Bitcoin Slides Below $113K as Markets Brace for Powell’s Jackson Hole Pivot

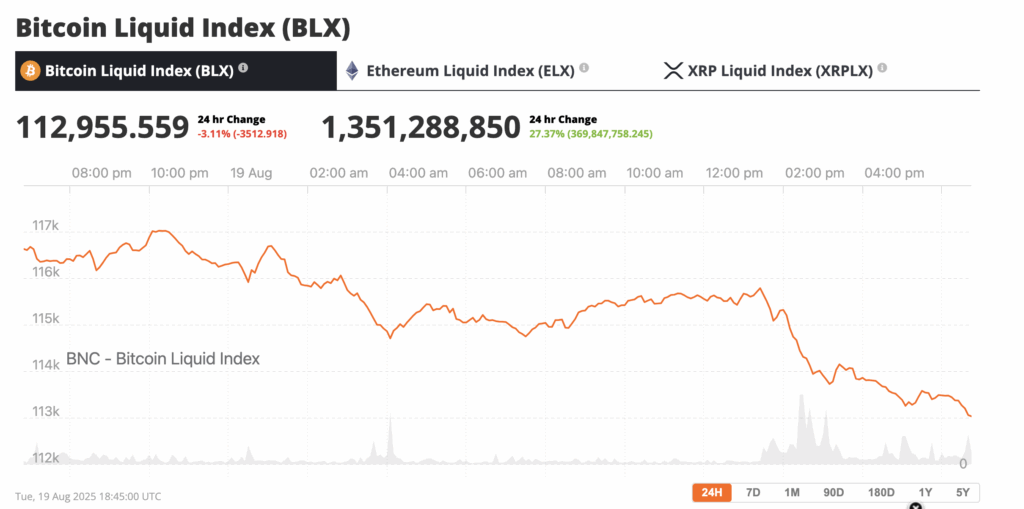

After smashing through $124,000 just days ago, Bitcoin has dropped more than 9% from its record peak, trading as low as $113,000 in the early U.S. session — its weakest level in nearly two weeks. Ether slid 3.5% on the day, and altcoins like Chainlink, Avalanche, Toncoin, Ethena, and Aptos all bled between 4–6%.

The broader picture? Investors are reassessing the Fed’s next move. Last week, most of Wall Street was pricing in a near-certainty of a September rate cut. But a hot Producer Price Index (PPI) report flipped that narrative, reviving fears that inflation is refusing to die quietly. That puts Powell’s Friday speech squarely in the spotlight.

Bitcoin dropped below $113,000, source: Bitcoin Liquid Index

The Treasury Bubble Deflates

The carnage wasn’t confined to tokens. Shares of so-called “crypto treasury strategy” companies — firms that pivoted into holding Bitcoin or Ether as a corporate treasury asset — continued to unwind.

- KindlyMD (NAKA), a BTC accumulator, fell another 14%.

- Bitmine Immersion (BNMR) and Sharplink Gaming (SBET), both Ethereum-aligned plays, sank 10% and 8%.

Even the heavyweight in this niche, Michael Saylor’s MicroStrategy (MSTR), is wobbling — down nearly 6% Tuesday and off 37% from its all-time high late last year. Still, the long arc of Saylor’s Bitcoin gamble remains intact: MSTR shares are up more than 20x since he started buying BTC five years ago. First-mover advantage buys you a lot of cushion.

Jackson Hole: All Eyes on Powell

The Kansas City Fed’s annual symposium in Jackson Hole is normally a highbrow academic affair. This year, it feels more like a market cliffhanger. The Fed has been walking a tightrope — balancing a slowing economy and signs of labor market cooling against stubbornly sticky inflation data.

Bank of America economists, hardly known for crypto drama, bluntly noted:

“With inflation essentially stuck over the past year, tariff pass-through still expected, and unemployment low, we still think there is a strong case for the Fed to remain on hold.”

Traders are listening. Odds of a September cut have dropped from 98% last week to 85% today, per the CME FedWatch tool. That’s still heavily skewed toward easing — but the shift underscores just how fragile sentiment is.

What It Means for Crypto

- Short-term: Risk-off means Bitcoin and Ether are vulnerable to more downside. The $110K level for BTC is now the line to watch.

- Medium-term: If Powell signals patience, crypto might face more turbulence before stabilizing. Rate cuts are still coming — but the Fed may want to keep its “hawkish credibility” intact longer.

- Long-term: The treasury-strategy bubble is a cautionary tale. Simply rebranding as a “crypto treasury company” no longer works now that easy gains are gone. Only firms with real cash flow and disciplined balance sheets will survive the washout.

The bigger irony? Crypto markets are simultaneously clamoring for looser monetary policy — and trying to prove they’re an alternative to fiat central banking. Powell’s words on Friday will test just how far that paradox stretches.

You May Also Like

Fed rate decision September 2025

3 Paradoxes of Altcoin Season in September