AI in Insurance Industry Statistics 2026: Shocking Growth Insights

Artificial intelligence (AI) continues to revolutionize industries globally, and insurance is no exception. From underwriting to customer service, AI-driven technologies are transforming how insurers operate, helping them deliver more personalized services while reducing costs. Imagine an industry where claims processing is done in minutes, not weeks. This is the promise of AI in insurance. As more companies adopt these technologies, the impact is set to reshape the landscape of risk management, customer engagement, and operational efficiency.

Editor’s Choice

- By 2026, around 80% of insurers are actively deploying AI across at least one core function, marking a shift from pilots to scaled production use.

- From 2026 onward, the AI in the insurance market is projected to grow at roughly 32–35% CAGR, pushing valuations well above $100 billion by the early 2030s.

- By late 2026, more than 35% of insurers are expected to deploy AI agents across at least three core functions, cutting processing time by up to 70%.

- Generative AI in insurance is on track for annual growth of nearly 29%, driving claims, pricing, and service automation through 2030.

- AI-driven automation is enabling insurers to reduce operational or processing costs by up to 15–20%, while improving speed and accuracy.

Recent Developments

- AI automates 50–60% of insurance claims, cutting handling costs by 25–40%.

- 76% of carriers run AI in at least one business function, with 80% experimenting with gen AI.

- AI adopters achieve 20–40% cost reductions in claims and onboarding.

- Drone + AI inspections cut assessment time up to 80% vs. traditional methods.

- Agencies using drones report 70% decrease in claims processing time.

- 80% of insurers expected to use AI for claims processing by 2026.

- AI expense ratios drop 2% in 2026 from claims automation.

- Insurance AI spend grows >25% in 2026.

- AI fraud detection offers a $160 billion opportunity for insurers.

- 67% of insurers are testing gen AI, 7% scaled to production.

Artificial Intelligence (AI) in the Insurance Market Growth Overview

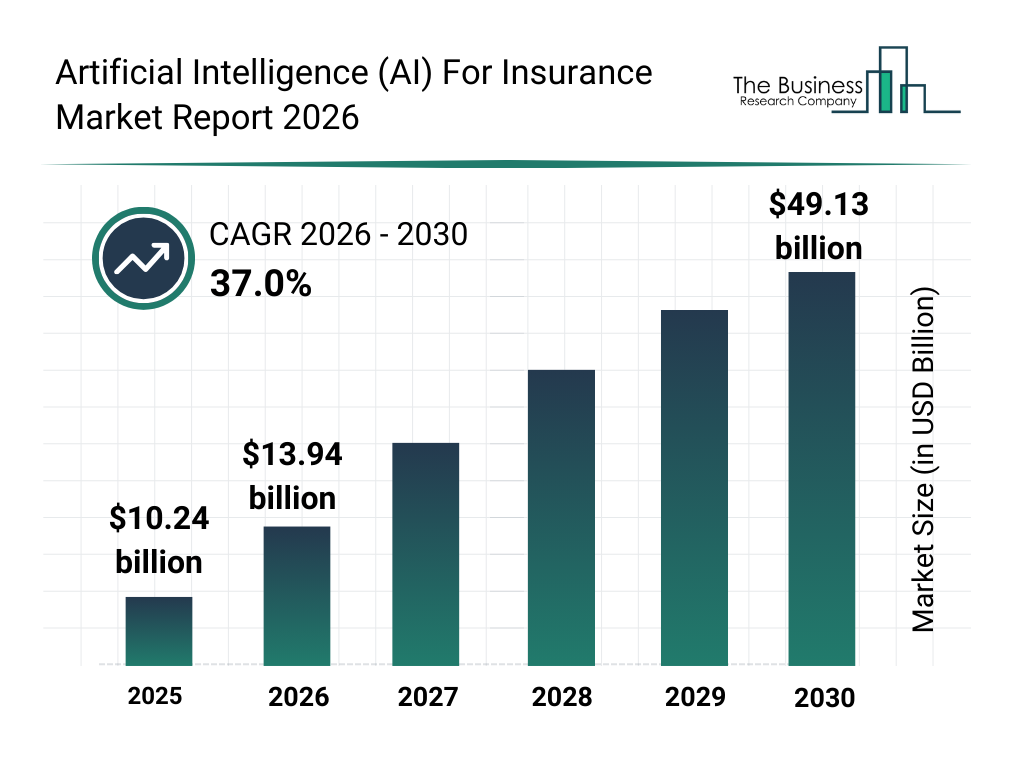

- The global AI in insurance market was valued at $10.24 billion in 2025, reflecting strong early adoption across underwriting, claims processing, and customer service.

- In 2026, the market is projected to grow to $13.94 billion, highlighting accelerating insurer investments in automation, fraud detection, and predictive analytics.

