MSTR Stock Dips 5% But Saylor Focuses on STRC for Bitcoin Purchases

Key Insights:

- MSTR stock is under pressure as the company’s BTC losses grow further amid the BTC price drop.

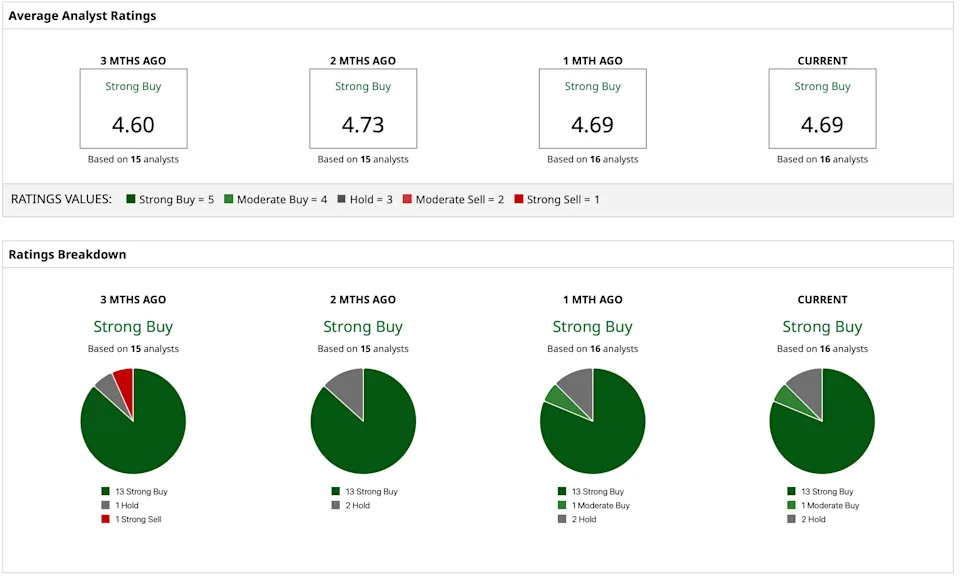

- Wall Street sentiment remains strong as analysts maintain a “Strong Buy” consensus with an average price target of $401.86.

- Strategy is also shifting focus toward its preferred shares (STRC), which recently hit $100 and offer an 11.25% variable dividend.

MicroStrategy (MSTR) stock price crashed 5% on Feb. 11 as the BTC price continues to slide to $65,000. Investors’ concerns have amplified as the MSTR stock is already down 20% in 2026, and over 70% from its all-time high.

However, Strategy Chairman Michael Saylor recently pointed out the $100 milestone attained by preferred shares STRC. Saylor noted that the company plans to issue more STRC shares and use the proceeds for additional Bitcoin purchases.

MSTR Stock Heading to $100?

There seems to be no bottom for the MSTR stock as the race to $100 is accelerating. The share price is already down 20% in the first month of 2026, making investors nervous.

On the other hand, the BTC price crash to $65,000 shows that the Strategy is sitting on nearly $6 billion in losses on its BTC holdings.

Despite this, market experts are confident that MSTR could stage a quick rebound. Citigroup is one of the optimistic players, which expects the MSTR stock to rally to $325.

Analysts rated MSTR stock a “Strong Buy.” They set its average price target at $401.86. This implies potential upside of approximately 221% from current levels.

MSTR stock buy calls | Source: Barchart

MSTR stock buy calls | Source: Barchart

Among the 16 analysts covering the stock, 13 rate it as a “Strong Buy.” One as a “Moderate Buy,” and two maintain a “Hold” recommendation. Thus, any slide further from here on the technical chart could present an opportunity to buy for long-term investors.

MSTR Stock Doesn’t Have A Problem Even If Bitcoin Goes to $8,000

During his recent Bloomberg interview, Strategy CEO Phong Lee said that the company remains largely insulated from the Bitcoin crash. Lee said Bitcoin must drop to about $8,000 per coin. It must also stay there for five years before the company sees it as a “real problem.”

His comments come amid heightened volatility in the crypto market. Lee and Michael Saylor addressed investor concerns about the balance sheet. They reassured stakeholders that MSTR stock remains supported despite large Bitcoin holdings.

However, critics like Peter Schiff have countered this call. In a sharp rebuttal on X platform, Schiff wrote:

Michael Saylor Shifts Focus to Preferred Shares STRC

Michael Saylor said in his latest interview that Strategy may issue more preferred shares. He explained the move would support Stretch (NASDAQ: STRC).

Phong Lee explained that issuing preferred shares could ease investor concerns. He emphasized this move would reduce worries about volatility in MSTR common stock.

In a recent interview with Bloomberg, Le discussed Bitcoin’s price swings, attributing the volatility to the asset’s digital nature. He explained that Bitcoin rallies amplify gains.

Strategy’s digital asset treasury model drives this effect. Higher BTC exposure boosts returns. The surge directly strengthens MSTR stock.

However, during market downturns, the stock tends to decline more sharply as well. Le added that Digital Asset Treasury (DAT) companies, including Strategy, are structurally designed to track the performance of Bitcoin.

This results in greater volatility and sensitive movements. Speaking to Bloomberg, Le said:

The STRC stock is up 12% since its issuance in July 2025, and is currently trading at $100. Moreover, the rising demand for STRC comes as it offers a variable dividend, currently at 11.25%.

The post MSTR Stock Dips 5% But Saylor Focuses on STRC for Bitcoin Purchases appeared first on The Market Periodical.

You May Also Like

Stellar (XLM) Powers IRL’s Stealth Crypto Onboarding at Major Cultural Events

The Best Crypto Presale in 2025? Solana and ADA Struggle, but Lyno AI Surges With Growing Momentum