Weekly: Polymarket Ban in Ukraine, Anniversary of the First Bitcoin Transaction, Postponement of the CLARITY Act, and Grok in the Pentagon

The Incrypted editorial team has prepared another digest of the week’s main events in the Web3 field. In it, we will tell you about the decision of the National Commission for the Regulation of Electronic Communications of Ukraine to ban Polymarket, the 17th anniversary of the first bitcoin transaction, the postponement of the CLARITY Act, the potential introduction of the Grok chatbot in the Pentagon, and much more.

Bitcoin

- Market dynamics of the asset

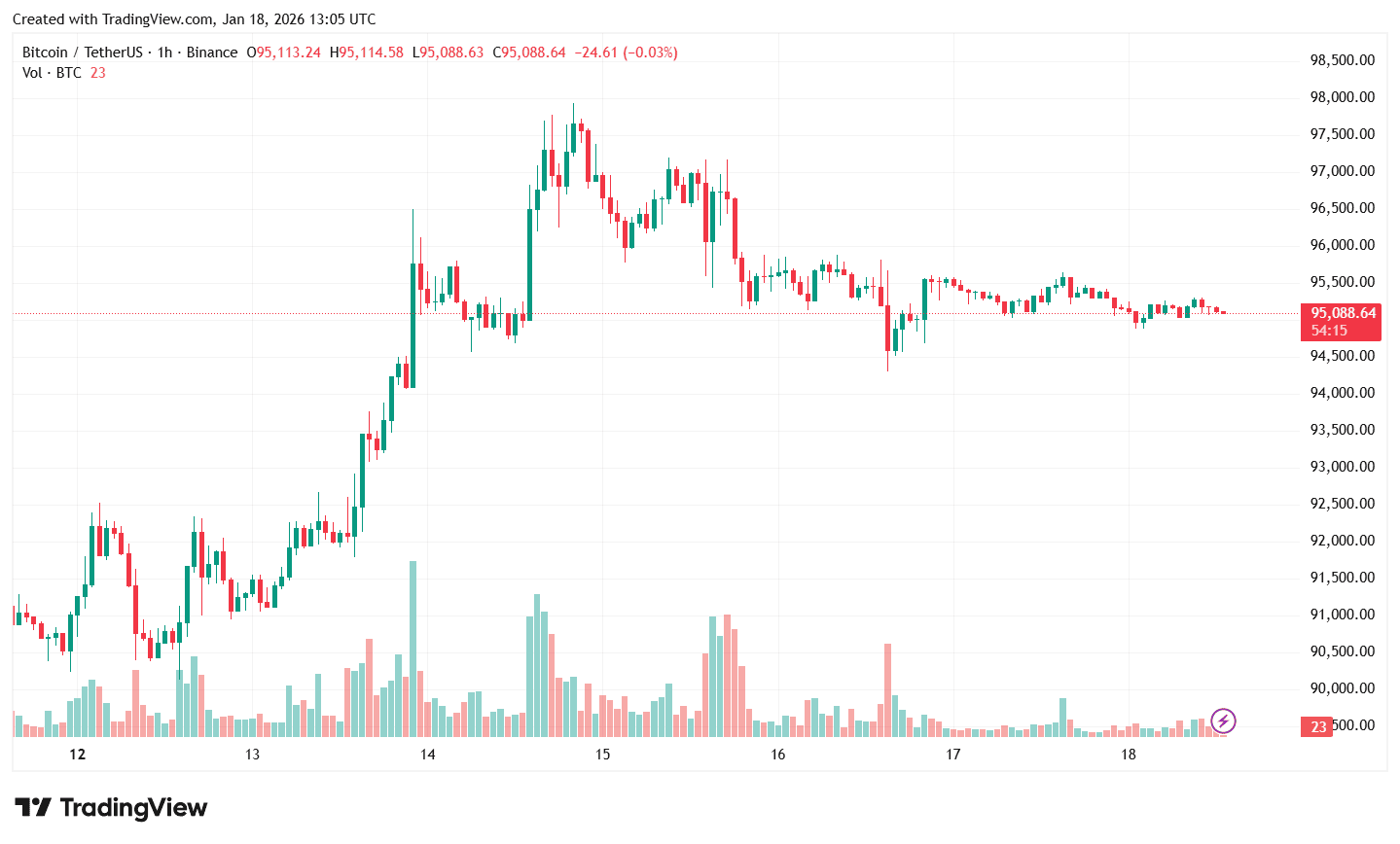

The crypto market started the week on the back of the 17th anniversary of the first bitcoin transaction — from 10 BTC with no value in 2009 to the price range of $96,000-97,000 in January 2026, which underlines the scale of the asset’s evolution. At the time of writing, the asset is trading at $95 088, according to TradingView.

Daily chart of BTC/USDT on Binance. Source: TradingView.

Daily chart of BTC/USDT on Binance. Source: TradingView.

The current market growth is confirmed by metrics: the Fear and Greed Index has risen to 61 points, whales are accumulating the asset, while retail investors are taking profits despite the growth of FUD on social media.

Against this backdrop, Ark Invest continues to view bitcoin as a mature macro asset and predicts a price of $300,000-$1.5 million by 2030 thanks to ETFs, corporate reserves, and reduced volatility.

However, Justin Bons, founder and chief investment officer of Cyber Capital, believes that bitcoin will decline in the next 7-11 years. He cited the gradual reduction of the security budget due to halving, as well as the risk of 51% attacks, censorship, and double spending in the medium term as the reasons for the collapse.

- Geopolitics and states — bitcoin as a defense and strategic reserve

In countries with economies in crisis, such as Iran, bitcoin plays a dual role: citizens are massively withdrawing assets to their own wallets to preserve their savings, while the state and related entities use crypto assets to circumvent sanctions.

