Ethereum Closes On All-Time High As ETH ETF Inflows And Futures Frenzy Drive Rally

Ethereum surged 8% to close in on its all-time high as US spot ETF inflows and record futures activity fueled a broad crypto market rally.

The surge comes amid lower-than-expected US inflation data yesterday, which boosted risk-on sentiment and raised expectations for future interest rate cuts.

Treasury Secretary Scott Bessent called for a 50 basis point rate cut next month and President Donald Trump ramped up pressure on Federal Reserve Chair Jerome Powell, saying he may sue him over construction work on the Fed building.

Ethereum is trading at $4,695 as of 5:03 a.m. EST, its highest level since November 2021, after surging more than 29% over the past week. It’s now within 4% of its ATH of $4,891.70 that it set on Nov. 16, 2021.

ETH price chart (Source: CoinMarketCap)

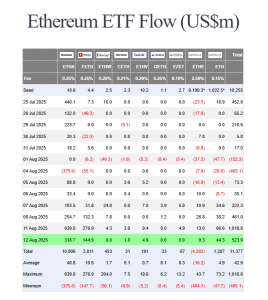

Ethereum ETFs Extend Inflows Streak After Record $1 Billion Day

Fueling the ETH rally is the strong inflows into spot US Ethereum ETFs over the last week.

US spot Ethereum ETFs notched record inflows yesterday, with investors pouring more than $1 billion into the funds, marking the largest single-day net addition since their launch last July.

Over the past 48 hours, the ETFs have attracted more than $1.5 billion in total, extending the positive net flow streak to 6 days, according to Farside Investor data.

US Spot Ethereum ETF inflows (Source: Farside Investors)

Of the over $1.5 billion that entered the funds in the past 48 hours, BlackRock’s ETHA product attracted the most capital. During the two-day period, more than $900 million entered the ETH ETF’s reserves.

In second place is Fidelity’s FETH, which managed to pull in more than $410 million during the same period.

Ethereum Open Interest Tops $60B As ETH Closes On ATH

Heightened interest around ETH is not only evident with US spot Ethereum ETFs, as open interest in the futures market for the altcoin soars to beyond $60 billion, setting a new all-time high (ATH).

In the last 24 hours, open interest for ETH futures edged up a fraction of a percentage to stand at more than $64.34 billion, according to CoinGlass. The last record was set on July 28, when the figure hit $58 billion.

The current open interest also represented over twice the value it stood at just weeks ago, in late June.

Retail Traders In “Disbelief” Of ETH Rally As Whales Swoop In

ETH’s recent performance comes despite a wave of fear, uncertainty and doubt (FUD) on social platforms.

Crypto sentiment tracking platform Santiment noted in an Aug. 12 X post that “traders have shown FUD and disbelief” as ETH’s price continues climbing higher.

The platform added that prices usually move in the opposite direction of retail traders’ expectations, and highlighted such instances in June 16 and July 30 of this year. On both days, there was “extreme greed” in the market, which ultimately led to price corrections, Santiment wrote.

“With key stakeholders accumulating loose coins that small $ETH traders are willing to part with right now, prices are showing very little sentiment resistance from breaking through and making history in the near future,” Santiment wrote in their X post.

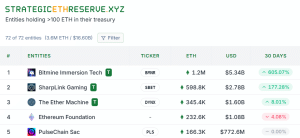

Much of the whale activity comes from the increasing number of public companies that are adding ETH to their balance sheets. Currently, these corporate buyers hold 5.19% of ETH’s total supply in their reserves, according to StrategicETHReserve data.

Top 5 biggest corporate ETH treasuries (Source: StrategicETHReserve)

The largest holders are Bitmine Immersion Technologies and SharpLink Gaming who hold $1.2 million ETH and 598.9K ETH, respectively.

ETH May Be Due For A Correction, Analysts Warn

Analysts have recently warned that ETH may be due for a correction soon after the stellar performance over the past month.

Among them is renowned crypto trader and analyst Ali Martinez, who told his over 149.4K X followers in a post earlier today that the TD Sequential has flashed a sell signal for Ethereum on the daily chart.

He subsequently warned that ETH dropping below the $4,150 mark could lead to a plunge to $3,980, or even $3,860 in an extreme case.

That warning follows an earlier post by Martinez in which he predicted that ETH could soar “straight towards $5,241” if it clears the $4,300 mark, which it has.

MN Fund CIO Michael van de Poppe also told his over 801.9K X followers in an Aug. 12 post that it may be best for investors and traders that are fully allocated to ETH to decrease their exposure slightly after the recent rally.

“What goes up vertically usually has harsh corrections,” he wrote.

Van de Poppe’s warning also follows a prior prediction that ETH will soar higher. Earlier on the same day, he compared the recent move by the altcoin to how BTC reacted to the launch of spot Bitcoin ETFs last year.

He subsequently forecast that ETH will soar to a new all-time high before consolidating. “There’s way more to come for this cycle,” he added.

You May Also Like

Michael Burry’s Bitcoin Warning: Crypto Crash Could Drag Down Gold and Silver Markets

Michelin-starred dimsum chain Tim Ho Wan doubles HK footprint with 10th store