later to add staking as an additional objective. If approved in the future, staking could allow the trust to accumulate more LINK over time.

The approval adds to the expanding list of U.S. spot crypto ETFs. Investor access is moving beyond Bitcoin and Ethereum into select altcoins with large market depth.

LINK remains one of the largest crypto assets by market value and is used widely across blockchain infrastructure. The ETF format offers exposure through standard brokerage accounts without wallet management.

Listing Clearance Opens Trading Access Through NYSE Arca

The listing clearance allows the product to trade on a regulated U.S. exchange. Investors can access Bitwise Chainlink ETF like other ETFs through standard brokerage platforms.

That includes retirement accounts, advisor platforms, and self-directed portfolios. The model aims to reduce friction for investors who want LINK exposure.

Also Read: Bitwise Files for First U.S. Spot Chainlink ETF, LINK Jumps 5%

The fund is structured to hold the asset directly inside the trust. This allows performance to reflect the spot market. It also removes the need to interact with crypto exchanges. The Bitwise Chainlink ETF design simplifies access for users who prefer traditional finance channels.

Fee Structure and Waivers Aim to Attract Early Liquidity

The fund’s annual management fee is set at 0.34%. Bitwise said it will waive sponsor fees for the first three months on the first $500 million in assets.

This reduces early costs and may support inflows during the initial trading period. Lower costs can also improve competitiveness against similar products.

Fee pressure is becoming a major issue across crypto ETFs. Investors tend to compare fund costs closely before allocating capital. Early liquidity is also tied to fees because market makers prefer active products. The waiver period may help the product build trading volume faster.

No Staking at Launch Keeps Structure Simple

The fund will not stake LINK at launch. This keeps operations closer to standard commodity-style spot ETFs. Staking may involve additional risk controls, custody practices, and regulatory review. A spot-only structure reduces complexity in the first phase.

Bitwise Chainlink ETF has said it may apply later for staking approval. If that happens, it could add a yield component to the product. That change would require additional permission and updated disclosure. For now, the product will focus on simple tracking of spot LINK.

Chainlink’s Oracle Role Drives Institutional Interest

Chainlink is known for its decentralized oracle network. It helps smart contracts access external data such as prices, events, and real-world inputs.

These feeds are used across DeFi, tokenized assets, and blockchain-based financial apps. This makes LINK part of infrastructure rather than only market speculation.

The asset’s utility is a core part of its institutional narrative. Funds tied to infrastructure tokens may attract a different investor segment. Many institutions focus on usage and adoption signals. Oracle networks remain central to many blockchain applications.

Comparison With GLNK Adds Competitive Pressure

The new product arrives after another U.S. spot offering linked to LINK. Grayscale recently converted its Chainlink Trust into a spot ETF trading under GLNK.

Reports said GLNK has accumulated $87.5 million in assets since approval. This provides a benchmark for measuring market demand.

Two listed products may increase liquidity in LINK-linked investment vehicles. It can also create fee competition between issuers. Investors may compare tracking quality and spreads. Early trading data will show how capital splits between products.

LINK Market Activity Rose After Approval News

LINK showed stronger activity following news of the listing clearance. Reports said the token gained more than 6% within 24 hours. Trading volume surged close to 80% during the same period. That move suggested rising trader interest.

Derivatives metrics also pointed to stronger positioning. Futures open interest climbed to around $665 million. That rise suggested fresh capital entering LINK markets. It also indicated traders were preparing for higher activity after ETF trading begins.