At the same time, Sygnum predicts that in 2026, several G20 countries may officially include bitcoin in their state reserves, which is in stark contrast to the semi-clandestine use of cryptocurrencies in sanctioned jurisdictions. Regulatory shifts in the US and the expected tokenisation of up to 10% of institutional bonds may make bitcoin not only a survival tool but also an element of the global financial infrastructure.

Ethereum

Despite the Bank of Italy’s warnings about systemic risks in the event of a sharp Ethereum crash — particularly for stablecoins and financial services that use it as a settlement layer — the network is showing signs of growing resilience.

User and business activity is on the rise: the average daily growth of new wallets has exceeded 327,000, and the L2 ecosystem is concentrating revenues, with Base ($147,000) sharply ahead of Arbitrum ($39,000) and Starknet ($9,000). Thus, regulatory fears contrast with market performance — Fusaka updates, stablecoins, and DeFi simultaneously boost demand and raise the issue of the need for safeguards.

At the time of writing, the price of Ethereum is at $3316, according to TradingView.

Daily chart of ETH/USDT on Binance. Source: TradingView.

Daily chart of ETH/USDT on Binance. Source: TradingView.

Crypto ETFs and market expectations

The beginning of 2026 was marked by cautious sentiment: from 5 to 9 January, investors withdrew $681 million from spot bitcoin ETFs and another $68.5 million from Ethereum ETFs, with negative dynamics continuing in three of the last four weeks.

Against this backdrop, analysts contrast the current boom cycle of 2020-2021: according to Benjamin Cowen, bitcoin’s growth is not accompanied by widespread interest in the market, and altcoins have been hiding weakness for years due to the dominance of BTC.

Wintermute’s data confirms this: in 2025, the median growth period of altcoins decreased to 20 days, open interest in their futures fell by 55%, and capital is increasingly flowing into bitcoin and Ethereum.

Stablecoins

- Geopolitics and systemic risks of stablecoins

Stablecoins are increasingly becoming an instrument of states and a source of risks for traditional finance: according to the WSJ, Venezuela used USDT to circumvent sanctions through PdVSA, while for the population, it has become a hedge against hyperinflation.

