Trump Administration Threatens to Drop Crypto Bill if Coinbase Doesn’t Accept Yield Deal

- White House threatens to drop Trump-backed crypto bill unless Coinbase returns and satisfies banking demands.

- Coinbase blames banks for blocking stablecoin yields while the industry splits on whether the exchange undermined legislation.

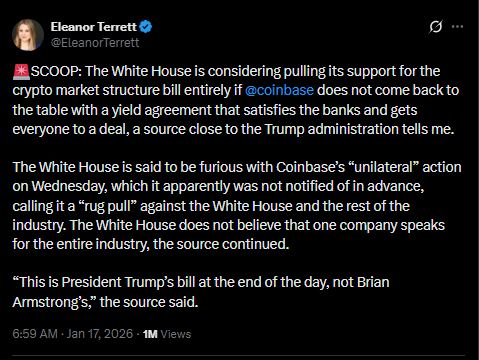

The Trump administration is warning it may walk away from the Digital Asset Market Clarity Act after Coinbase withdrew its support. The move has triggered strong reactions from officials, with the White House reportedly “furious” over what it viewed as a unilateral decision by the exchange. According to journalist Eleanor Terrett, a source close to the administration called Coinbase’s action a “rug pull” that shocked government officials and the broader industry.

Coinbase’s CEO, Brian Armstrong, cited growing influence from banking interests in the bill’s latest version. He argued that the current draft would severely restrict users’ ability to earn yields on stablecoins and included provisions that effectively block tokenized equities.

Armstrong also raised concerns about expanded surveillance powers that would compromise financial privacy and reduce the authority of the Commodity Futures Trading Commission in favor of the Securities and Exchange Commission.

The administration now expects Coinbase to return to the negotiation table. “This is President Trump’s bill at the end of the day, not Brian Armstrong’s,” the source told Terrett. Officials are pushing for a revised version that meets the demands of banking groups and resolves the disagreement around stablecoin yields.

Source: Eleanor Terrett on X

Source: Eleanor Terrett on X

Crypto Users Split on Coinbase Strategy

Coinbase’s sudden withdrawal has widened divisions within the crypto industry. Critics, including Citron Research, accused Armstrong of undercutting the bill for business reasons. They suggested the firm fears competition from tokenized securities platforms and wants clarity without sharing the benefits with rivals. Supporters of the bill worry that one company’s objections may derail legislation meant to address larger regulatory gaps.

Others in the space sided with Armstrong. Nic Carter of Coin Metrics wrote, “Then the banks should stop trying to screw everyone over,” accusing financial institutions of trying to protect their savings deposits by cutting off competition from digital alternatives. Many in the crypto sector believe the bill favors banks at the expense of innovation and user choice.

Ripple’s Brad Garlinghouse chose not to engage directly, while general reaction across the community remains mixed. Some believe Coinbase overstepped its influence. “Coinbase is not crypto. Coinbase is one exchange in crypto,” one user noted, emphasizing that no single entity should control the direction of regulatory policy.

Senate Delay May Push Crypto Bill to February

The Senate Banking Committee canceled the scheduled markup session for January 15. No replacement date has been announced. Some insiders suggest the delay could stretch into February. Senator Cynthia Lummis acknowledged the bill’s current draft needs a rethink. She said,

Despite the pause, some remain hopeful. Galaxy Digital CEO Mike Novogratz said he expects the Clarity Act to pass within the next two weeks, citing his conversations with senators. He believes the recent fallout won’t prevent lawmakers from eventually reaching an agreement on a workable bill.

]]>You May Also Like

Vanguard’s $505mln MSTR bet – Is the Bitcoin blockade officially over?

Cardano Whales Accumulate 200M Tokens During Dip, Fueling Bullish Hopes