Crazy weekend: Crypto’s Solana moment in 10 charts

Author: Ignas , Crypto KOL

Compiled by: Felix, PANews

This past weekend was probably the craziest weekend in crypto. Here are 10 charts to help you understand:

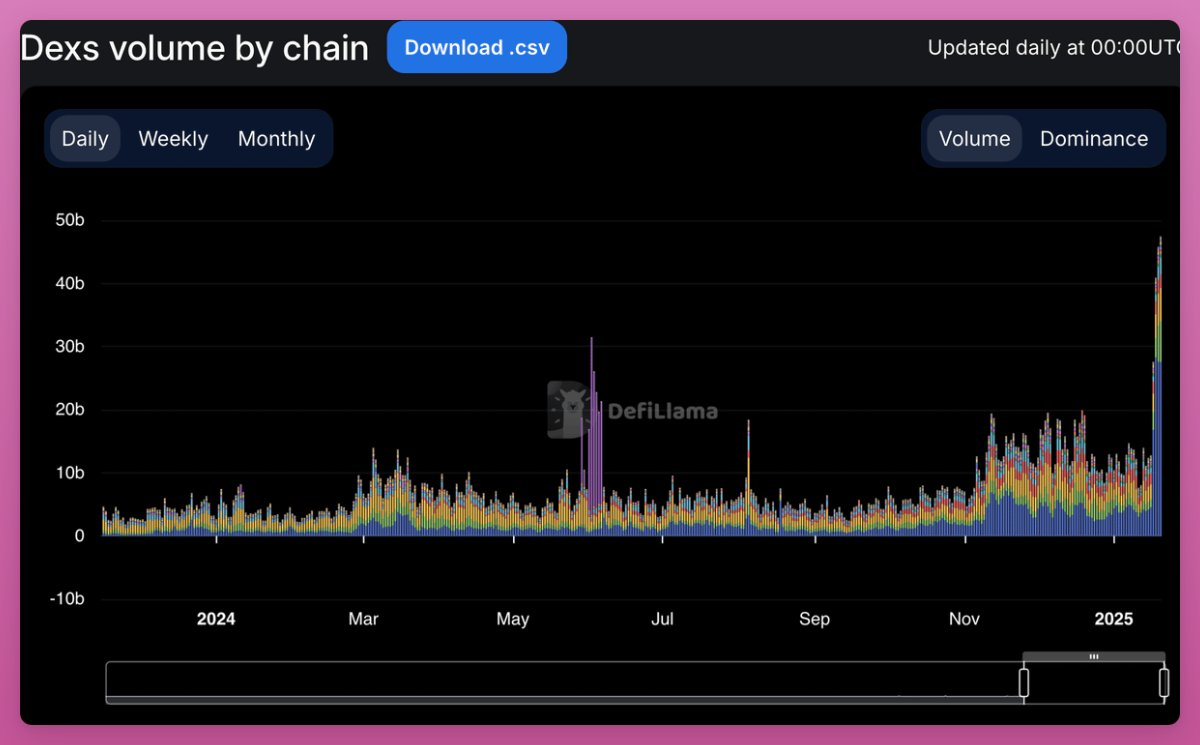

Record DEX trading volumes:

