Banking Statistics 2026: What You Must Know Now

In a world increasingly shaped by digital innovations, shifting consumer expectations, and complex regulatory demands, this year is a transformative year for banking. As global economies face persistent inflation and interest rate pressures, banks adapt swiftly to meet challenges and opportunities. The journey from traditional banking to a fully digital experience has never been more compelling, with today bringing new milestones that redefine how institutions operate, grow, and engage with customers. In this article, we explore the latest statistics, trends, and crucial developments shaping the global banking sector.

Editor’s Choice

- Global digital wallet transaction value is forecast to exceed $16 trillion by 2028 as usage expands across retail, remittances, and in‑app payments.

- Global sustainable finance issuance is expected to reach $1.621 trillion in 2026, including $700 billion in green bonds and $255 billion in green loans.

- Sustainability-linked loan issuance is projected to climb to $160 billion in 2026, from $139 billion in 2025.

- Global banks’ credit losses are forecast to rise to about $510 billion in 2026, roughly 10% higher than in 2025.

- AI-driven systems fully automate 54% of all customer interactions in U.S. banks, improving efficiency and responsiveness.

Recent Developments

- Global fintech investment reached $53 billion in 2025 across 5,918 deals, marking a 21% year-over-year increase.

- AI in banking is projected to expand at a 29.30% CAGR from 2026 to 2035, driven by digitization and modernization initiatives.

- Chatbots now handle 70% of Tier 1 customer queries at leading North American banks, as AI-driven automation scales.

- AI-enhanced credit risk models have improved loan approval accuracy by 34% in mid-size banks, reducing default risk.

- About 134 countries representing 98% of global GDP are exploring or developing CBDCs.

- 62 countries are piloting CBDCs for domestic retail payments, while 27 countries test them for cross-border payments.

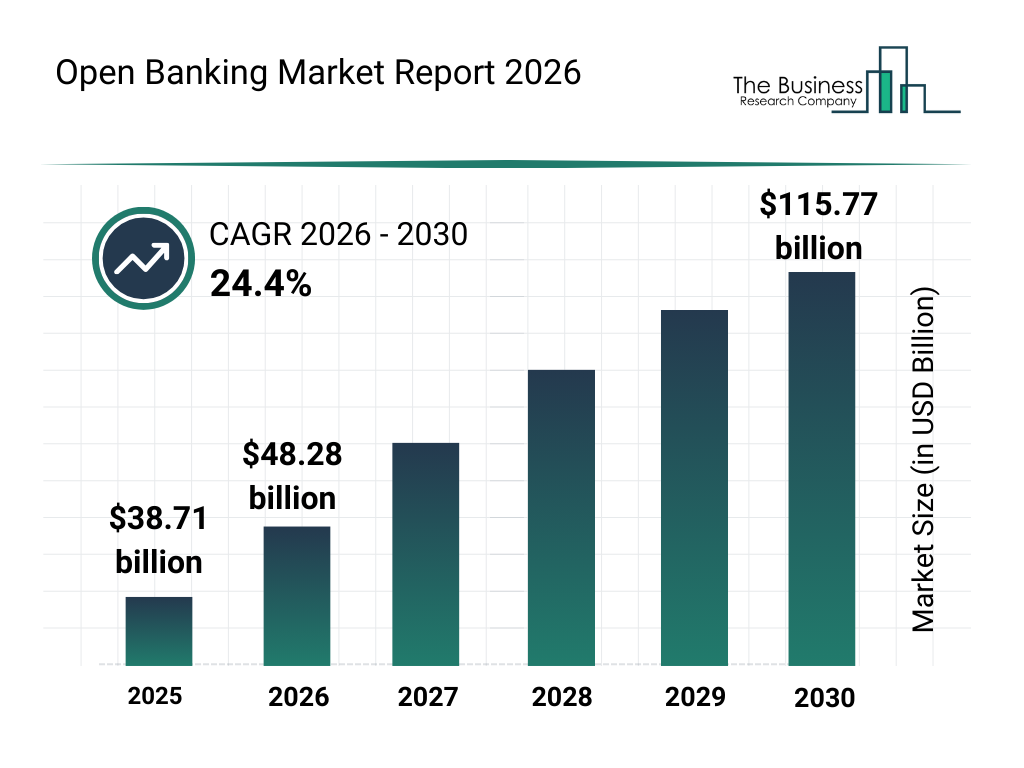

Open Banking Market Growth Highlights

- The global open banking market was valued at $38.71 billion in 2025, reflecting early but accelerating adoption across financial services.