- Between 2026 and 2030, the AI insurance market is expected to expand at a robust 37.0% CAGR, signaling one of the fastest growth rates across the financial services sector.

- By 2030, the market is forecast to reach $49.13 billion, driven by widespread deployment of machine learning, natural language processing, and generative AI across core insurance operations.

- The sharp increase in market size underscores a shift from AI pilot programs to enterprise-wide implementation among global insurers.

- This rapid growth trajectory reflects rising demand for cost reduction, faster claims settlement, personalized insurance products, and enhanced risk assessment powered by AI technologies.

(Reference: The Business Research Company)

(Reference: The Business Research Company)

The Evolution of AI in the Insurance Industry

- Gen AI adopters cut onboarding costs 20–40% via automation.

- AI fraud tools boost detection 15–20%, cut false positives 20–50%.

- Multimodal AI saves 20–40% claims costs.

- AI fraud detection saves P&C insurers $80–160 billion by 2032.

- Insurance AI spending rises >25% yearly.

Impact of AI in Insurance

- AI cuts claims processing time 99.4%, from 30 min to 10 sec per claim.

- Intelligent automation reduces claims cycle times 40–60%.

- AI reduces revenue leakage up to 35% through continuous monitoring.

- Gen AI cuts P&C leakage 30–50%, creating $100 billion in benefits.

- AI-powered claims automation boosts efficiency for 70–80% insurers.

- AI-native CLM reduces contract leakage up to 40%.

- Voice AI cuts claim processing 70%, from days to 4 days.

Artificial Intelligence Adoption and Perception in Insurance

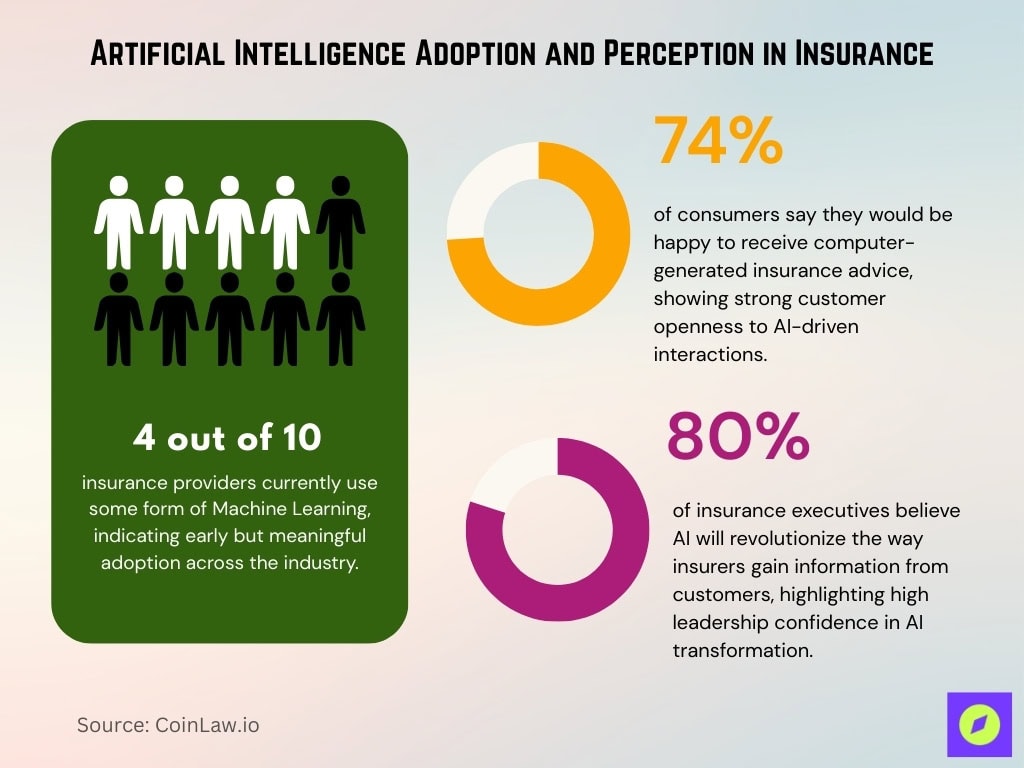

- 4 out of 10 insurance providers are already using Machine Learning, showing that AI adoption has moved beyond experimentation into real operational use.

- 74% of consumers say they are comfortable receiving computer-generated insurance advice, highlighting growing trust in AI-driven customer interactions.

- 80% of insurance executives believe AI will revolutionize how insurers gather and analyze customer information, signaling strong leadership confidence in AI-led transformation.

- The alignment between consumer acceptance (74%) and executive optimism (80%) suggests accelerating momentum for AI deployment across insurance workflows.

- These figures collectively indicate a shift toward data-driven decision-making, automated insights, and personalized insurance experiences powered by AI technologies.

