Pi Network (PI) Price: Coin Gains 7% Ahead of February 15 Mainnet Upgrade

TLDR

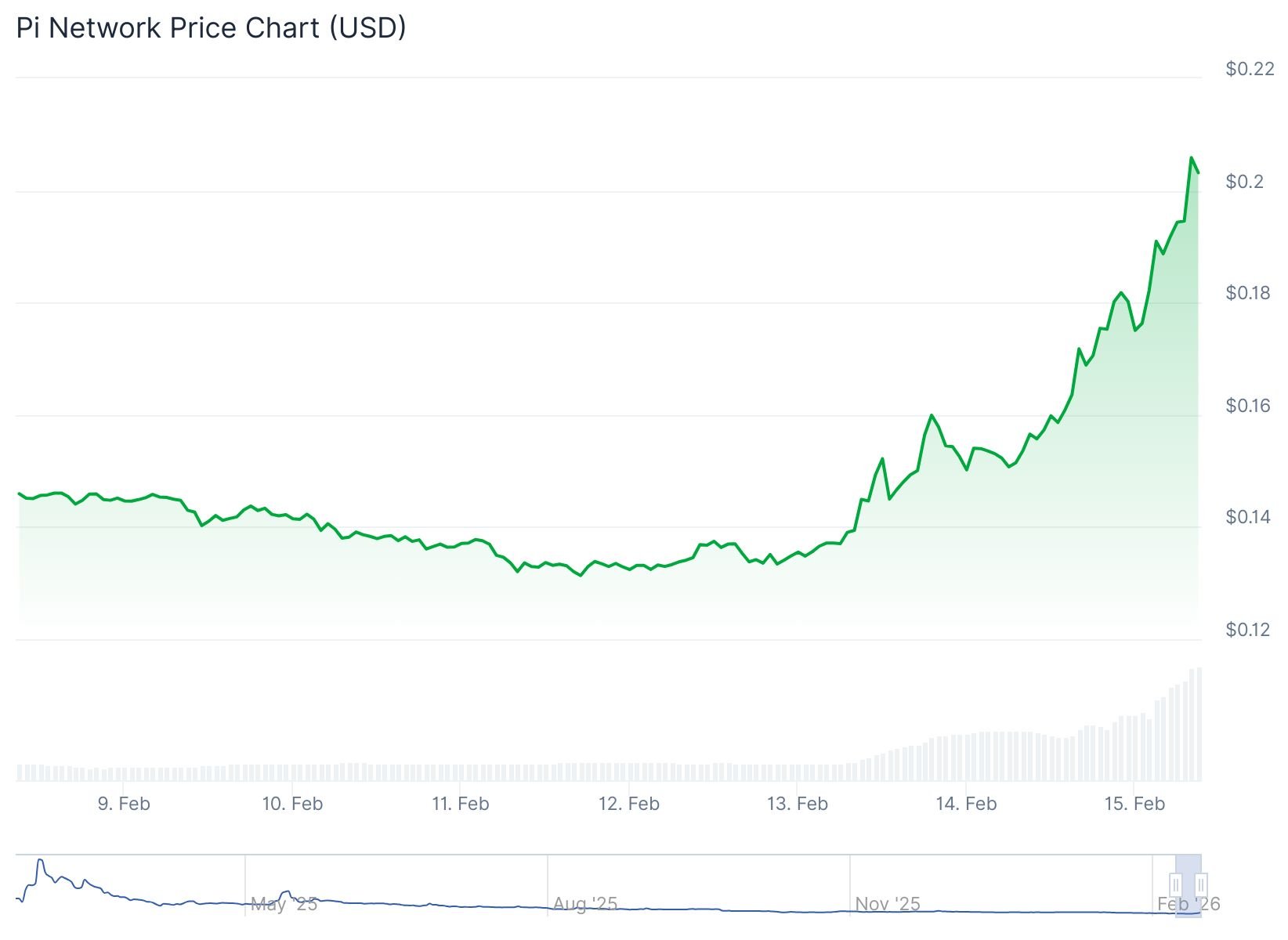

- Pi Network (PI) price jumped 7.41% to $0.162, recovering from its year low of $0.1302

- Mainnet upgrade deadline set for February 15, 2026, requiring all node operators to update to version 19.6

- U.S. inflation dropped to 2.4% in January from 2.6% in December, fueling hopes for Federal Reserve interest rate cuts

- Overall crypto market rose 4.84% to $2.4 trillion, boosting Pi Coin alongside other digital assets

- Technical indicators show RSI at 66 and CMF at 0.41, suggesting strong buying momentum with potential resistance at $0.17

Pi Network price climbed 7.41% in the last 24 hours, reaching $0.162 after spending a week in bearish territory. The recovery marks a bounce from the year’s low of $0.1302.

PI Network (PI) Price

PI Network (PI) Price

Trading volume surged to over $32 million as the price pushed past the $0.15 mark. The move comes as several factors align to support the cryptocurrency.

Pi Network announced a deadline of February 15, 2026, for all mainnet node operators to upgrade to version 19.6. The update focuses on performance optimization, enhanced security measures, and improved scalability.

Over 16 million users have already migrated to the mainnet as of February 2026. The team stated that nodes must complete the upgrade to stay connected to the network.

The project is testing palm-print authentication to improve KYC operations and two-factor authentication. Pi Network is expanding its ecosystem with Pi DeFi, PiDAO governance, and university innovation hubs.

The team submitted its MiCA whitepaper with hopes of listing on regulated European exchanges by the end of 2025. Kraken has already added Pi Network to its listing roadmap, though this doesn’t guarantee an actual listing.

Inflation Data Supports Market Recovery

U.S. inflation data released in January showed the Consumer Price Index dropping to 2.4% from December’s 2.6%. The figure came in below the expected 2.5%.

Core inflation held steady at 2.5%. The data suggests the Federal Reserve might implement three interest rate cuts this year.

Lower interest rates typically benefit cryptocurrencies and other risk assets. Investors often move money into crypto when traditional savings rates decline.

Broader Market Momentum

The overall cryptocurrency market cap increased by 4.84% to $2.4 trillion in the past 24 hours. Bitcoin, Ethereum, and other major cryptocurrencies posted gains following the inflation report.

Pi Coin’s rise mirrors the broader market recovery. The Relative Strength Index sits at 66, approaching overbought territory.

The Chaikin Money Flow indicator reads 0.41, showing strong buying pressure. Technical analysts point to $0.17 as the next resistance level.

A break above $0.17 could push Pi Network toward $0.1750 or even $0.20 in the near term. Support levels sit at $0.15 and $0.1450.

Some analysts warn this could be a dead-cat bounce, a temporary recovery during a longer downward trend. The coin remains below all moving averages on the daily chart.

Pi Network formed a double-bottom pattern at $0.1537 but has yet to break through key resistance levels. The Supertrend indicator still shows bearish momentum.

The token hit a record low of $0.1280 earlier this week. A drop below that level could push the price toward $0.10.

The post Pi Network (PI) Price: Coin Gains 7% Ahead of February 15 Mainnet Upgrade appeared first on CoinCentral.

You May Also Like

a16z Crypto Founder Discusses Stablecoins: The "WhatsApp Moment" in the Crypto World Has Arrived

Spheron Network Joins Hivello for DePIN Supply Scaling