Source: CoinMarketCap

Source: CoinMarketCap

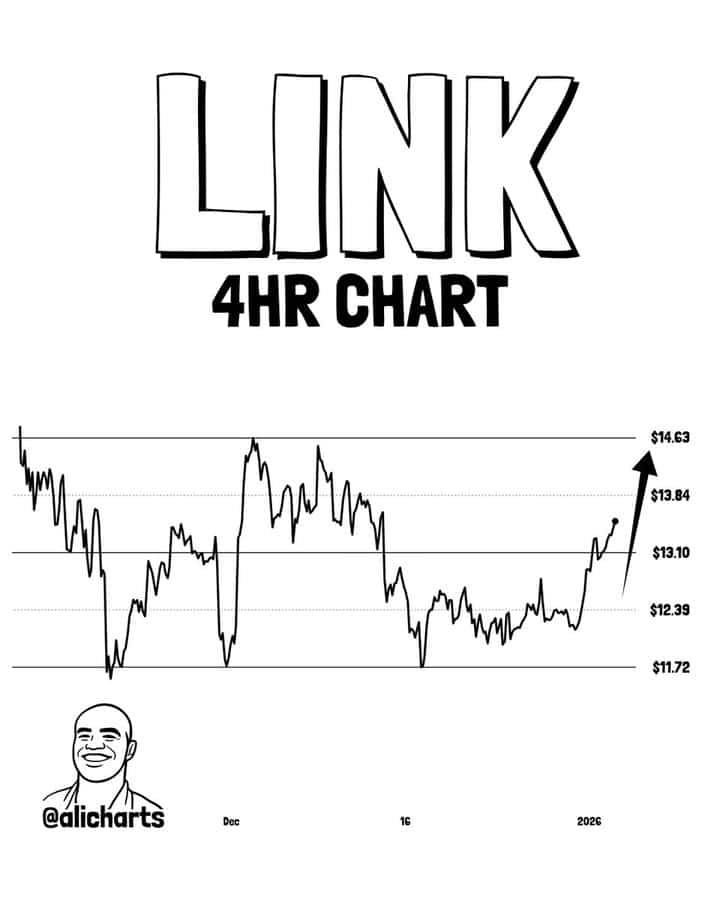

Analyst Ali Martinez said on X that LINK has room to climb toward $14.63, marking the top of its current trading channel. He added that major resistance levels look limited before that target.

Source:

Source:

Growing Spot ETF Range Expands Crypto Access in the U.S.

This approval adds to a wider trend in regulated crypto investment products. U.S. spot ETF acceptance has expanded beyond Bitcoin and Ethereum. Asset managers are now targeting large-cap altcoins with deep liquidity.

This trend could reshape market structure over time. More ETF access can change liquidity distribution and investor behavior. It also expands the reach of crypto assets to mainstream capital channels. LINK now joins the list of assets gaining that pathway.

Conclusion

Bitwise Chainlink ETF has been cleared for listing on NYSE Arca and could begin trading as early as tomorrow. The fund will trade under CLNK and hold LINK directly to track spot performance.

It will charge a 0.34% management fee with a short-term sponsor fee waiver for early assets. The launch adds to the expansion of U.S. spot crypto ETFs into high-liquidity altcoins and infrastructure tokens.

Also Read: Bitwise Files for First U.S. Spot Chainlink ETF With Coinbase as Custodian

Appendix Glossary of Key Terms

Spot ETF: An exchange-traded fund that holds the asset directly to track its spot price.

NYSE Arca: A U.S. stock exchange where ETFs are listed and traded.

Chainlink (LINK): A crypto asset used to power Chainlink’s oracle network and services.

Oracle Network: A system that delivers real-world data to smart contracts securely.

Custody: The storage and protection of digital assets, usually handled by a custodian.

Staking: Locking tokens to support a network in return for rewards.

Sponsor Fee Waiver: A temporary removal of fund sponsor fees to lower investor costs.

Open Interest: The total number of active futures contracts that are not closed.

Frequently Asked Questions About Bitwise Chainlink ETF

1- What is a Bitwise Chainlink ETF?

Bitwise Chainlink ETF is a spot ETF designed to provide exposure to LINK through a regulated exchange listing.

2- What ticker will it use on Bitwise Chainlink ETF?

It is expected to trade under CLNK on NYSE Arca.

3- Does it include staking?

No. Staking will not be included at launch.

4- What is the fee of Bitwise Chainlink ETF?

The annual management fee is 0.34%, with an early sponsor fee waiver on initial assets.

References

CryptoBriefing

TheCryptoBasic

Read More: Bitwise Chainlink ETF Approved, Set to Trade on NYSE Arca as CLNK">Bitwise Chainlink ETF Approved, Set to Trade on NYSE Arca as CLNK

You May Also Like

Community Banks, Crypto Industry ‘Are Allies’ In CLARITY Act Clash: Exec

$350K Bitcoin Prediction by Robert Kiyosaki as Ethereum Remains Strong Despite Bearish Pressure and $HYPER Pumps