Tether has invested in over 120 companies: CEO Ardoino

Tether is putting its profits to work, revealing a massive venture portfolio that stretches far beyond stablecoins.

- Tether CEO Paolo Ardoino says the company has invested in several companies through its venture arm.

- The stablecoin issuer’s portfolio spans fintech, AI, blockchain, and energy, with more expected in the coming months.

- So far in 2025, Tether has rolled out several high-profile investments.

On July 23, CEO Paolo Ardoino revealed that the company has invested in more than 120 companies through its venture arm, Tether Investments. He stressed that these investments are funded entirely from Tether’s own profits, not from the reserves backing USDT (USDT) or its other offerings.

The stablecoin issuer generated $13.7 billion in profit last year, and Ardoino says the company is deploying those earnings into strategic bets across fintech, AI, energy, blockchain, and other sectors.

“At Tether, we invest in transformative companies, visionary teams, and groundbreaking technologies that champion decentralization and individual sovereignty,” the company wrote in a blog post. “Our focus spans critical sectors including payment infrastructure, renewable energy, Bitcoin, agriculture, artificial intelligence, and tokenization.”

Ardoino added that the current number is expected to grow “significantly” in the coming months as the firm ramps up its venture strategy. The latest reveal builds on a series of acquisitions and investment announcements made earlier this year.

Tether’s 2025 investment streak

In February, the stablecoin issuer announced a strategic investment in self-custodial crypto wallet Zengo to enhance the security and accessibility of blockchain tools. Ardoino said the investment aligns with the stablecoin firm’s commitment to empowering users by providing reliable, secure, and accessible tools.

Building on this, Tether backed Chile-based crypto exchange Orionx with fresh capital to scale its stablecoin-powered infrastructure in June. That same month, the venture arm acquired a 31.9% stake in Canadian gold mining firm Elemental Altus Royalties, purchasing 78.4 million shares from La Mancha Investments. The deal also includes an option to purchase an additional 34.4 million shares later this year.

Alongside these ventures, Tether has continued to build its reserves, holding more than 100,000 Bitcoin and 80 tons of physical gold to support its gold-backed token, XAUT.

You May Also Like

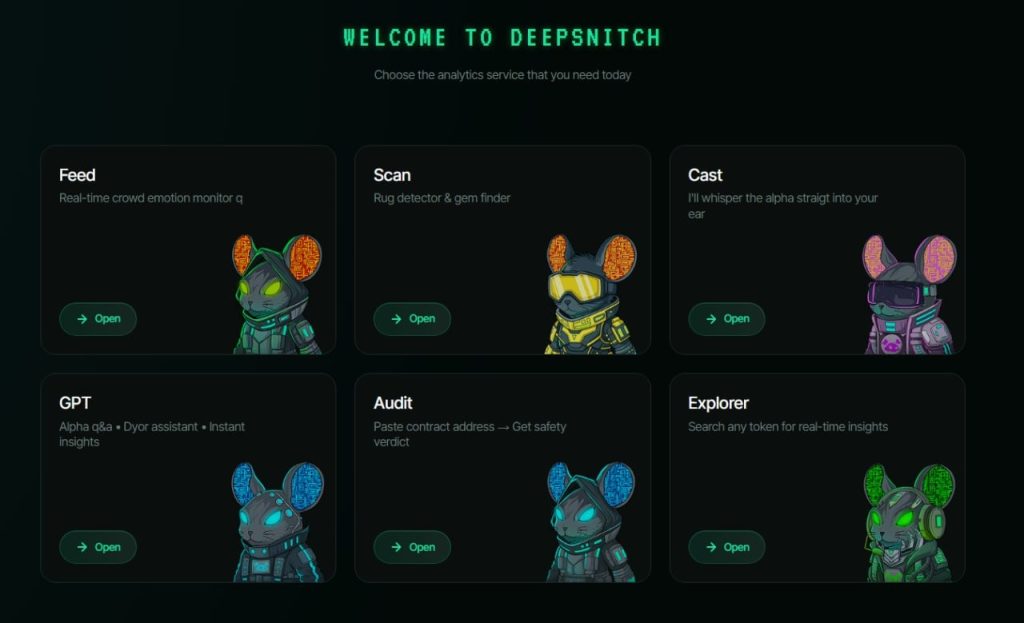

WLFI Token Price Prediction for March Is Ahead of Bitcoin, as TRX Is Stable; But DeepSnitch AI Is Moving to a New Level of Explosive 250x Returns

SEI Technical Analysis Feb 24