XRP ETF Approval Odds Soar to 90% After Ripple-SEC Legal Battle Ends

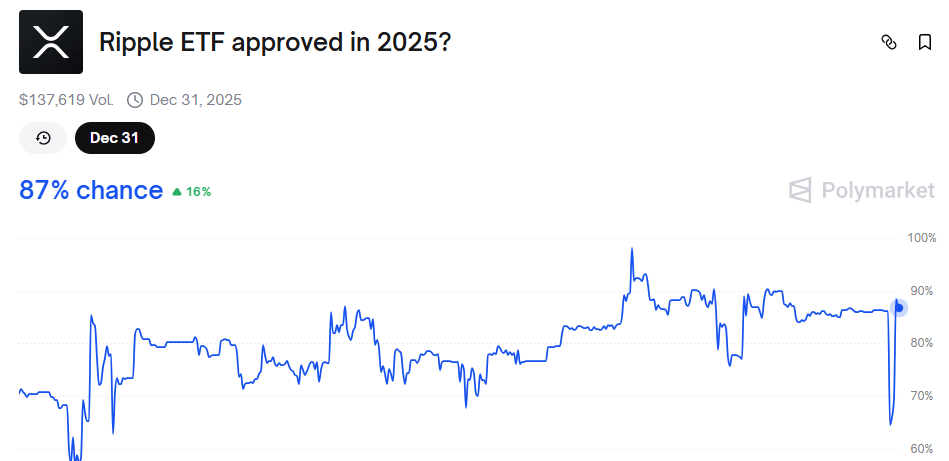

On Aug. 8, data from Polymarket revealed that the chances of the U.S. Securities and Exchange Commission greenlighting a Ripple ETF soared to almost 90%.

End of Legal Battle Removes Key Hurdle

The odds of the U.S. Securities and Exchange Commission (SEC) approving a Ripple exchange-traded fund (ETF) briefly jumped to just under 90% on Aug. 8. Data from the blockchain-based predictions platform Polymarket shows that the chances of the ETF getting approved spiked by more than 20 percentage points in less than 24 hours.

The surge in the odds followed reports that the SEC and Ripple, the issuer of XRP, had agreed to end their long-running legal battle. As reported by Bitcoin.com News, both parties filed a joint stipulation on Aug. 7 to dismiss their appeals in the XRP case. The two parties had been locked in a battle over the status of XRP, with the SEC insisting it met the security threshold and Ripple rejecting that claim.

A series of legal setbacks in court, coupled with the arrival of a more pro-crypto U.S. administration, ultimately weakened the commission’s resolve and prompted it to agree to end the case that began in 2020. Many observers believe that the conclusion of this protracted legal battle removes a key regulatory hurdle, as there were widespread fears that the unresolved case would have provided the SEC with substantial grounds to reject a Ripple ETF application.

Prior to Aug. 6, the odds of a Ripple ETF were above 70%. The last time the odds were below that threshold was April 22. Immediately after the odds dropped to 62%, Eric Balchunas, a senior ETF analyst at Bloomberg, attributed it to the disclosure that SEC Commissioner Caroline Crenshaw had voted against approving the ETF. However, Balchunas, who puts the approval odds at 95%, suggested that Crenshaw’s “no” vote may be meaningless as she is outnumbered by those leaning toward approval.

Meanwhile, the news that Ripple’s legal woes were over also appeared to give XRP a boost. The digital asset jumped by more than 12% to $3.36 before retreating to $3.24. Some proponents of the digital asset believe XRP could now test or even surpass its all-time high set in July.

You May Also Like

MicroStrategy Secure From Forced Bitcoin Sales Now

Fed forecasts only one rate cut in 2026, a more conservative outlook than expected