Can Digitap ($TAP) Save Your Portfolio in the Bear Market? Price Target $1.85: Best Crypto to Buy

The crypto market has been stuck in a bearish trend over the past few months. Retail investors are witnessing increasing losses in their portfolios as major altcoin prices continue to decline in the bear market. Savvy investors have already moved away from purely speculative altcoins driven solely by hype and sentiment and are carefully shifting toward thriving utility-driven altcoins to buy.

While most altcoins underperform in a bear market, a few emerging projects still show remarkable growth due to their innovative solutions to real-world problems. One such project that is outperforming the market and grabbing significant investor attention is Digitap ($TAP), the first-ever omnibanking platform.

In its ongoing crypto presale, $TAP is available at $0.0467 and has seen strong demand from early buyers. Rising daily inflows from new investors, nearly $5 million raised within months, and forecasts of $1.85 by the end of 2026 suggest Digitap could be the best crypto to buy right now.

Can Digitap Hit the $1.85 Price Target in 2026?

Digitap began its crypto presale last year, offering investors $TAP at the lowest price of $0.0125 in the first stage. The token’s price had been set to increase a fixed amount with each new stage, rewarding early entry with compounding returns.

Stage one investors have already locked in returns of over 270% on their initial capital, despite a bearish broader market. These holders continue to back $TAP as one of the best altcoins to buy in 2026, as the token still remains undervalued.

The token is currently priced at $0.0467 and is waiting to surge to $0.0478 in the upcoming stage. A listing price of $0.14 has been fixed for $TAP, delivering over 1,000% ROI to stage one holders and 200% ROI to investors who purchase at the current stage.

Investors could book their profits as soon as the token lists across multiple exchanges after the presale. However, given the current rate of demand growth and the platform’s growing popularity, $TAP is expected to rally after the listing, reaching a much higher price target of $1.85 in 2026.

As a result of this massive upside potential, $TAP has emerged as the best crypto to buy in early 2026 among retail investors seeking to recover their portfolios.

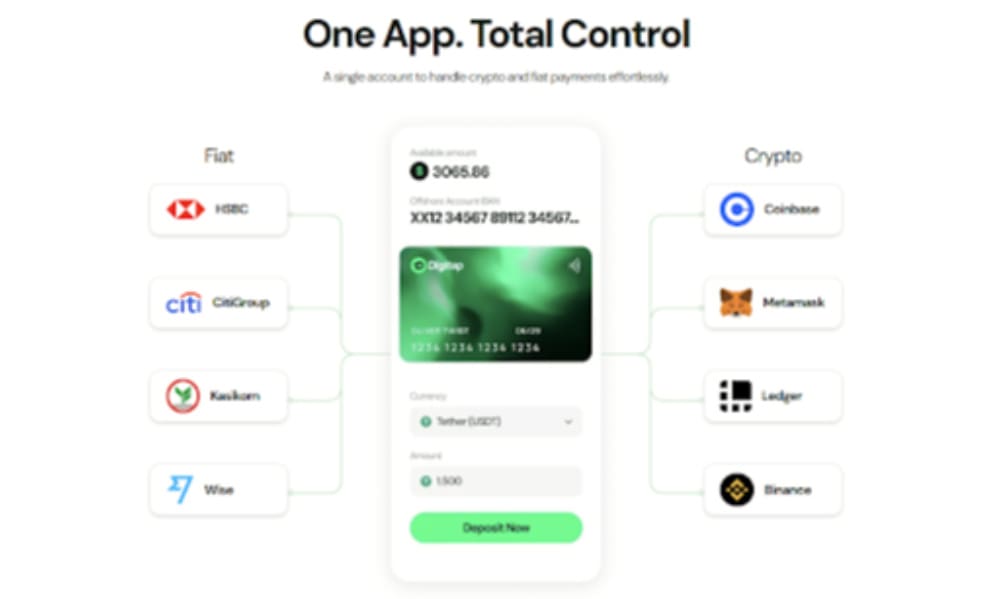

Digitap’s Omnibanking Platform: Crypto and Fiat in One Dashboard

Digitap has emerged as one of the best utility-driven altcoins to buy due to its unique crypto and fiat payment solution. The project has developed the first-ever fully functional omnibanking platform, available on the Apple App Store and Google Play Store, that lets users deposit digital assets and multiple fiat currencies and manage them from a single dashboard.

The platform allows users to open personal or business accounts and to make cross-border payments backed by Visa, with no region-specific restrictions. However, the growth of the payment platform depends on how easily users can move funds into it. To improve accessibility, Digitap is now focusing on simplifying how users fund their accounts via major blockchain networks.

Digitap

Digitap

Digitap is strengthening its real-world utility with a Solana integration that will enable users to fund their Digitap wallets and accounts using assets held on the Solana network. The launch of Solana deposits has been a catalyst for a significant rise in presale demand over the past few weeks.

The integration expands Digitap’s utility beyond its native ecosystem and attracts millions of crypto investors on the Solana network to the Digitap platform. After Solana, the platform also plans to expand connectivity for Ethereum and Bitcoin. This effort to simplify funding has significantly accelerated mass adoption, dramatically increasing $TAP’s potential to rally to $1.85 after the presale.

$TAP Token Utility: Staking and Burn Mechanisms

The native token $TAP is the fuel for the Digitap ecosystem, supporting payments, staking, and rewards across the platform. The total token supply has been hard-capped at 2 billion to maintain scarcity and allow deflationary value growth.

Multiple burn mechanisms have been designed to gradually reduce the circulating supply of $TAP. The tokens for burning will be withdrawn from transaction fees, platform profits, and staking penalties. Users can stake $TAP tokens to earn up to 124% APY during the crypto presale period and 100% APY post-listing.

The combination of real-world utility and smart supply management offers holders both functional use and long-term growth potential. Ultimately, this makes $TAP an attractive option for investors during both the presale and the post-listing period.

Could $TAP be the Best Crypto to Buy in 2026?

With strong utility, growing blockchain integrations, and periodic presale price hikes, $TAP has emerged as one of the best altcoins to buy in early 2026. Investors can earn a stable return until the token listing, regardless of broader market volatility.

USE THE CODE “BIGWALLET35” FOR 35% OFF $TAP TOKENS. LIMITED OFFER

Presale investors can also take advantage of staking rewards for additional returns while they wait for $TAP to list.

A live omnibanking platform, the launch of Solana deposits, and planned Ethereum and Bitcoin connectivity are driving adoption. These fundamentals strengthen the forecast that $TAP could easily reach $1.85 in 2026, highlighting the massive upside potential for early holders.Discover the future of crypto cards with Digitap by checking out their live Visa card project here:

Presale https://presale.digitap.app

Website: https://digitap.app

Social: https://linktr.ee/digitap.app

Win $250K: https://gleam.io/bfpzx/digitap-250000-giveaway

You May Also Like

Regulatory Clarity Could Drive 40% of Americans to Adopt DeFi Protocols, Survey Shows

Michael Burry’s Bitcoin Warning: Crypto Crash Could Drag Down Gold and Silver Markets