Crypto Inflows Hit $2B Last Week, Largest Since October 2025

Digital asset investment products recorded $2.17 billion in inflows last week. It was the largest weekly total since October 2025, just days before the prior market crash.

Most of that capital entered early in the week before sentiment flipped on Friday.

Bitcoin BTC $93 055 24h volatility: 2.2% Market cap: $1.86 T Vol. 24h: $43.37 B absorbed the bulk of demand with $1.55 billion in inflows.

Ethereum ETH $3 218 24h volatility: 3.0% Market cap: $388.40 B Vol. 24h: $29.99 B followed with $496 million, while Solana SOL $133.8 24h volatility: 5.9% Market cap: $75.61 B Vol. 24h: $5.82 B added $45.5 million.

Blockchain equities also saw strong interest, pulling in $72.6 million.

On the other hand, a number of altcoins saw inflows as well including, XRP ($69.5 million) XRP $1.97 24h volatility: 3.9% Market cap: $119.73 B Vol. 24h: $3.78 B , Sui ($5.7 million) SUI $1.56 24h volatility: 12.0% Market cap: $5.89 B Vol. 24h: $1.19 B , LIDO ($3.7 million) LDO $0.55 24h volatility: 9.2% Market cap: $461.97 M Vol. 24h: $56.32 M , and Hedera ($2.6 million) HBAR $0.11 24h volatility: 6.8% Market cap: $4.66 B Vol. 24h: $191.65 M .

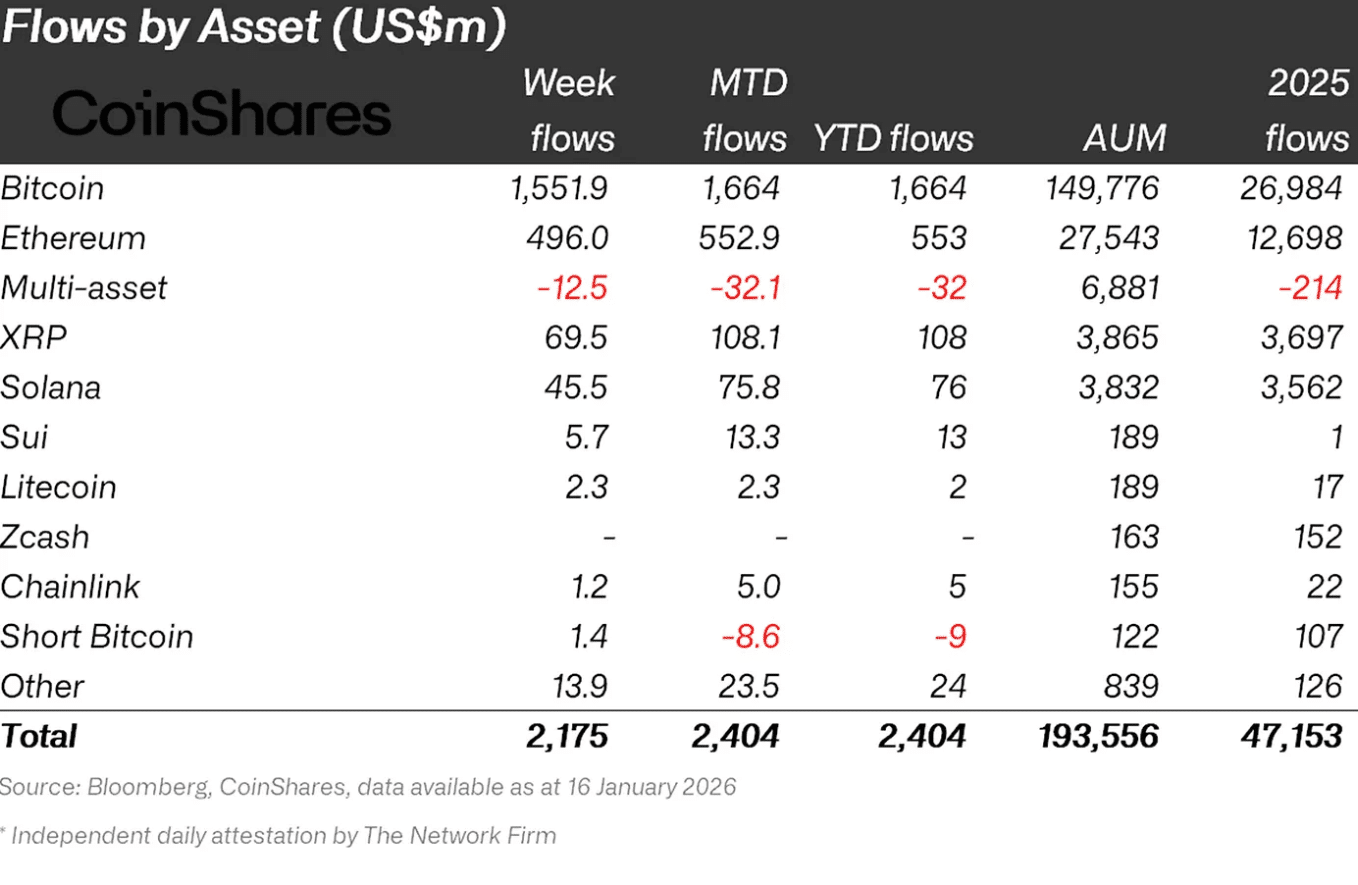

Digital asset product flows by asset. | Source: CoinShares

Sentiment Weakened on Friday, US Leads

According to CoinShares, it was a rough week for crypto. Friday alone saw $378 million in outflows as markets reacted to geopolitical tensions and renewed tariff threats from US President Donald Trump.

Diplomatic disputes over Greenland and policy uncertainty in the US weighed on risk assets.

On the other hand, flows were broad across regions, but the US dominated activity.

US-based products recorded $2.05 billion in inflows. Germany followed with $63.9 million, Switzerland with $41.6 million, Canada with $12.3 million, and the Netherlands with $6 million.

The distribution shows institutional demand remains concentrated in US entities, despite improving global participation.

However, these flows came despite regulatory pressure. Proposed language under the US CLARITY Act could limit yield-bearing stablecoins, which could affect Ethereum tokens.

Santiment’s Market Insight

According to blockchain analysis platform Santiment, wallets holding between 10 and 10,000 BTC accumulated aggressively in early January.

Since late December, they have added roughly 59,000 BTC while retail wallets reduced exposure over the same period. Such scenarios have historically supported higher prices.

Santiment added that spot Bitcoin ETF volume hit a record high midweek at roughly $19.6 billion while Ethereum ETFs also posted one of their strongest weeks, with daily volume exceeding $1 billion.

The platform said that current metrics indicate returning capital but uneven confidence. Institutions are deploying through regulated products while retail participation is fading.

nextThe post Crypto Inflows Hit $2B Last Week, Largest Since October 2025 appeared first on Coinspeaker.

You May Also Like

Trump’s cyber strategy vows to ‘support the security’ of cryptocurrencies and blockchain

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement