Bitcoin (BTC) Price: Falls to $72,900 Before Recovering on Government Shutdown Deal

TLDR

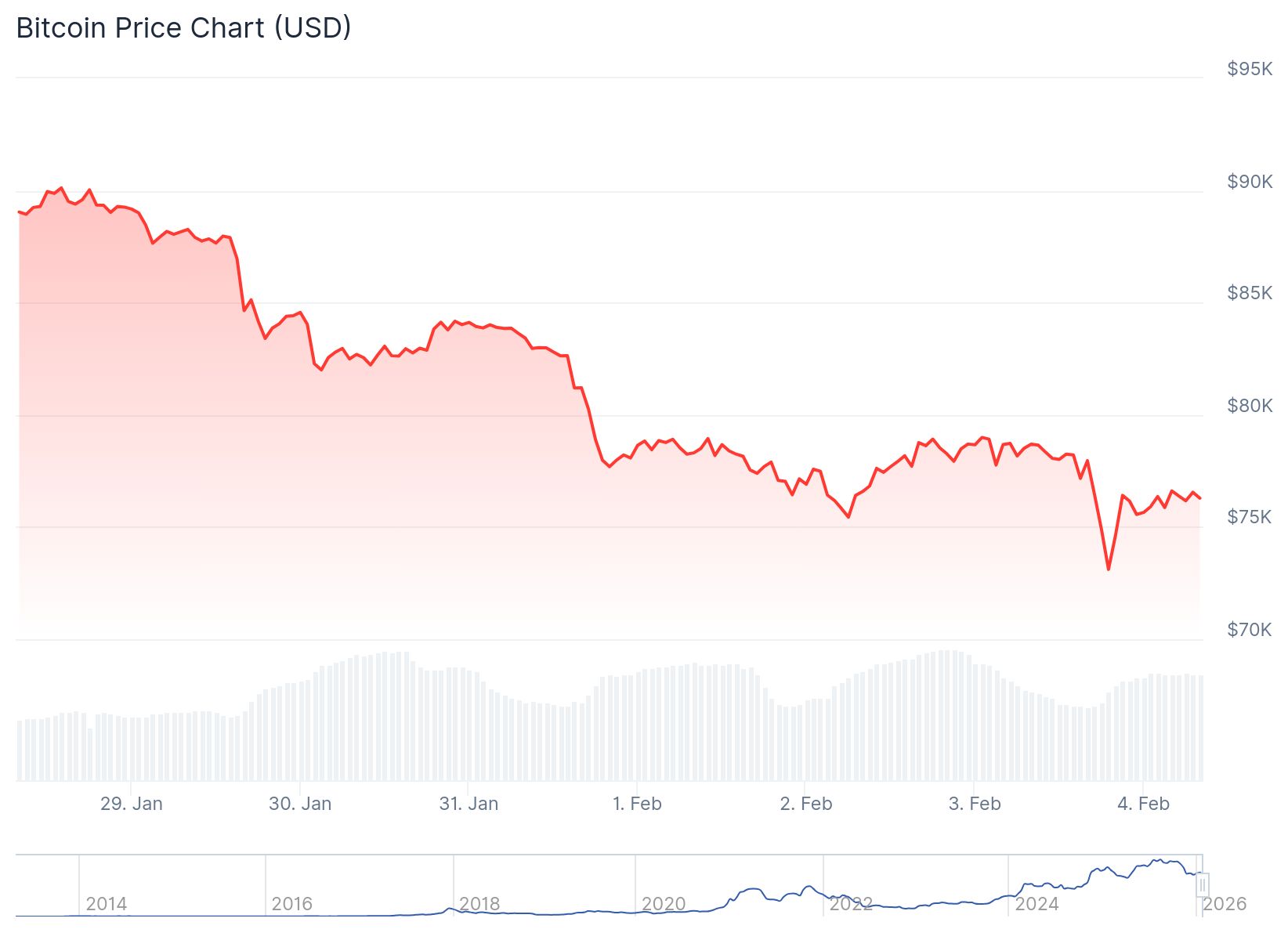

- Bitcoin dropped to $72,900 on Tuesday, its lowest price since November 2024, before rebounding to above $76,000.

