Solana (SOL) Price: Bulls Eye Breakout As Token Holds Above $85 Support

TLDR

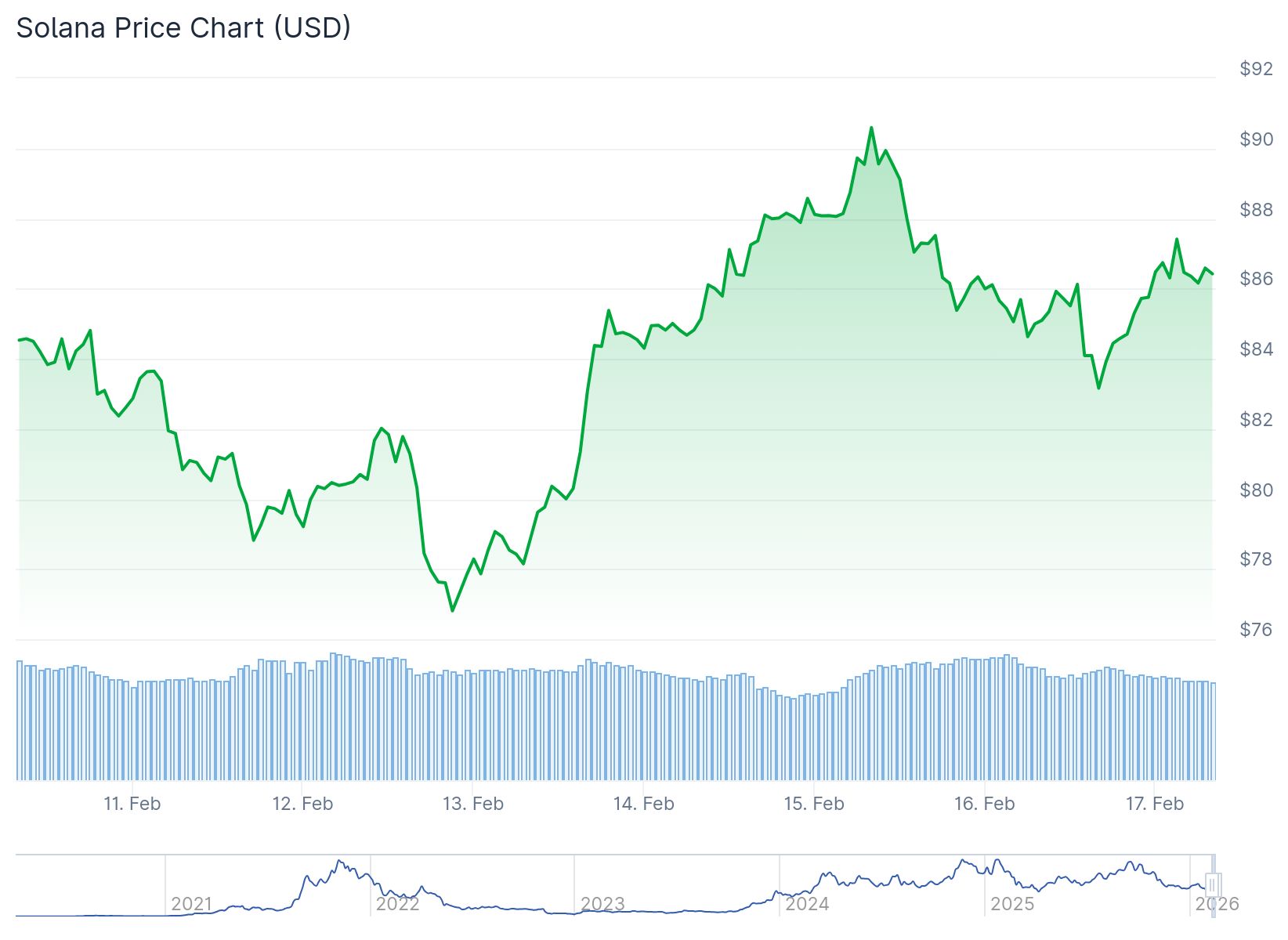

- Solana price fell below $90 and is currently trading above $85 after failing to break the $92 resistance level

- Bulls need to push SOL above $92 to trigger another rally, with next targets at $95 and potentially $102

- A rising channel pattern shows resistance at $88, with the 100-hourly moving average providing support

- If SOL drops below $82 support, the price could decline toward $76.50 or lower to $72

- Long-term analysis suggests a potential drop to $47-$49 based on weekly chart patterns, though short-term range is $76.60 to $89.80

Solana has entered a correction phase after failing to maintain momentum above $90. The cryptocurrency is currently trading above the $85 level, supported by the 100-hourly simple moving average.

Solana (SOL) Price

Solana (SOL) Price

The recent price action saw SOL decline from a high of $91.20. The token dropped below both the $90 and $88 levels in quick succession. This move took the price below the 50% Fibonacci retracement level measured from the $76.54 swing low.

Bulls stepped in to defend the $82 support zone. The price has since recovered and stabilized above $85. A rising channel pattern has formed on the hourly chart with resistance sitting at $88.

The immediate challenge for Solana lies at the $88 resistance level. Beyond that, the $90 mark represents the next hurdle. The key resistance level remains at $92, which has rejected previous rally attempts.

Path to Higher Prices

A successful break above $92 could open the door to $95. Further gains might push the price toward $102. However, failure to clear the $92 barrier could trigger another downward move.

The first support level sits at $85. Below that, $82 represents a critical zone that aligns with the 61.8% Fibonacci retracement level. A break below $82 would likely send SOL toward $76.50.

If the $76.50 support fails, the next target on the downside would be $72. The short-term range has been identified between $76.60 and $89.80, with $83.20 acting as the midpoint.

Long-Term Technical Picture

The weekly chart shows a more bearish outlook for Solana. A head and shoulders pattern formed after the price reached $252.90. This pattern, combined with Fibonacci extension levels, points to a potential target of $47-$49.

The weekly Directional Movement Index indicates a strong bearish trend remains in place. Moving averages on this timeframe also reflect downward momentum.

On the daily chart, several resistance zones have been identified. The $95 and $110 areas represent imbalances. The $120-$127 zone is marked as a bearish order block and another key resistance area.

Any bounce to these higher levels would likely face rejection given the longer-term downtrend. A break above $128.34, the daily swing high, would be needed to reverse the current trend.

Total Value Locked on the Solana network recently hit new all-time highs. This shows continued network confidence despite the price decline. The real-world asset market cap on Solana also surpassed $1 billion.

Banking giant Citi completed an internal proof of concept using Solana. This development shows traditional finance institutions are exploring the blockchain.

The current price action has SOL trading in a defined range over the past ten days.

The post Solana (SOL) Price: Bulls Eye Breakout As Token Holds Above $85 Support appeared first on CoinCentral.

You May Also Like

Russians flock to US messenger imo amid restrictions on Telegram and WhatsApp

Rockwell Automation Cuts Maintenance Costs, Finds Savings for Canadian Supplier, Perth County Ingredients, with Fiix CMMS