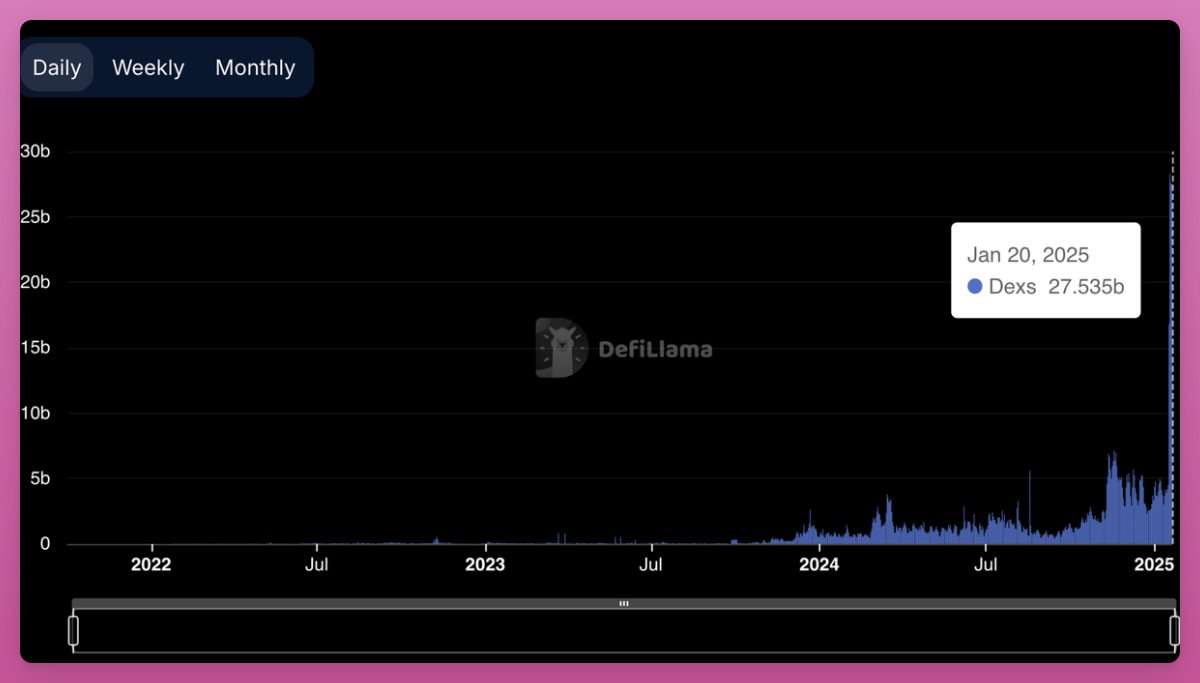

The Solana network DEX transaction volume reached 27 billion US dollars, far exceeding ETH's 5 billion US dollars.

DEX trading volume on Solana jumped from an average of approximately $5 billion to $27 billion, a 5.4x increase.

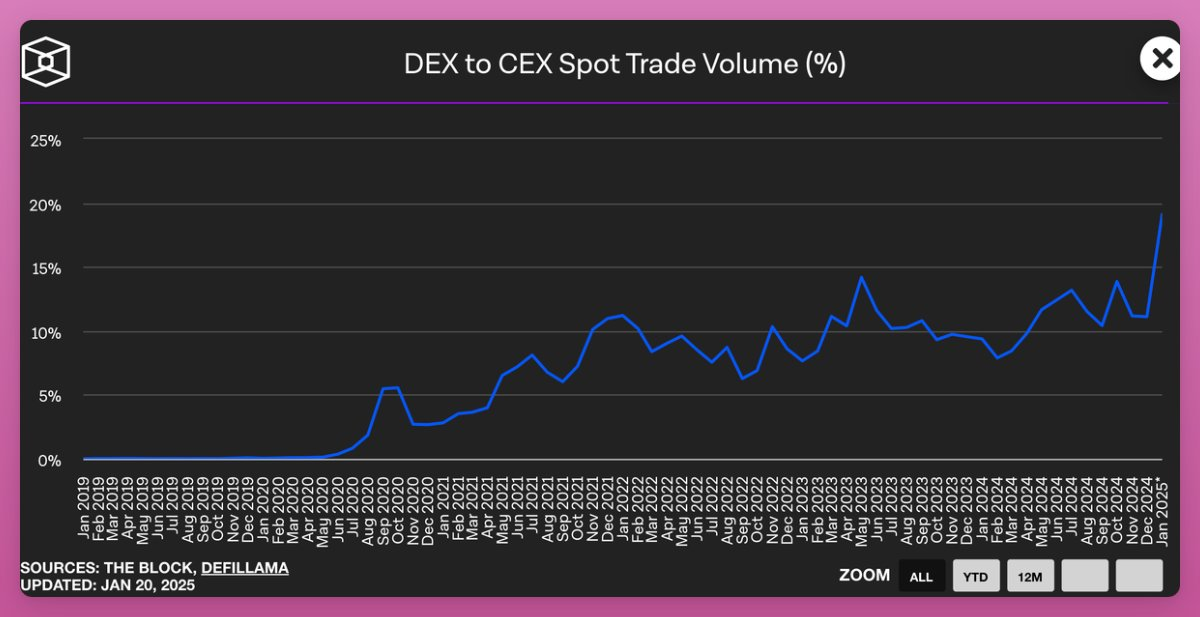

As a result, DEX’s share of CEX spot trading volume reached an all-time high of 19%.

