Midnight token price jumps after Google and Telegram partnership news

The privacy-focused blockchain Midnight saw renewed market interest this week after Cardano founder Charles Hoskinson announced key developments at the Consensus Hong Kong conference.

- Midnight gained attention after Charles Hoskinson confirmed a late-March mainnet launch and cited collaborations with Google and Telegram at Consensus Hong Kong.

- The project is positioned as a selective-disclosure privacy layer, with the new Midnight City Simulation introduced to test the network ahead of launch.

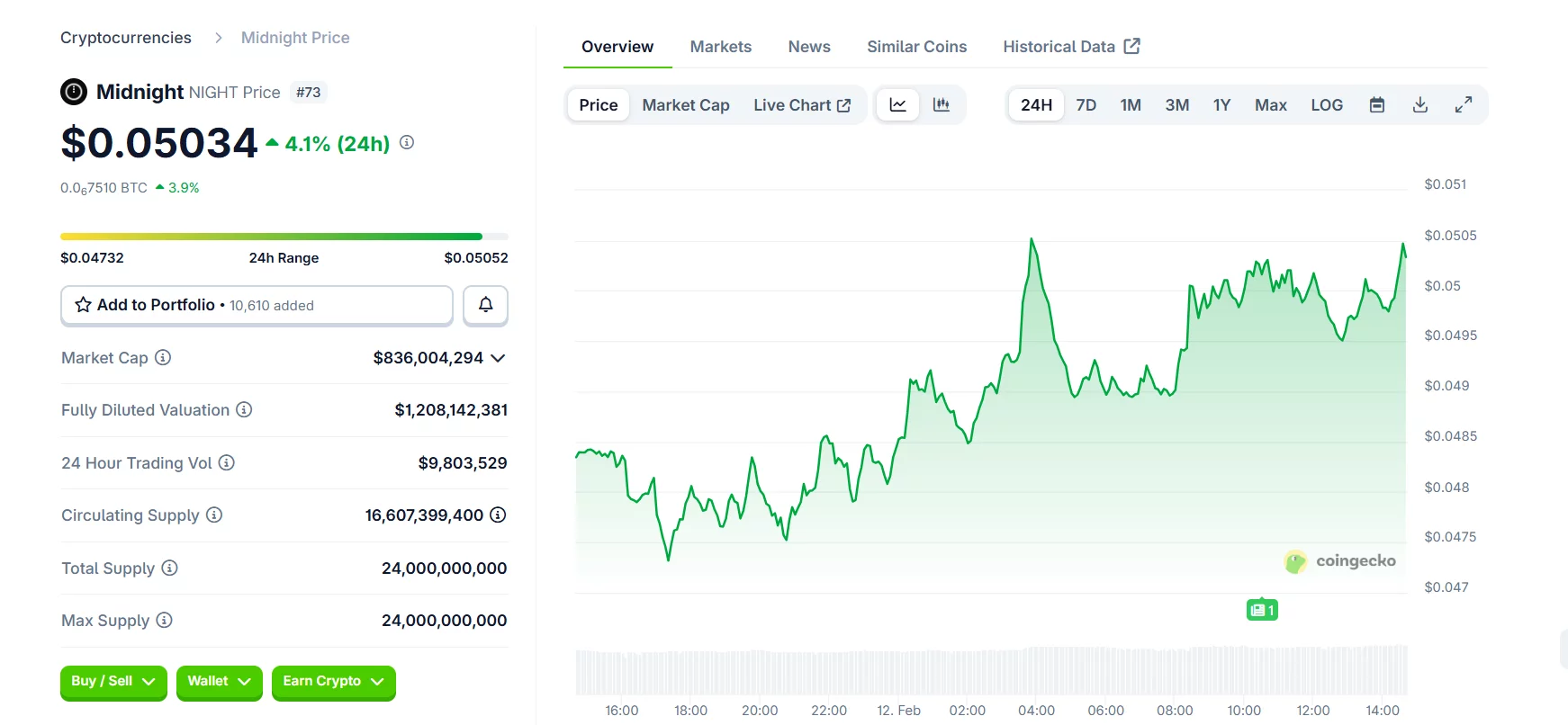

- The NIGHT token rose to around $0.048–$0.051, up roughly 3–4% in 24 hours.

This includes the project’s scheduled mainnet launch in late March and collaborations involving Google and Telegram.

Hoskinson’s remarks highlight Midnight’s evolution toward a “selective disclosure” privacy layer for blockchain applications, balancing confidentiality with real-world compliance.

While neither Google nor Telegram have independently confirmed the arrangement, Hoskinson said they are among partners helping support Midnight’s rollout and infrastructure.

“We have some great collaborations to help us run it,” he said. “Google is one of them. Telegram is another. We’re really excited, there’s more that will come.”

The announcement also introduced the Midnight City Simulation, a testing platform intended to stress-test network proof generation with AI agents well ahead of mainnet.

Midnight price uptick reflects renewed interest

Midnight’s native token NIGHT has responded positively to the news, trading at around $0.048–$0.051 at press time with modest short-term gains.

According to live price data, the token is up roughly 3–4 % in the past 24 hours, indicating renewed investor appetite following the partnership and mainnet timeline disclosure.

Midnight’s full mainnet debut, expected in March as a Cardano (ADA) partner chain with zero-knowledge proofs and “rational privacy” features, is now the next major catalyst for global markets.

Hoskinson has also made it clear that Midnight will not pursue direct onboarding of legacy privacy coin communities, such as Monero and ZCash, instead focusing on broader user adoption.

“You don’t try to get anybody from Monero or ZCash over,” he said during a Q&A session at Consensus Hong Kong on Thursday.

You May Also Like

Franklin Templeton CEO Dismisses 50bps Rate Cut Ahead FOMC

Rheem® and ecobee partner to launch the ecobee Smart Thermostat Lite | Works with EcoNet® Technology