Ondo Brings 200+ Tokenized Stocks to Solana, Challenging xStocks Dominance

Ondo Finance expanded its tokenized securities platform to Solana on Jan. 21, entering the blockchain’s growing market for digital versions of traditional stocks where rival xStocks has held roughly 93% market share since launching in June 2025.

The expansion brings 200+ tokenized US stocks and exchange-traded funds to Solana, making Ondo Global Markets the largest tokenized stock issuer on the network by asset count, according to the company’s announcement. Users can access the assets through the Jupiter trading platform.

Ian De Bode, President of Ondo Finance, said the platform enables users to buy tokenized stocks at brokerage prices with liquidity sourced from exchanges including NASDAQ and NYSE. The available assets include growth stocks, blue-chip equities, and commodity-linked products tracking gold and silver.

Ondo says users can create and redeem tokens instantly during US market hours rather than relying on liquidity pools, a design the company claims supports larger trades with less price impact.

Competitive Landscape

Ondo enters a market that xStocks, operated by Backed Finance, has dominated since its June 30, 2025 launch. The competitor brought tokenized US stocks to Solana with access through Kraken, Bybit, and Jupiter.

As of Jan. 19, xStocks had processed more than $3 billion in total transaction volume with over 57,000 unique holders, according to a Solana Foundation case study updated Jan. 19, 2026. The platform holds approximately $182 million in deposited assets on Solana.

Market Context

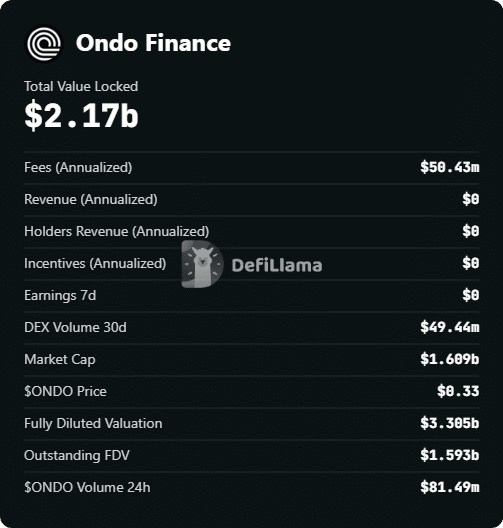

Ondo Finance launched its Global Markets platform on Ethereum in September 2025 with over 100 tokenized assets before expanding to BNB Chain in October 2025. The company holds $2.17 billion in total value locked across all products, according to DefiLlama, making it one of the largest real-world asset platforms in crypto.

Ondo Finance key metrics showing $2.17 billion in total value locked across all chains | Source: DefiLlama

Nick Ducoff, Head of Institutional Growth at the Solana Foundation, said the launch brings a broad range of tokenized US stocks and ETFs into the Solana ecosystem, expanding what is possible for onchain finance. He added that real-world assets represent an important part of Solana’s future as the network powers internet capital markets.

The company’s native token ONDO ONDO $0.33 24h volatility: 1.6% Market cap: $1.59 B Vol. 24h: $86.19 M , is among projects facing significant supply increases this month, with $1.7 billion in previously locked tokens becoming available for trading across the broader market.

nextThe post Ondo Brings 200+ Tokenized Stocks to Solana, Challenging xStocks Dominance appeared first on Coinspeaker.

You May Also Like

MAXI DOGE Holders Diversify into $GGs for Fast-Growth 2025 Crypto Presale Opportunities

UK crypto holders brace for FCA’s expanded regulatory reach