Price discovery happens on DEXs, not CEXs.

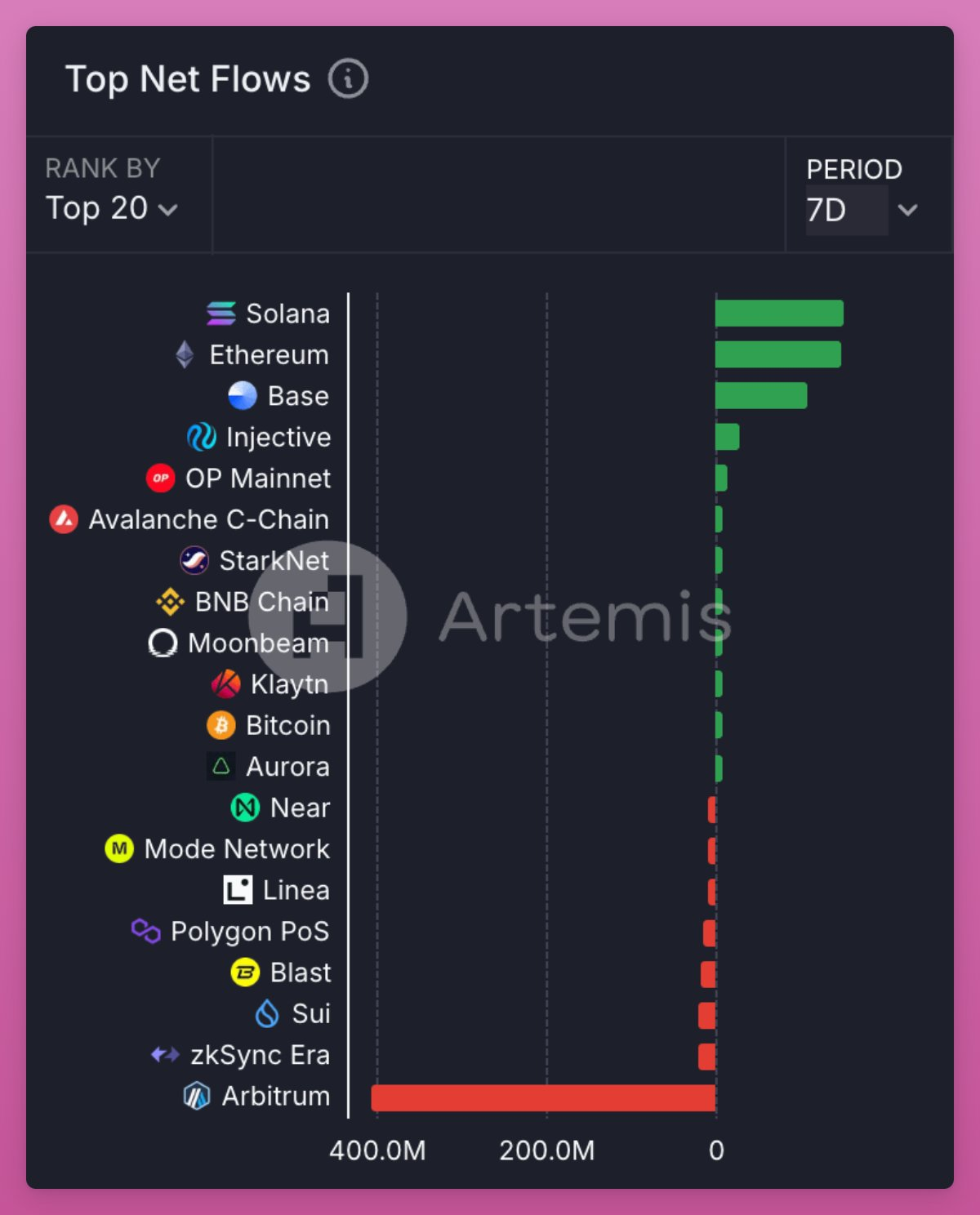

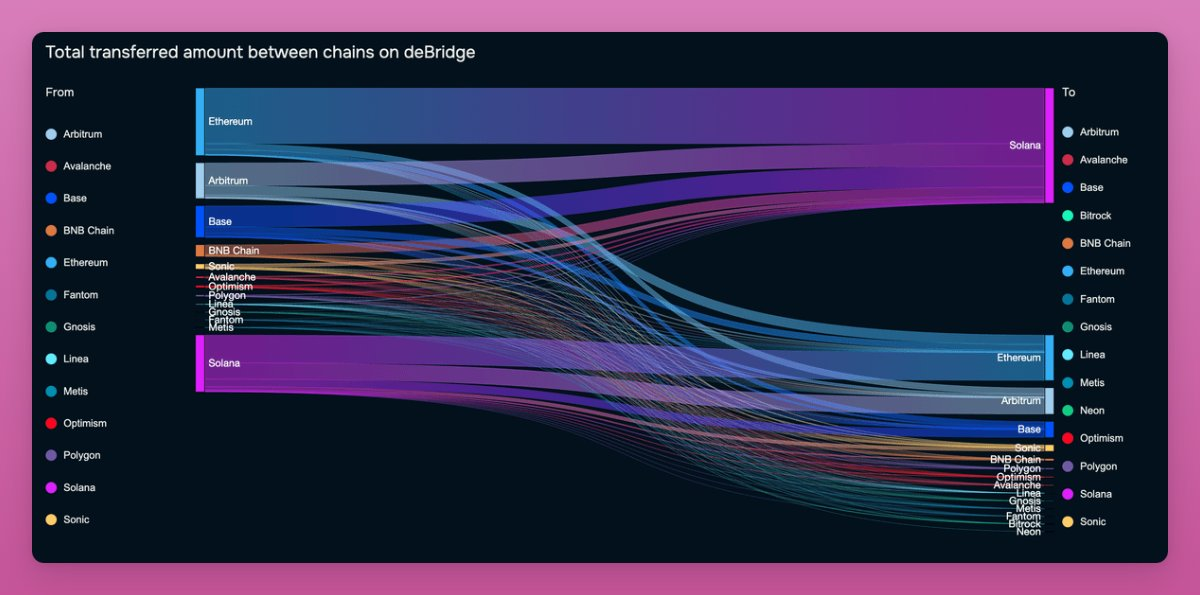

Funds flowed from Arbitrum to Solana, ETH, and Base.

The Solana network saw a net inflow of $153 million, while Arbitrum lost $405 million in the week.

The following figure is another way to visualize Solana traffic.

DeBridge analysis shows that about $300 million is flowing into Solana each week, mainly from Ethereum, Base, and Arbitrum.

Solana’s outflows reached approximately $140 million.

Phantom reports more than 8 million requests per minute.

Phantom users traded $1.25 billion in volume, with 10 million transactions.

Assuming Phantom’s current rate is 0.85%, the swap fee is $10.6 million.

