Crypto ETFs Dominate Institutional Portfolios Amid Record-Breaking Demand

Crypto ETFs are dominating new fund launches, attracting billions as investors flock to regulated bitcoin and ethereum exposure, eclipsing traditional offerings and reshaping Wall Street’s growth narrative.

Wall Street Turns to Crypto ETFs as Investors Demand Regulated Exposure

Cryptocurrency exchange-traded funds (ETFs) have emerged as dominant players in the market for newly launched funds, drawing billions in investor capital since early last year. Nate Geraci, president of Novadius Wealth Management, host of ETF Prime, and co-founder of the ETF Institute, stated on social media platform X on Aug. 10:

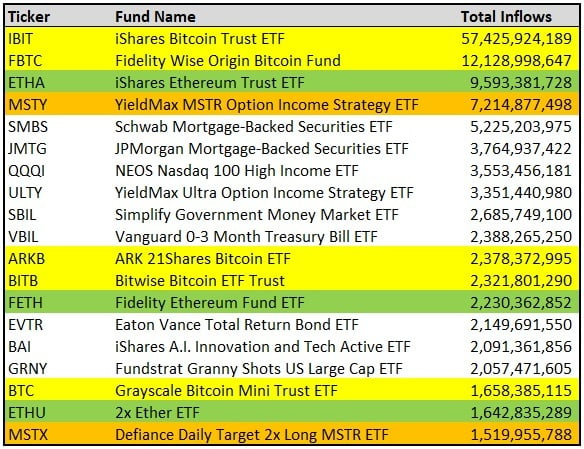

He added that five of them are spot BTC ETFs, two are spot ETH ETFs, two are MSTR ETFs, and one is a leveraged ETH ETF. His analysis showed the top four performers are all crypto-related, led by the Ishares Bitcoin Trust ETF (IBIT) at $57.45 billion, followed by the Fidelity Wise Origin Bitcoin Fund (FBTC) with $12.13 billion, and the Ishares Ethereum Trust ETF (ETHA) at $9.59 billion.

Top ETF performers launched since last year. Source: Nate Geraci

Top ETF performers launched since last year. Source: Nate Geraci

While traditional fixed income and equity products such as the Schwab Mortgage-Backed Securities ETF and JPMorgan Mortgage-Backed Securities ETF appeared in the rankings, they lagged behind crypto’s surge. The YieldMax MSTR Option Income Strategy ETF (MSTY) placed fourth with $7.21 billion in inflows. Microstrategy (Nasdaq: MSTR), which has rebranded as Strategy, is a business intelligence software company known for its significant investment in bitcoin, which it holds as its primary treasury reserve asset.

Other high-ranking digital asset offerings included the ARK 21Shares Bitcoin ETF (ARKB) at $2.38 billion, Bitwise Bitcoin ETF Trust (BITB) with $2.32 billion, and Fidelity Ethereum Fund ETF (FETH) at $2.23 billion. Smaller but notable inflows went to the Grayscale Bitcoin Mini Trust ETF ( BTC) at $1.66 billion and the 2x Ether ETF (ETHU) with $1.64 billion.

Market observers say these figures underscore growing institutional and retail demand for crypto exposure via regulated investment vehicles. Advocates emphasize that ETFs allow investors to access bitcoin and ethereum without direct asset custody, while leveraging established market infrastructure.

You May Also Like

8.18 Million Solana Committed on CME as SOL Options Prepare to Go Live

Willy Woo Warns Liquidity Breakdown Could Cap Bitcoin’s Rally Despite Short-Term Relief