Democrats Accuse SEC of “Pay-to-Play” in Justin Sun Case Dismissal

Congressional Democrats have formally accused the Securities and Exchange Commission (SEC) of operating a pay-to-play scheme in its handling of crypto enforcement cases, with particular focus on the agency’s treatment of Tron founder Justin Sun.

The allegations center on Sun’s substantial financial ties to the Trump family and the subsequent pause in the civil fraud case against him.

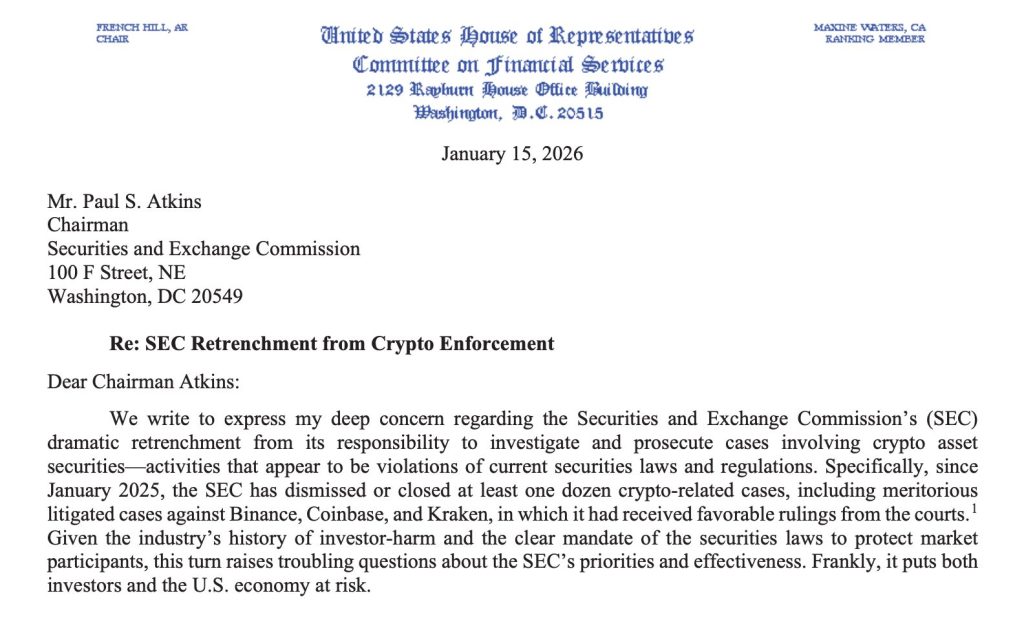

Representative Maxine Waters sent a detailed letter to SEC Chairman Paul Atkins on January 15, highlighting what she describes as a “troubling” pattern of dropped enforcement actions following significant crypto industry donations to President Trump’s campaign and businesses.

The letter demands answers about whether political considerations influenced regulatory decisions.

Source: House Financial Services Committee Democrats

Source: House Financial Services Committee Democrats

Financial Connections Raise Red Flags

The Democrats’ letter outlines Sun’s extensive financial relationship with Trump family ventures, noting his $75 million investment in World Liberty Financial through multiple purchases and his position as an official adviser to the project.

Sun became the top holder of Trump’s memecoin, earning an invitation to a May 2025 White House dinner for major investors.

Waters wrote that Sun’s activities “create the unmistakable appearance of a pay-to-play arrangement: a defendant to an SEC enforcement action pours tens of millions into ventures tied to the President’s family, and shortly thereafter his case is stayed.“

The letter emphasizes that crypto companies donated at least $85 million to Trump’s reelection campaign, with firms like Coinbase, Kraken, and Ripple contributing at least $1 million each to his inauguration.

The timeline proves particularly significant. The SEC filed its fraud lawsuit against Sun in March 2023, alleging he orchestrated unlawful token sales and manipulated trading volumes.

Despite building, as Waters describes, a strong case with favorable judicial rulings, the agency requested a stay in February 2025 to explore a settlement.

Strong Legal Case Put on Hold

The original SEC complaint detailed serious allegations against Sun and his companies.

Regulators claimed Sun “engineered the offer and sale of two crypto asset securities” without proper registration while directing “hundreds of thousands of TRX wash trades” that generated approximately $31 million from unsuspecting investors.

According to Waters, Judge Vernon Broderick of the Southern District of New York sustained core allegations in a parallel private class action, finding that plaintiffs plausibly alleged Sun and Tron illegally sold TRX as an unregistered security.

Several celebrities who promoted Sun’s tokens settled SEC charges and paid fines totaling hundreds of thousands of dollars.

Waters emphasized the case’s strength, stating “the SEC’s case was not speculative or marginal—it was built on a rigorous investigation that resulted in detailed allegations of systematic securities violations confirmed by judicial rulings and co-defendant settlements.“

No adverse rulings had impaired the SEC’s position before the stay.

Broader Enforcement Retreat Questioned

Beyond the Sun case, Democrats expressed alarm over the SEC’s dismissal of major enforcement actions against Binance, Coinbase, and Kraken.

The agency dropped its Binance case in May 2025 “as an exercise of discretion” despite favorable court rulings, while Coinbase and Kraken cases ended through joint stipulations citing the agency’s “ongoing efforts to reform its regulatory approach.“

Waters wrote that “the unjustified decision by the SEC to walk away from these and other meritorious enforcement cases against crypto firms has created the unmistakable inference of a pay-to-play scheme.“

She warned that this retreat “has left a vacuum whereby securities violations by crypto firms are not enforced and U.S. investors are not protected.“

The letter demands that the SEC either request that the court lift the stay and litigate Sun’s case in accordance with its original complaint or reach a settlement reflecting the case’s strength.

Democrats also requested preservation and production of documents regarding any communications with third parties seeking to influence the outcome.

The controversy adds to mounting scrutiny of the SEC’s dramatic policy shift under Chairman Atkins, who assumed leadership after Trump’s inauguration.

Waters had previously requested that House Financial Services Committee Chairman French Hill schedule oversight hearings with Atkins to examine what she characterized as the agency’s unprecedented politicization and retreat from investor protection.

You May Also Like

Vàng Cán Mốc Lịch Sử 5.000 USD: Khi Dự Báo Của CEO Bitget Gracy Chen Trở Thành Hiện Thực Và Tầm Nhìn Về Đích Đến 5.400 USD

Why the Bitcoin Boom Is Not Another Tulip Mania