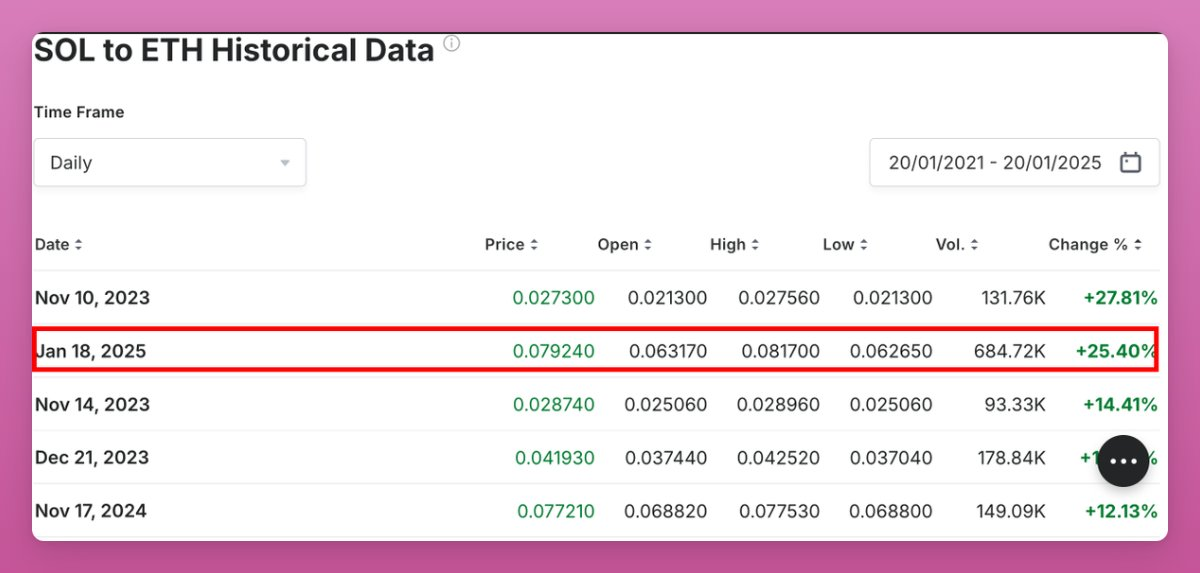

On the day the TRUMP coin was launched, SOL recorded its largest single-day increase against ETH since 2021. The 25% increase further hit the morale of the Ethereum community and increased pressure on internal reforms of the Ethereum Foundation.

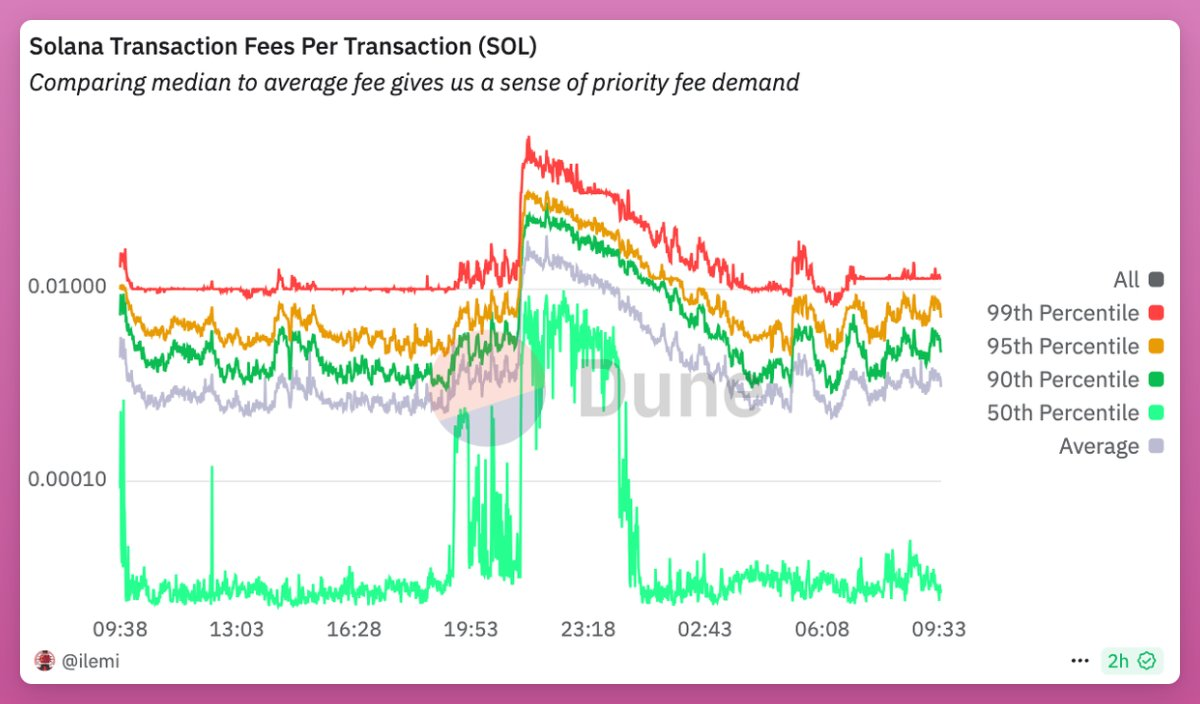

However, not all is good for Solana:

- Average cost increased 20 times

- Many people simply cannot complete the transaction

High fees are very beneficial for SOL stakers.

A total of $57 million in fees were paid, but the majority were $33 million in priority fees and $23.5 million in Jito Tips ( Jito verification tips).

