FTX Hearing: Creditors in restricted jurisdictions may choose to transfer their claims to non-restricted jurisdictions for claims

PANews reported on July 23 that FTX Historian, an account that tracks FTX's bankruptcy and compensation, summarized the key points of last night's hearing: Previously, if a creditor was in a "restricted jurisdiction" (such as China or Russia), his funds would be immediately confiscated according to the initial proposal of FTX's asset recovery party. Now the situation has changed, and creditors may be able to transfer their claims to non-restricted countries. The initial motion was "If the creditor is in a restricted jurisdiction, his claims or compensation will be immediately confiscated", and the updated motion is expected to limit or delete this clause. Creditors can move to non-restricted areas (such as from China to Singapore and the UAE) and receive a distribution of funds, and the jurisdiction can be changed before the distribution. Affected creditors (such as those who have completed KYC in China but live in other countries) may be able to recover their funds through this, but they need to update information and seize the opportunity. In addition, the hearing reduced the risk of debt buyers, and they are likely to increase their bids.

You May Also Like

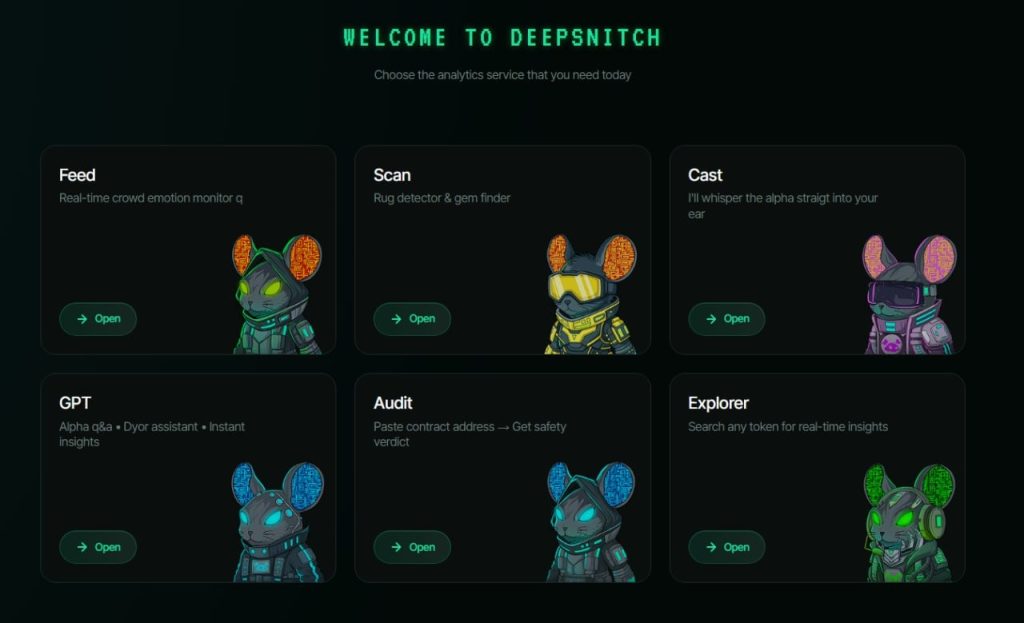

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24