In turn, central banks are testing formal integrations — Pakistan is exploring the launch of WLFI’s USD1 stablecoin alongside its own CBDC, which contrasts with the informal use of USDT in sanctioned economies.

The banking sector is reacting with restraint: Bank of America CEO Brian Moynihan warned that the legalization of stablecoin interest could cause an outflow of up to $6 trillion in deposits, increasing pressure on the US financial system.

- Institutional integration and payment infrastructure

At the same time, major players are accelerating the institutional adaptation of stablecoins: Visa, in partnership with BVNK, is launching stablecoin payment processing in Visa Direct, and Ripple is investing $150 million in LMAX to use RLUSD as collateral in institutional trading.

Circle positions USDC as the core of the “internet financial system”, emphasizing its scale — more than $50 trillion in online payments, operation in 30 networks, and humanitarian cases, including Ukraine.

Project news

- Private cryptocurrency rally

The privacy token segment surged ahead: Monero updated its ATH near $600 amid a split in Zcash and macro uncertainty, and daily trading volume increased by 243%.

Against this background, DASH added more than 70% per day (price > $65, market cap ~$815 million), which contrasts with the general restraint of most altcoins and indicates the rotation of capital into the “private” narrative.

- Scandals and volatility around personal tokens

The NYC token, launched by former New York City mayor Eric Adams, collapsed by more than 70% almost immediately after launch amid a lack of transparent tokenomics and suspicions of liquidity withdrawal of almost $3.4 million. Adams himself denies rug-pulling and any financial gain, but the case stands in stark contrast to the growth of private coins, highlighting the difference between narrative hype and market trust.

- Corporate decisions and the survival of crypto businesses

At the company level, the market is balancing between growth and contraction: CoinGecko is exploring strategic options, including a possible sale for around $500 million, while claiming a “position of strength” and focus on long-term development.

At the same time, MANTRA has taken a different path — the CEO announced restructuring and staff reductions after the financial crisis and the collapse of the OM token, which demonstrates the contrast between stable data platforms and vulnerable DeFi projects.

Regulation

- Blocking Polymarket in Ukraine and legal risks

The Polymarket forecasting platform was officially blocked in Ukraine by the decision of the National Commission for the State Regulation of Communications and Information because of the lack of a gambling license. Lawyers stressed that using the service creates legal risks for citizens, including possible administrative liability and the lack of any legal protection in the event of disputes. Additional attention of the regulator was drawn to Polymarket related to the war in Ukraine, which strengthened the arguments in favor of blocking.

- Progress with pauses in the CLARITY Act

Although the US Senate came close to considering the CLARITY Act after months of negotiations, the Banking Committee took a break to finalize a framework bill on the structure of the crypto market. The latest version of the bill prohibits income payments only for storing stablecoins, but allows rewards for user activity — from transactions and staking to liquidity and participation in network management. At the same time, delays, industry criticism, and the political backdrop are weakening the chances of a quick passage, despite claims of bipartisan consensus.

- USA: political pressure and stagnant crypto regulation

The conflict over the Federal Reserve System (FRS) has escalated in the US: Jerome Powell reported pressure from the Department of Justice and the Trump administration, while the president denied his intention to fire him but did not give up his influence on the regulator’s course.

Against this backdrop, Cardano CEO Charles Hoskinson accused the White House of destroying trust in the crypto industry through politicization and Trump Coin, which, he said, has disrupted bipartisan progress and frozen key initiatives.

- Ukraine: regulatory timelines and personnel signals

In Ukraine, a working group is preparing a draft law on virtual assets for the second reading within 1-1.5 months, signaling a shift from discussion to practical regulation. At the same time, the appointment of Oleksandr Borniakov as acting Minister of Digital Transformation strengthens the pro-European and pro-crypto-regulatory vector of state policy.