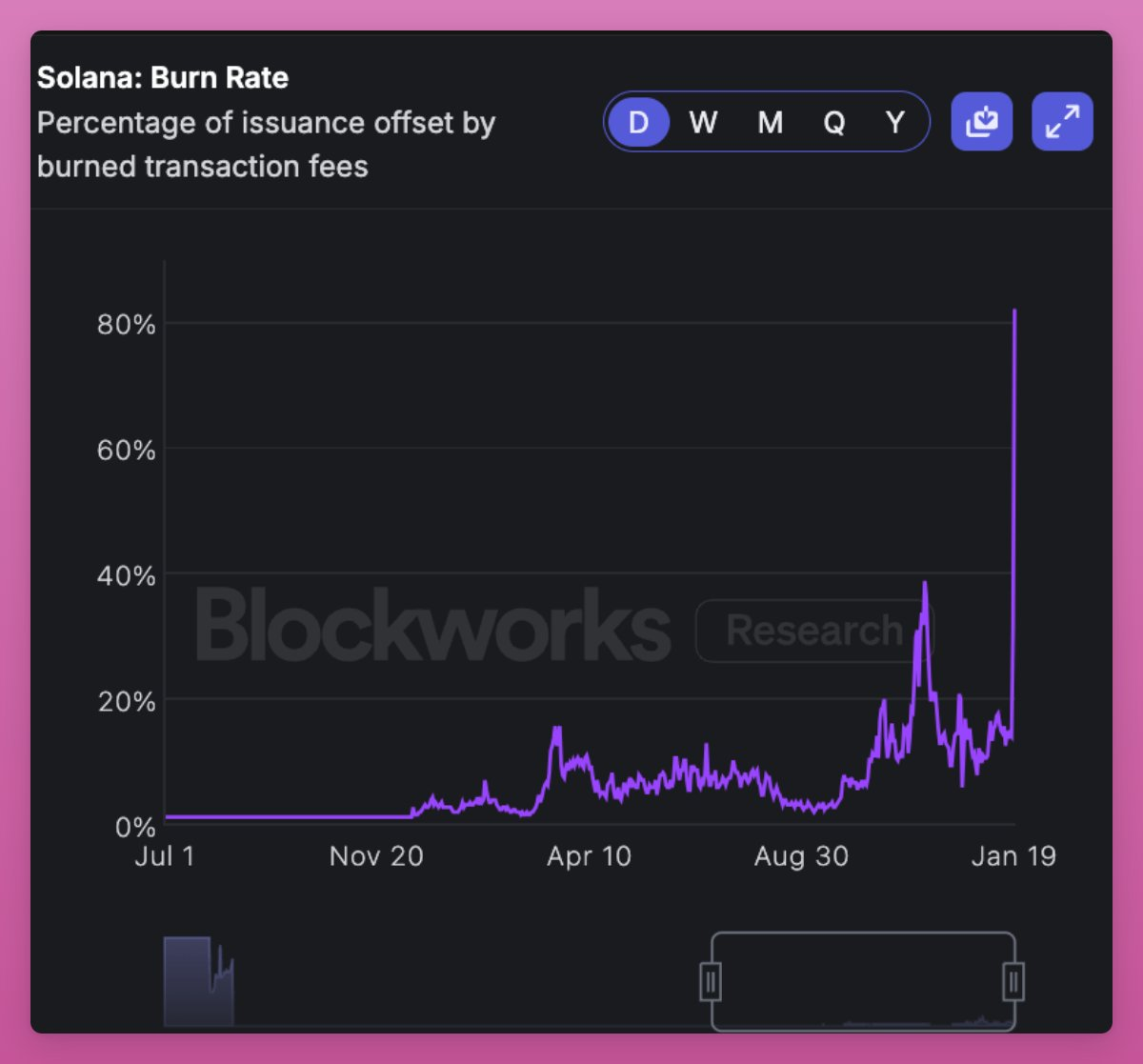

Importantly, SOL destroyed a record amount of approximately $16.7 million.

Don’t use “ultra-sound money” as an excuse, because weekend destruction accounts for 81% of SOL issuance, which is much higher than daily.

