PNC Bank to Offer Crypto Services Through Coinbase Partnership

Pittsburgh-based financial services corporation PNC Bank has announced adding Coinbase’s Crypto-as-a-Service platform, enabling customers to buy, hold and sell crypto.

The crypto move announced on Tuesday said that PNC will also offer “best-in-class” banking services to Coinbase. The PNC-Coinbase deal comes amid growing demand for regulated crypto offerings.

“This collaboration enables us to meet growing demand for secure and streamlined access to digital assets on PNC’s trusted platform,” said William S. Demchak, CEO of PNC Bank.

PNC Bank has become one of the largest American banks to launch crypto services at large. Following years of cautious approach, US banks are increasingly embracing crypto, signalling steps toward deeper integration of digital assets in mainstream portfolios.

“Traditional finance is slowly waking up to crypto’s call and is vying for a piece of the pie,” Gadi Chait, Xapo Bank’s Investment Manager, told Cryptonews.

PNC Bank did not disclose the timeline for its crypto launch.

Newfound Token Enthusiasm Among US Banks

US banks are seeking deeper ties with crypto firms to avoid missing out on deals spurred by a more relaxed regime under Trump.

Traditional banks JPMorgan Chase and Citigroup have announced plans to get involved in stablecoin offerings. Further, Bank of America CEO Moynihan said that it is trying to understand client demand before its stablecoin rollout.

PNC Bank, which manages $421 billion in client assets, has become the latest institution to join a growing list of banks deepening their crypto exposure.

Analysts Increase Price Targets For PNC Bank

Following Tuesday’s announcement, shares of PNC Financial Services Group, the bank’s parent company, rose 0.59%, according to Google Finance data.

Besides, Coinbase is quickly becoming a key entry point for banks looking to test the crypto waters. The firm saw significant analyst activity with Piper Sandler and Cantor Fitzgerald, both increasing their price targets for the company.

Piper Sandler raised the firm’s price target on Coinbase to $350 from $190, attributing to a more positive outlook for digital assets.

Coinbase’s crypto-as-a-service platform offers partners custody and trading tools, which otherwise would be expensive to build.

You May Also Like

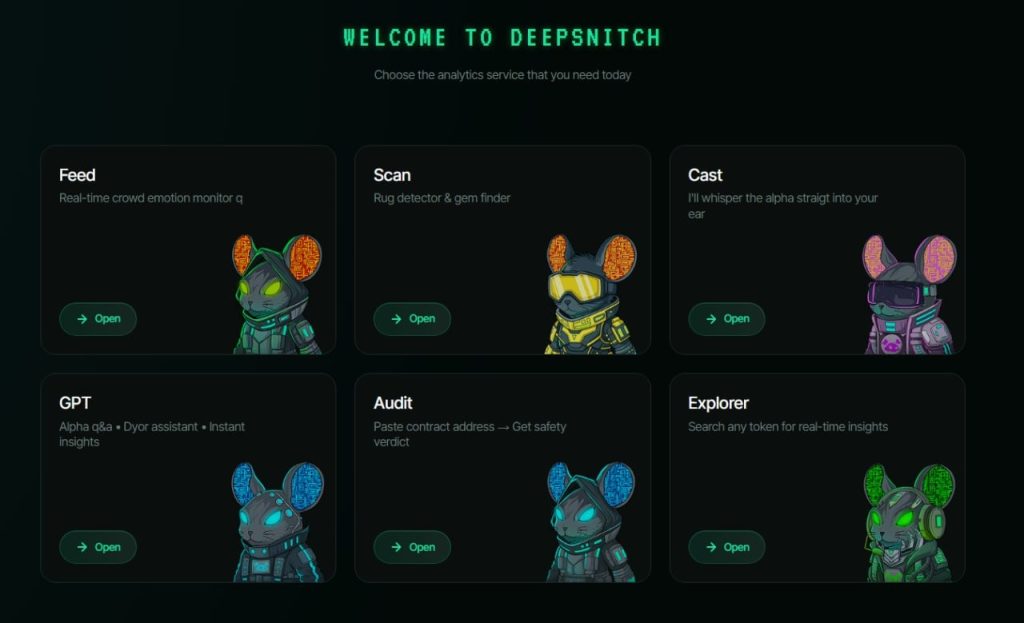

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24