(Reference: Scalefocus)

(Reference: Scalefocus)

Regional Breakdown of Generative AI Market Share in Insurance

- North America holds 44% share in 2025, leading generative AI insurance adoption.

- Asia Pacific is the fastest-growing region for generative AI in insurance.

- Europe is valued at $2.58 billion in 2025 for AI insurance.

- Asia Pacific reaches $2.80 billion in 2025, led by India ($0.58 billion) and China ($0.71 billion).

- Latin America ($0.33 billion) and the Middle East & Africa show moderate growth.

- South America and the Middle East & Africa lag with smaller shares.

Cyber Insurance Market Poised for Exponential Growth

- The global cyber insurance market reached $20.56 billion in 2025, projected to reach $30 billion by 2030.

- Premiums to hit $23 billion by 2026, growing 15–20% annually.

- Written premiums grow 15% in 2026, driven by AI threats.

- Market valued at $14.2 billion in 2025, reaching $73.5 billion by 2034 at 17.88% CAGR.

- North America holds 36.9% cyber insurance market share in 2025.

- AI cuts claims cycle time 35% (42 to 27 days).

- Top 50 insurers drop expense ratios by 2 points via AI automation.

Factors Driving Adoption of AI in Insurance

- 82% AI-adopting insurers incorporate gen AI.

- 79% carriers are open to synthetic data for privacy challenges.

- 34% insurers roll out AI agents across functions.

- 90% executives evaluate gen AI, 7% scaled successfully.

- 80% Canadian insurers prioritize AI.

Generative AI Advances to Reshape the Cyber Risk Landscape

- 71% of businesses implemented gen AI in at least one function.

- 90% businesses are interested in gen AI insurance coverage.

- 66% would pay 10%+ higher premiums for gen AI coverage.

- AI amplifies phishing, deepfakes, and vulnerability scanning at scale.

- AI cuts cyber claims expense ratios by 2 points for the top 50 carriers.

- Cyber premiums rise 15% due to AI threats in 2026.

- 71% businesses adopted gen AI, with cybersecurity as the top risk.

- AI underwriting shifts to real-time risk scoring.

The Benefits of Using AI in Insurance Agencies

- AI reduces administrative tasks 30%, freeing agents for client relations.

- AI cuts underwriting time from weeks to hours, up to 90% faster decisions.

- AI chatbots reduce customer service costs 20-40%, boosting satisfaction.

- AI underwriting drops decision time from 3-5 days to 12.4 minutes at 99.3% accuracy.

- AI agents cut processing time up to 70% across core functions.

- AI underwriting achieves 70% cost reduction and a minute of processing.

- AI cuts underwriting from 3 days to 3 minutes, accuracy up 20%.

- AI automation reduces claims expense ratios by 2 points.

- AI frees underwriters from 33% admin time for strategic work.

AI and ML Applications Across Insurance-Related Industries

- P&C insurance holds 40.67% AI market share.

- Health insurance leads adoption at 84%.

- Life insurance ~20% AI market share.

- Auto/motor insurance 9.33% AI market share.

- BFSI leads AIaaS with 32.10% share.

- Machine learning 61.20% AI technology share.

- Cloud deployments 50.33% market share.

How AI and Machine Learning are Changing the Insurance Industry

- AI/ML automates 50-60% claims, cutting costs 25-40%.

- AI reduces claims cycle 40-60% via intelligent automation.

- 76% carriers use AI in business functions, 80% experiment with gen AI.

- AI underwriting drops the time from 3-5 days to 12.4 minutes.

- ML cuts fraud 30-50%, $100 billion P&C opportunity.

- AI/ML boosts underwriting accuracy 99.3%.

- 80% insurers use AI claims processing.

- AI cuts admin 30%, agents focus on client growth.

- ML shortens health claims approval 42%.

Frequently Asked Questions (FAQs)

About 76–80% of insurers are either using AI in pilot projects or intend to adopt generative AI within two years.

By 2026, up to 91% of insurance companies are expected to have adopted AI in some form.

Routine claims are processed 40–60% faster through AI automation in mature insurance operations.

AI‑leading insurers have generated roughly 6.1× higher total shareholder returns than laggards.

Conclusion

The insurance industry is entering a new era with AI at its core, transforming every aspect from customer service to risk management. The continued adoption of AI technologies will drive efficiency, reduce costs, and offer more personalized services to customers. The future of insurance will be shaped by AI innovations, and companies that embrace these advancements will be best positioned to thrive in this rapidly evolving market.

The post AI in Insurance Industry Statistics 2026: Shocking Growth Insights appeared first on CoinLaw.

You May Also Like

Polymarket sues Massachusetts in growing state-federal fight over prediction markets

Saxton & Stump Expands Pennsylvania Footprint to the Lehigh Valley With Elite IP Team