XRP Price: Eight Corporations Commit $2 Billion to Reserves in February 2026

TLDR

- XRP Ledger’s real-world asset value jumped 265% in 30 days to $1.4 billion, while distributed assets rose 8% to $303 million

- Eight major corporations committed $2 billion to XRP reserves in early February 2026, led by Evernorth Holdings with $1 billion

- Stablecoin market cap on XRP Ledger grew 18% to $416 million with transfer volume up 45% over 30 days

- New XRP addresses surged 51.5% in 48 hours after price dropped to $1.20, showing strong network growth

- Trading volume stayed above $9 billion since February 5 dip, with whale accumulation replacing retail activity

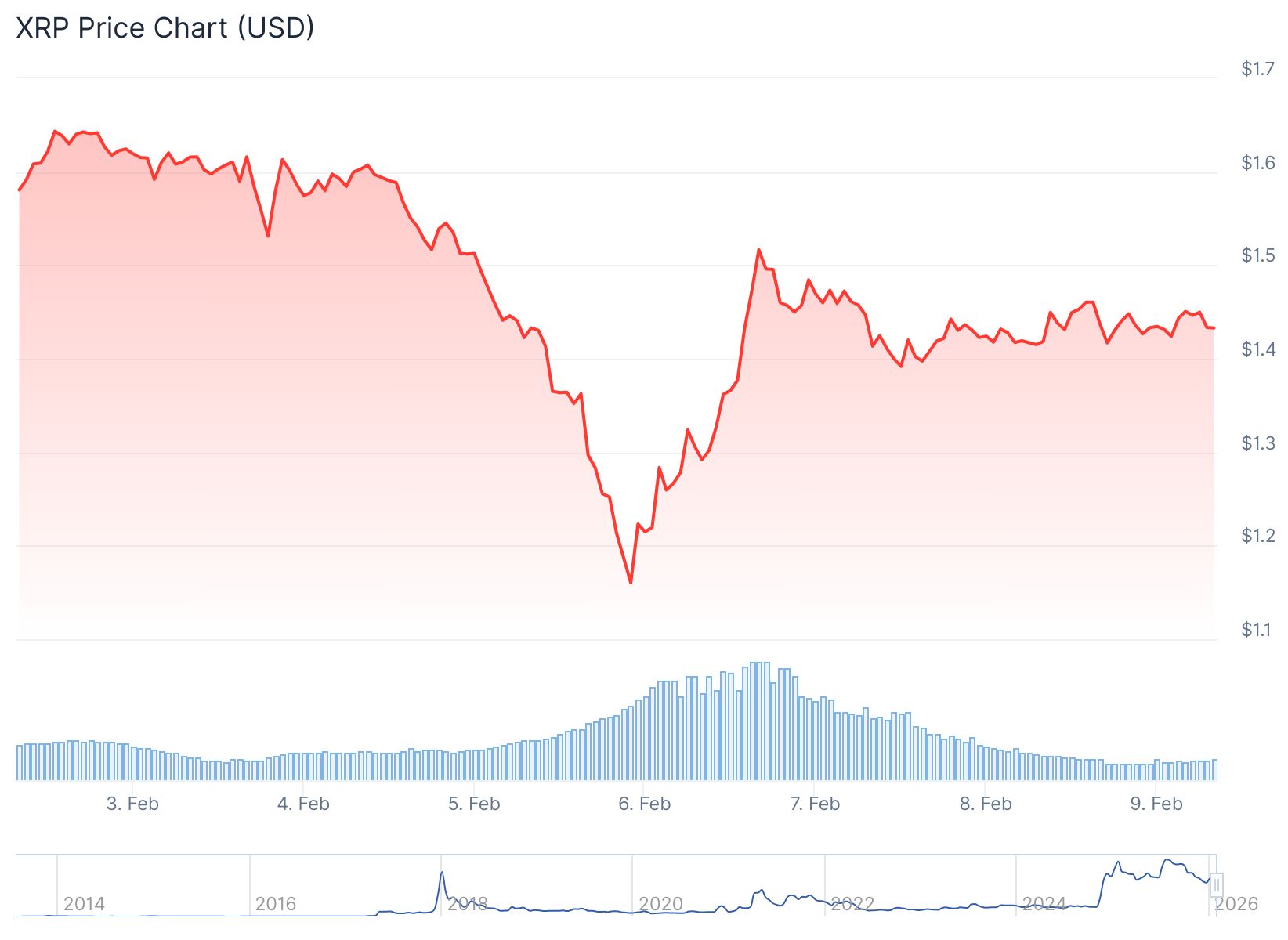

XRP dropped over 45% in early February 2026, but the decline attracted major institutional investors rather than scaring them away. The price fell to $1.20 on February 5, creating what corporations viewed as a buying opportunity.

XRP Price

XRP Price

Eight major companies committed $2 billion to XRP reserves during this period. Evernorth Holdings led the group with a $1 billion commitment. Trident Digital Tech followed with $500 million, while Webus International added $300 million.

VivoPower International committed $100 million to XRP reserves. Other corporate investors included Wellgistics Health, Nature’s Miracle Holding, Gumi Inc., and Hyperscale Data. These companies focused on long-term strategic positioning rather than short-term price movements.

Source: Token Relations

Source: Token Relations

Whale activity increased after the price drop to $1.20. CryptoQuant data showed large investors took control while retail orders remained low. This pattern indicated institutional confidence in XRP’s future value.

The XRP Ledger saw growth in multiple areas during the last 30 days. Real-world asset value on the ledger reached $1.4 billion, up 265% from the previous month. Distributed assets rose 8% to $303 million during the same period.

Real-World Assets Expand on XRP Ledger

The number of unique real-world asset holders increased by 69% over 30 days. The total reached 22 organizations, all believed to be financial institutions or businesses. Each new holder brings more accounts and routine transactions to the network.

Source; CryptoQuant

Source; CryptoQuant

Real-world assets represent traditional financial products like Treasury bills, bonds, money market funds, commodities, and stocks. These assets get tokenized, meaning blockchain tokens represent their ownership claims. This system can make holding, managing, and transferring assets faster and cheaper.

The XRP Ledger uses two types of real-world assets. Represented assets use the blockchain as a database. Distributed assets can be transferred using the blockchain while their properties are tracked in the database.

Transaction fees on the XRP Ledger are paid in XRP. Accounts must also hold an XRP reserve to exist on the ledger. Growing real-world asset activity means more XRP usage for fees and reserves.

Stablecoin Growth Shows Increased Usage

Stablecoin activity on XRP Ledger grew during the same 30-day period. The stablecoin market cap rose 18% to $416 million. Total stablecoin transfer volume climbed 45% in the same timeframe.

These numbers show more people and institutions using for regular transactions and trade settlement. Ripple’s RLUSD stablecoin dominates the network and gained adoption among users.

Network activity surged after the February 5 price drop. Glassnode data showed new XRP addresses jumped 51.5% in just 48 hours. This spike reflected growing user adoption driven by corporate interest and whale accumulation.

Trading volume remained strong throughout the period. Volume stayed above $9 billion since the February 5 dip to $1.20. Between February 6 and 7, volume surged past $15 billion even though price stayed well below all-time highs.

XRP traded at $1.43 on February 9, 2026, up 1.32% for the day. The market cap stood at $87 billion with 3 billion in trading volume.

The post XRP Price: Eight Corporations Commit $2 Billion to Reserves in February 2026 appeared first on CoinCentral.

You May Also Like

Teledyne Advances U.S. National Defense with Multiple Awards for SDA’s Tranche 3 Tracking Layer Program

The Rise of Secure Digital Payments in a Cashless Economy