Ether ETFs Land Second-Biggest Inflow Ever With $729 Million Entry

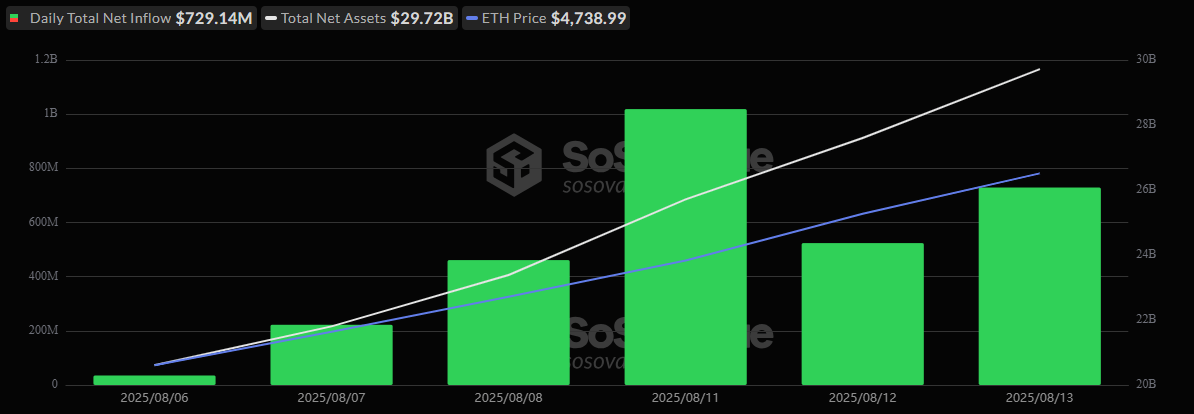

Ether exchange-traded funds (ETFs) posted their second-highest single-day inflow ever at $729.14 million, while bitcoin ETFs notched a sixth consecutive day of gains with $86.91 million in net inflows. Both markets saw record trading volumes and fresh all-time highs in net assets.

Ether ETFs Shatter Records Again With $729 Million Inflow As Bitcoin ETFs Mark 6 Days Green

The appetite for crypto ETFs has rarely been this intense. Wednesday, Aug. 13, saw ether ETFs smash past another milestone, raking in $729.14 million, the second-largest single-day haul in their history, while bitcoin ETFs quietly extended their winning streak to six days with $86.91 million in fresh inflows.

For ether ETFs, it was another powerhouse day. Blackrock’s ETHA dominated with $500.85 million, supported by Fidelity’s FETH at $154.69 million. Grayscale’s Ether Mini Trust brought in $51.34 million, ETHE added $7.38 million, while Bitwise’s ETHW and Franklin’s EZET chipped in $10.85 million and $3.59 million, respectively.

No outflows were recorded, with trading volume reaching a record $4.47 billion, and net assets climbed to a new peak of $29.72 billion.

Source: Sosovalue

Source: Sosovalue

Interestingly, bitcoin’s surge came without its institutional flagship. Blackrock’s IBIT sat on the sidelines, recording zero flows. Instead, Ark 21shares’ ARKB took the lead with $36.58 million, followed by Fidelity’s FBTC with $26.70 million.

Grayscale’s Bitcoin Mini Trust added $11.42 million, while Bitwise’s BITB and Invesco’s BTCO contributed $7.32 million and $4.90 million, respectively. Not a single bitcoin ETF posted an outflow. Total value traded soared to $4.97 billion, pushing net assets to an all-time high of $158.64 billion.

Two days of historic inflows and record volumes suggest one thing: institutional crypto demand is hitting overdrive, and ETH is firmly in the driver’s seat.

You May Also Like

U.S. Moves Grip on Crypto Regulation Intensifies

Bitcoin ETFs Surge with 20,685 BTC Inflows, Marking Strongest Week