Is LINK Price Gearing Up for a Breakout After Equities Go On-Chain?

The post Is LINK Price Gearing Up for a Breakout After Equities Go On-Chain? appeared first on Coinpedia Fintech News

The LINK price is back in focus in early 2026 as Chainlink expands its role beyond crypto-native markets. By bringing real-time U.S. stock and ETF pricing on-chain, the protocol is strengthening its position as core infrastructure for tokenized finance, while market sentiment and price structures hint at a key phase.

LINK Price Strengthens as Equities Go On-Chain

Chainlink recently introduced real-time U.S. stock and ETF price feeds to blockchain networks, a move that significantly expands DeFi’s addressable market. Until now, most decentralized applications relied on delayed or synthetic pricing when referencing traditional assets. With this upgrade, tokenized equities can now react to live market movements, allowing more accurate settlement, collateral management, and automated execution.

As a result, the LINK crypto narrative has shifted toward infrastructure dominance. With nearly $80 trillion in global equities now compatible with on-chain systems, Chainlink is positioning itself at the center of tokenized finance, where reliable data is non-negotiable.

Institutional Momentum and Social Signals Around LINK Price

Meanwhile, the announcement triggered a visible spike in social activity. Despite broader market weakness, LINK recorded a five-week high in social volume, indicating renewed attention.

Historically, such spikes often coincide with key inflection points rather than sustained tops, particularly when paired with fearful sentiment.

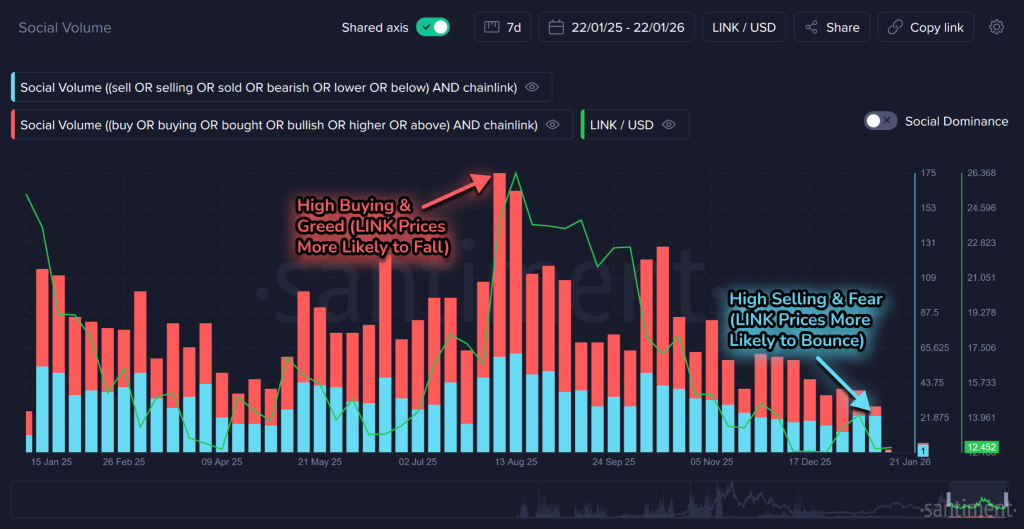

Santiment data comparing bullish and bearish keywords shows elevated fear and selling trend.

Interestingly, these conditions have often preceded price stabilization or rebounds, as excessive pessimism tends to reflect short-term exhaustion rather than structural weakness in the LINK price USD trend.

LINK Price Chart Reflects a Long-Term Technical Setup

From a market-structure perspective, the LINK price chart continues to trade within a long-term ascending trendline visible on higher timeframes. This pattern has already produced two strong rallies along the same rising trendline, reinforcing its technical relevance.

Currently, LINK/USD is consolidating near the lower boundary of this structure, a zone that has historically attracted demand. As long as this ascending trendline holds, the broader LINK price forecast remains constructive, with upside momentum gradually rebuilding after the recent correction.

Macro Relief Adds Breathing Room for LINK Price Action

In addition, short-term macro relief supported crypto sentiment after reports suggested that tariff-related tensions eased. This allowed market participants to refocus on protocol-level developments rather than macro shocks. In this context, Chainlink crypto’s expansion into real-world asset pricing stands out as a fundamental driver rather than a speculative headline.

Consequently, the LINK price prediction narrative increasingly ties valuation to infrastructure demand rather than cyclical hype, reinforcing its relevance in both DeFi and institutional blockchain adoption.

You May Also Like

The Channel Factories We’ve Been Waiting For

Gold Hits $3,700 as Sprott’s Wong Says Dollar’s Store-of-Value Crown May Slip