The following figure shows the Solana destruction rate:

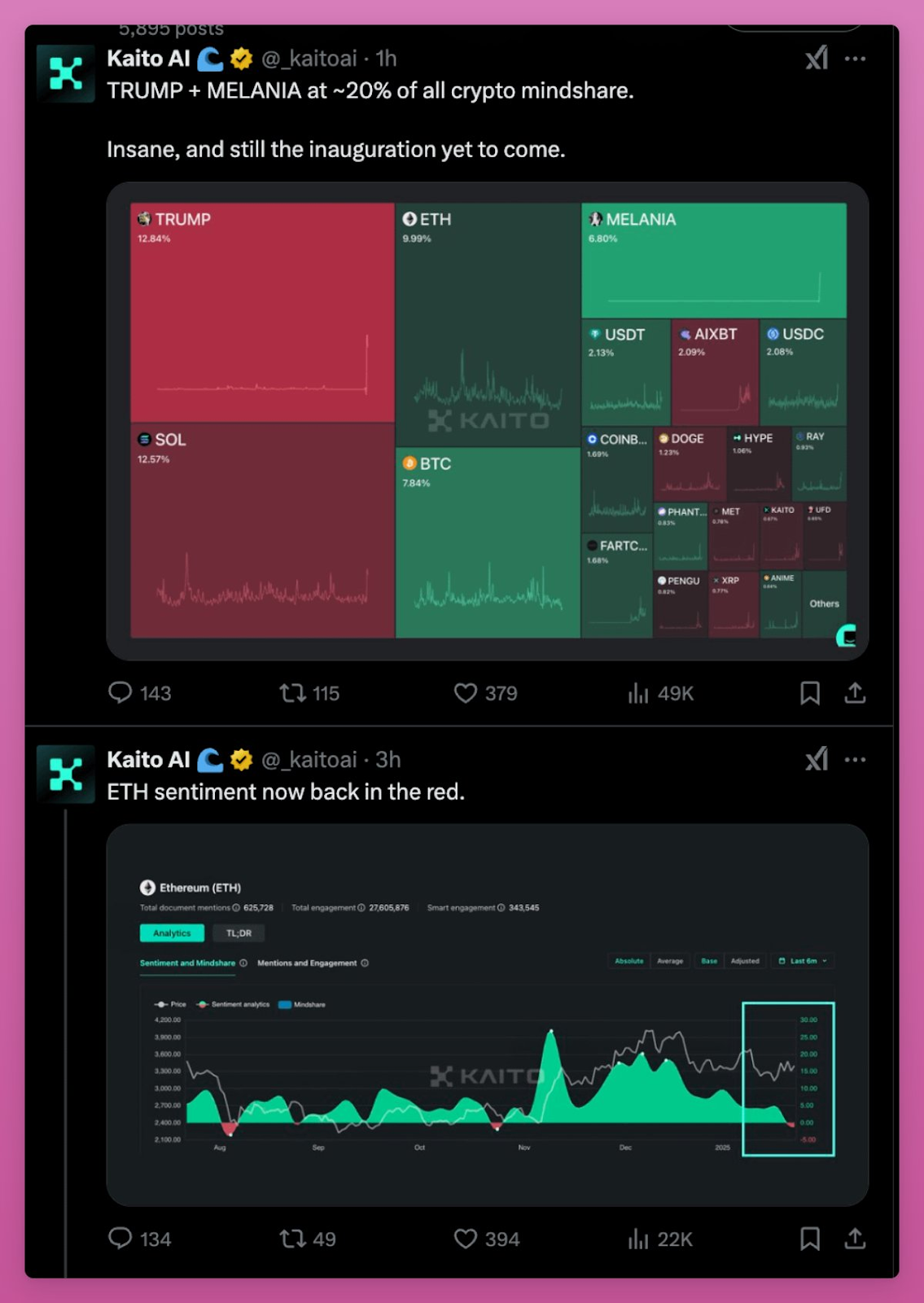

Overall, it was a wild weekend for Solana, with TRUMP, MELANIA, and SOL dominating the market. Meanwhile, sentiment on ETH turned negative again.

Related reading: Trump family is making a comeback! The market value of "First Lady Coin" MELANIA has exceeded 10 billion in a short period of time, and the details of multiple tokens have caused market controversy

You May Also Like

Sunrun Shares Plunge 28% Following Disappointing 2026 Cash Flow Forecast

IP Hits $11.75, HYPE Climbs to $55, BlockDAG Surpasses Both with $407M Presale Surge!