- Regulatory changes in the world

Dubai has introduced strict restrictions, banning privacy tokens, mixers, and revising the definition of stablecoins, while France has warned 90 crypto companies without a MiCA license of possible closure from July. Meanwhile, Moldova is moving more gently: the country will legalize the ownership and trading of crypto assets in 2026, but will ban payments and introduce a 12% tax, synchronizing with MiCA.

South Korea, after a nine-year ban, has allowed corporations to invest in crypto assets, but with clear restrictions — up to 5% of equity per year. This approach contrasts with Dubai’s outright ban on certain instruments and demonstrates Seoul’s focus on controlled integration rather than driving the industry out.

Artificial intelligence

- Infrastructure and strategic investments in AI

OpenAI has signed a $10bn contract with Cerebras until 2028, providing up to 750MW of computing resources, in response to the explosive growth in demand for AI training.

Meanwhile, BlackRock predicts that US investment in AI infrastructure will exceed $500 billion in 2026, emphasizing that unlike the dot-com bubble, the market is supported by real capital expenditure by hyperscale companies.

- Corporate partnerships and integration of AI into products

Apple confirmed a multi-year agreement with Google, making Gemini the basis of Apple Intelligence and Siri, while not breaking off cooperation with OpenAI — a bet on a multi-vendor model versus dependence on a single supplier.

In retail, Walmart, together with Google, integrates Gemini into purchases through the open UCP standard, focusing on personalization and speed of delivery, unlike competitors’ closed ecosystems.

- Experiments, risks, and non-standard applications of AI

Startup Conceivable is using AI robots to automate in vitro fertilization (IVF), reducing costs and human dependency, but also provoking ethical debate — a stark contrast to purely commercial AI cases.

Meanwhile, Grok 4.20 demonstrates 10-12% profitability in live trading, contrasting real financial results with reputational and regulatory risks.

- Grok in the Pentagon

The Pentagon plans to integrate Elon Musk’s Grok chatbot into its AI systems this month, continuing its course of accelerated implementation of generative AI without “ideological restrictions”. Grok will work in parallel with Google products within the military infrastructure, providing support for operations and analytics. The Grok 4.20 model has already demonstrated its effectiveness in live stock trading with a yield of 10-12%, which underlines its potential in real-world conditions.

Hackers

In 2025, cryptocurrency fraudsters stole a record $17 billion, which was the highest figure in the history of observations, Chainalysis notes. The bulk of the losses were caused by identity fraud, which grew by 1400% over the year, and the average payment increased from $782 to $2764. AI-based schemes proved to be 4.5 times more profitable than traditional ones, indicating the industrialization and increasing technological complexity of criminal operations.

- BitMine invests $200 million in Beast Industries by blogger MrBeast;

- Celestia co-founder Mustafa Al Bassam presented the Celestia Vision 2.0 concept for global online markets;

- Delphi Digital predicts the maturity and institutionalization of the crypto market in 2026;

- The investor lawsuit against Oracle highlights the risks of financial investments in AI;

- The NEAR Committee outlines plans for 2026 with a focus on network scaling, infrastructure abstraction, and preparation for agent-based commerce and AI;

- MetaMask added support for TRON;

- Base app changes its focus to trading and on-chain assets;

- BERA token trading volume increased by 2000% amid the network’s new strategy for 2026;

- In the US, a teenager from California died of an overdose after using ChatGPT as a personal drug advisor.

Articles

The Incrypted editorial team has prepared an article on DAC8 rules and tax transparency in the European Union. You can read more here:

In addition, readers can find out about the “death” of the classic alt-season in the corresponding section:

- We’ve gathered the key investments in blockchain, cryptoassets, and AI over the past week in one article.

- We regularly update the Incrypted crypto calendar, where you will find a lot of interesting events and announcements.

You May Also Like

TrendX Taps Trusta AI to Develop Safer and Smarter Web3 Network

Fed Rate Cut and Tariff Effects: Powell’s Inflation Outlook