- Market size is projected to reach $48.28 billion in 2026, indicating a strong year-over-year expansion as API-driven banking gains momentum.

- In 2027, the open banking market is estimated to grow to approximately $60.00 billion, driven by increased fintech integration and regulatory support.

- The market is expected to climb to around $75.00 billion in 2028, fueled by wider enterprise adoption and embedded finance use cases.

- By 2029, global open banking revenues are forecast to hit $95.00 billion, as data-sharing ecosystems mature and consumer usage deepens.

- The market is projected to reach $115.77 billion by 2030, highlighting the rapid scale-up of open banking platforms worldwide.

- Overall, the open banking market is forecast to grow at a strong CAGR of 24.4% between 2026 and 2030, underscoring its position as one of the fastest-growing segments in financial services.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

Global Economic Challenges and Banking Sector Impact

- Global inflation is projected to moderate to 4.0% on average, down from 5.76% in 2024 but still above pre-pandemic norms.

- OECD inflation averaged around 4.2% year-on-year in mid-2025, highlighting persistent price pressures in advanced economies.

- Global banking sector net interest income is forecast to grow by more than 7%, even as policy rates begin to decline across major economies.

- Funds intermediated by the global banking system grew by about $122 trillion between 2019 and 2024, an increase of roughly 40%.

- Compliance operating costs for retail and corporate banks have risen by over 60% since pre‑financial crisis levels, with further increases expected.

- Financial crime compliance costs increased for 98% of EMEA institutions and 99% in the US and Canada, underscoring regulatory pressure.

Peer Group Comparisons

- JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo now hold a combined $13.3 trillion in assets.

- China’s four largest state-owned banks (ICBC, ABC, CCB, BOC) together control about $21.9 trillion in assets.

- BNP Paribas, Crédit Agricole, and HSBC manage a combined asset base of roughly $8.2 trillion.

- Japan’s three mega-banks (MUFG, SMFG, Mizuho) together hold around $7.1 trillion in assets.

- Canada’s Big Six banks plus Desjardins account for about $9.8 trillion in assets, with the Big Six alone holding roughly $8.8 trillion.

- Nubank has grown to approximately 127 million customers, while Revolut serves about 65 million customers globally.

- RBC and TD each report assets above C$2.0 trillion, cementing their status as Canada’s largest banks.

