The crypto market is regaining momentum once again as the Bitcoin price hit the $97,000 level. As such, traders have now started to price in the possibility of the token touching $100,000 before the end of January.

Traders Look to $100,000 Bitcoin Price Breakout by January 31

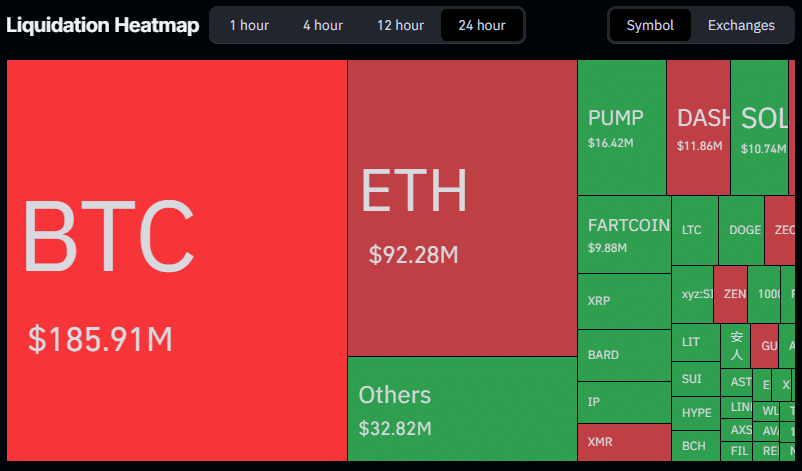

According to data from TradingView, the token jumped above $97,000 to an eight-week high. The rally caught the bears unaware, liquidating over $680 million in short positions across all derivatives exchanges.

Source: TradingViewIn the meantime, on Polymarket, there are chances exceeding 74% that BTC will hit 100,000 USD within this month.

Source: PolymarketThe Bitcoin price has continued moving upwards, taking advantage of the momentum it gained yesterday when it broke above the $96,000 level. The breakout further solidified the general trend of recovery it started in January.

At the same time, data from SoSoValue also reveals that U.S. spot BTC ETFs attracted over $843 million in net inflow in one trading day.

Of these, BlackRock led the charge with more than $648 million in daily inflows to push its cumulative total above $63 billion, while Fidelity’s FBTC followed with inflows nearing $125 million.

Not surprisingly, the rally unfolded despite a hotter-than-expected U.S. Producer Price Index report. November PPI inflation rose 3% year-over-year, beating forecasts for its highest reading since mid-2025.

Normally, higher-than-expected inflation data could weigh on risk assets. The coin instead pushed past the important $95,000 level.

Adding to the backdrop, the U.S. Supreme Court once more delayed a ruling on the legality of Trump-era tariffs. These bearish developments had little to no impact on the Bitcoin price’s upside move.

Why Investors Expect BTC to Return to Former Highs

According to Glassnode, long-term holders are increasing profits at a significantly slower rate than in previous cycles.

In past peaks, the exchange flow of coins per week exceeded 100,000. This is already a serious fall to below 12,800 per week. This is a clear indication that there is less selling pressure despite the fact that prices are touching $93,000 to $110,000.

According to Glassnode, profit taking is still a part of the process but not with the same aggressiveness observed during other phases of distribution. The Bitcoin price is therefore free to rally with an uptick.

The noteworthy aspect is that the owner of World’s Largest IQ made a positive remark about the prospects of doing so in the near future, joining Bitwise’s CIO bullish call.

Despite this positive trend, some risks have also been identified by analysts, which may be treated as negative factors. The issue with regard to the USA and Iran is having a impact on the globe as a whole. Though there was a slight fall in the prices of oil because of de-escalation of tension, sudden spikes could result in a change in market sentiment.

Source: https://coingape.com/crypto-traders-bet-on-bitcoin-price-hitting-100k-before-month-end-as-btc-breaks-97k/