- The recovery came after Congress passed a bill to end the partial government shutdown and Nvidia CEO Jensen Huang dismissed concerns about OpenAI friction.

- Liquidations totaled $740 million in the past 24 hours, with $287 million in bitcoin longs and $267 million in ethereum longs being wiped out.

- The drop pushed 44% of bitcoin’s supply underwater, with the coin falling 30% from its recent high of $108,000.

- Analysts suggest the extreme bearish sentiment could trigger a short-term countertrend rally, though failure to bounce soon could lead to further declines toward $60,000.

Bitcoin experienced extreme volatility on Tuesday, plunging to its weakest level in over a year before staging a sharp recovery.

Bitcoin (BTC) Price

Bitcoin (BTC) Price

The largest cryptocurrency fell to $72,900 during early U.S. trading hours. This marked its lowest point since November 2024, when Donald Trump won the presidential election.

Bitcoin then rebounded 5% from those lows, climbing back to $76,800 before the advance weakened again. Ethereum followed a similar pattern, jumping 10% from session lows to above $2,300 before giving back some gains.

The recovery began after Congress reached a deal to end the partial government shutdown. The U.S. House passed the funding bill 217 to 214, which now heads to President Trump for signature.

The shutdown had started on January 31 when the House failed to pass the funding bill in time. The Senate had already approved it on January 30.

Market Relief From Tech Sector

Additional pressure eased when Nvidia CEO Jensen Huang appeared on CNBC. He dismissed speculation about friction between the chipmaker and OpenAI.

His comments addressed growing concerns about the stability of ChatGPT creator OpenAI. These concerns had weighed on sentiment in the AI-fueled tech rally.

The volatile price action left damage across crypto markets. Total liquidations across digital asset derivatives surged to $740 million over the past 24 hours, according to CoinGlass.

Source: Coinglass

Source: Coinglass

Long positions, those betting on higher prices, took the biggest hit. Bitcoin longs accounted for $287 million in liquidations. Ethereum longs added another $267 million.

Over $122 million in crypto long positions and $26 million in shorts were liquidated in just one hour at the peak of volatility.

Technical Analysis and Supply Metrics

The drop erased all gains bitcoin made since Trump’s election night victory. The cryptocurrency last traded below $74,000 prior to that November event.

Glassnode Account Manager Sean Rose noted that 44% of bitcoin’s supply is now underwater. The token has dropped about 30% in the past month from a recent high of $108,000.

This pushed the “supply in profit” down to 56% from 78%. The metric suggests weak hands may continue to sell.

Bitcoin’s Relative Strength Index now hovers around the oversold level of 30. The last time RSI reached this low was near the 2022 bear market bottom, when bitcoin subsequently fell another 20%. A similar move today would imply a drop toward $60,000.

Despite the rebound, bitcoin breached the April 2025 “tariff tantrum” lows. This marked a key technical breakdown, raising the risk of deeper correction.

Benjamin Cowen, founder of Into The Cryptoverse analytics firm, said the overwhelming bearish sentiment might set up a short-term countertrend rally. He noted that when bitcoin sweeps prior lows, it often triggers relief rallies.

Polymarket data shows a 61% chance bitcoin will fall to $70,000 this month. The probability of reaching $90,000 this month has dropped to just 18%. Market analyst The Cryptic Wolf expects bitcoin to bounce from the $70,000 to $74,000 range but remains convinced the asset isn’t in a bear market and will set new highs this year.

The post Bitcoin (BTC) Price: Falls to $72,900 Before Recovering on Government Shutdown Deal appeared first on CoinCentral.

You May Also Like

Nibiru – The Next Era of Money

The Role of Technology in Effective Decision Processes