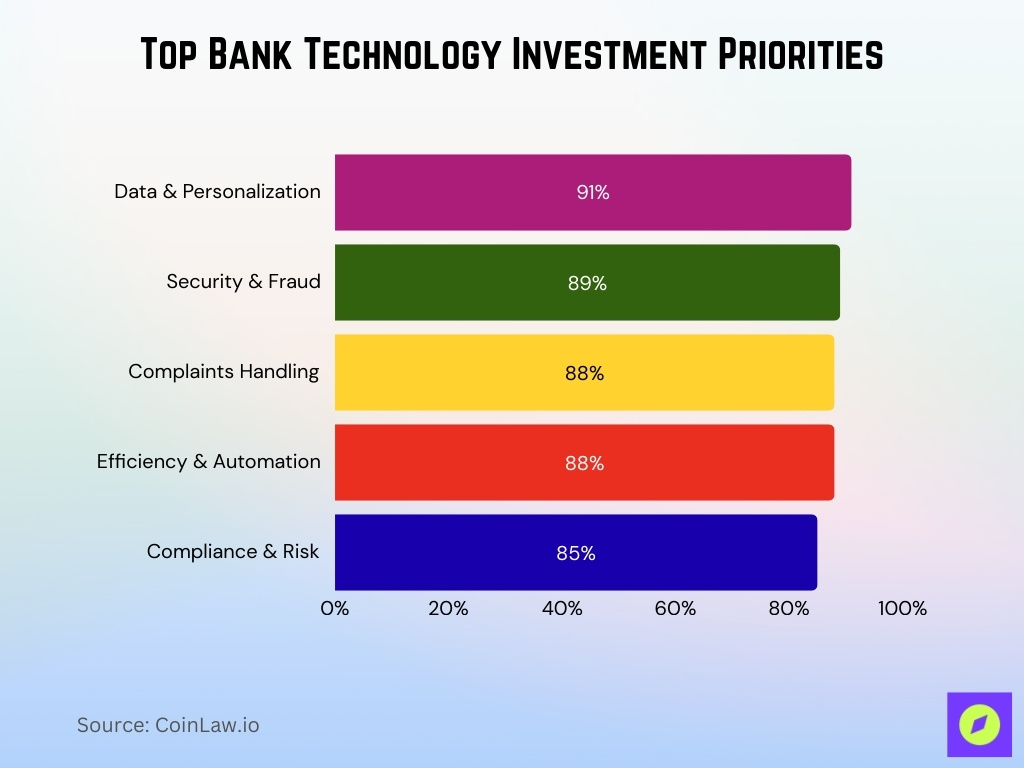

Banks’ Top Investment Priorities

- Data-driven insights and personalization lead bank investment plans, with 91% of banks prioritizing advanced analytics to improve customer experiences and decision-making.

- Security and fraud prevention remain a critical focus area, as 89% of banks invest in strengthening defenses against cyber threats and financial crime.

- Complaints and disputes management is a key operational concern, with 88% of banks allocating budgets to improve resolution speed and customer satisfaction.

- Operational efficiency and automation rank equally high, with 88% of banks investing in automation to reduce costs and streamline internal processes.

- Regulatory compliance and risk management continue to demand significant resources, with 85% of banks prioritizing compliance technologies to meet evolving regulatory requirements.

(Reference: N-iX)

(Reference: N-iX)

Deposit Market Share Reports

- U.S. total deposits grew 4.0% year-over-year in December 2025, up from 3.6% in November.

- U.S. commercial bank deposits reached about $18.54 trillion at year-end 2025, rising to roughly $18.65 trillion by late January.

- Total deposits in the EU27 from businesses and households increased by about 4.55% to €17.05 trillion.

- EU deposits from households alone rose 1.4% year-over-year to around €11.7 trillion.

- China’s largest state-owned banks’ deposits climbed to over ¥142 trillion, with individual deposits exceeding corporate deposits by nearly ¥10 trillion.

- China’s total banking deposits were reported at roughly $46.99 trillion in December 2025.

- Deposits from EU businesses and households represent about 57% of EU banking sector funding, indicating strong reliance on deposit funding.

Retail Banking and Traditional Banking Trends

- 216.8 million Americans use digital banking services, and 77% of banking interactions now occur via digital channels.

- 64% of U.S. adults prefer mobile banking apps, compared with 25% who favor browser-based online banking.

- 91% of consumers say access to mobile and online banking is important when choosing a bank.

- U.S. mobile banking adoption reached 72% of adults in 2025, while global mobile banking users climbed to 2.17 billion.

- More than 50% of U.S. consumers report using mobile apps more than any other method to manage their bank accounts.

Which Age Groups Prefer Online vs Mobile Banking?

- Ages 15–24: 74.1% primarily use mobile banking, while 6.3% mainly use online banking.

- Ages 25–34: 69.4% primarily use mobile banking, compared with 12.9% who mainly use online banking.

- Ages 35–44: 60.5% primarily use mobile banking, versus 18.4% who mainly use online banking.

- Ages 45–54: 49.1% primarily use mobile banking, while 22.8% mainly use online banking.

- Ages 55–64: 33.2% primarily use mobile banking, compared with 27.3% who mainly use online banking.

- Ages 65+: 28.2% primarily use online banking, while 15.3% mainly use mobile banking.

Summary of Deposits and Historical Bank Data

- Customer deposits at the world’s 1,000 largest banks total about $103 trillion, up from $89 trillion five years earlier.

- U.S. banks’ total deposits stand at approximately $19.75 trillion, up 3.59% year-over-year.

- U.S. commercial bank deposits reached about $18.72 trillion in December, up from $18.15 trillion in April.

- Global commercial banking market revenue is projected to grow from $4.32 trillion in 2025 to $12.67 trillion by 2032, at a 16.4% CAGR.

- U.S. banks’ total deposits have increased from $14.54 trillion in 2019 to $19.75 trillion in Q3 2025, a gain of roughly 36%.

- The average one-year term deposit interest rate across many economies now ranges between 2%–5%, with several emerging markets above 6%.

Traditional Banking vs. Digital Banking

- Traditional banks still hold about 80–85% of global banking assets, while digital banks and neobanks account for roughly 5–10%.

- Digital banks worldwide are projected to generate about $1.61 trillion in net interest income, growing at a 6.8% CAGR through 2029.

- Digital banking is now preferred by 77% of consumers, with 41% favoring mobile apps and 33.5% web browsers.

- Around 53.7 million U.S. consumers are expected to hold neobank accounts, up from 29.8 million in 2021.

- Neobank users’ average monthly transaction value increased from $950 in 2022 to $1,200 in 2023.

- Customer acquisition costs at traditional commercial banks can reach about $760 per client, versus roughly $176–$326 for digital‑first acquisition.

- About 27% of banking customers now use direct online‑only banks, separate from app‑centric neobanks.

- Roughly 80% of neobank users rely on their digital accounts for day‑to‑day transactions.

OECD and BIS Banking Statistics

- Dollar, euro, and yen foreign currency credit grew by 5%, 10%, and 6% year-on-year, respectively, at end-Q1 2025.

- Global cross-border bank credit expanded by $917 billion in Q2 2025 to reach $37 trillion, pushing year-on-year growth to about 10%.

- In Q1 2025, global cross-border bank credit rose by $1.5 trillion to $34.7 trillion, with credit to EMDEs up $100 billion.

- Cross-border bank credit to EMDEs grew by 3.8% year-on-year in Q4 2024, led by a $47 billion rise to emerging Asia-Pacific.

- Cross-border remittances via mobile apps increased by 40%, supported by digital platforms and real-time payment rails.

- Sub-Saharan Africa’s cross-border banking flows grew by 9%, driven by infrastructure and energy sector financing.

- Latin America’s cross-border banking claims rose by 8%, while the Caribbean recorded a 6% increase in flows.

- Euro area banks maintained a return on equity of around 10% with a cost-to-income ratio near 55%, supported by higher interest margins.

Regulatory and Compliance Changes

- Basel III monitoring shows Group 1 banks’ average CET1 ratio at around 12.9%, with all reporting an NSFR above 100%.

- Global financial crime compliance costs are estimated at about $206 billion per year for banks and fintechs.

- AI-driven AML systems could save regulated firms up to $183 billion annually in compliance costs.

- The global AML solutions market is projected to grow from $4.13 billion in 2025 to $9.38 billion by 2030 at a 17.8% CAGR.

- Global AML system spending is forecast to reach about $51.7 billion by 2028.

- Three-quarters of banking customers are willing to share biometric data for security, supporting wider digital KYC adoption.

- More than 70% of Indian banks already use biometric authentication for secure KYC, and 83% of global banking CIOs plan to increase or maintain such investments.

Frequently Asked Questions (FAQs)

Banks that accelerate digital adoption can reduce operating costs by approximately 20–40% through automation and branch optimization.

To rank within the World’s top 10 banks by assets in 2026, institutions generally need assets above ~$2.4 trillion.

Mobile payments comprise roughly 49% of all digital banking transactions worldwide in 2026.

The top two banks, Industrial and Commercial Bank of China (~$6.30 trillion) and Agricultural Bank of China (~$5.70 trillion), together hold over $12 trillion in assets.

Conclusion

The banking sector continues to evolve at an unprecedented pace, shaped by regulatory reforms, technological advancements, and growing societal expectations around sustainability. The shift toward digital-first banking is irreversible, with banks worldwide investing heavily in innovation to meet customer demands for faster, safer, and more convenient services.

At the same time, traditional banks are reimagining their role, blending digital advancements with in-branch experiences to retain and attract customers. From ESG commitments to blockchain integrations, the industry’s priorities reflect a balance between profit and purpose. These trends and statistics not only highlight the resilience of the banking sector but also underscore its critical role in the future of finance, providing a blueprint for the challenges and opportunities that lie ahead.

The post Banking Statistics 2026: What You Must Know Now appeared first on CoinLaw.

You May Also Like

Jerome Powell’s Press Conference: Crucial Insights Unveiled for the Market’s Future

Shiba Inu Price Forecast for Feb 9: Here’s Key Overhead Resistance for Any Move Upwards