Meituan (3690.HK) Stock; Plunges 12% Despite 11.7% Revenue Rise

TLDRs:

- Meituan revenue rises 11.7% but profit falls nearly 97% amid delivery price war.

- Increased costs, courier incentives, and marketing spend drive Q2 earnings slump.

- Competition with Alibaba and JD.com pressures margins across local commerce operations.

- JD.com’s full-time rider model challenges Meituan’s gig economy approach in China.

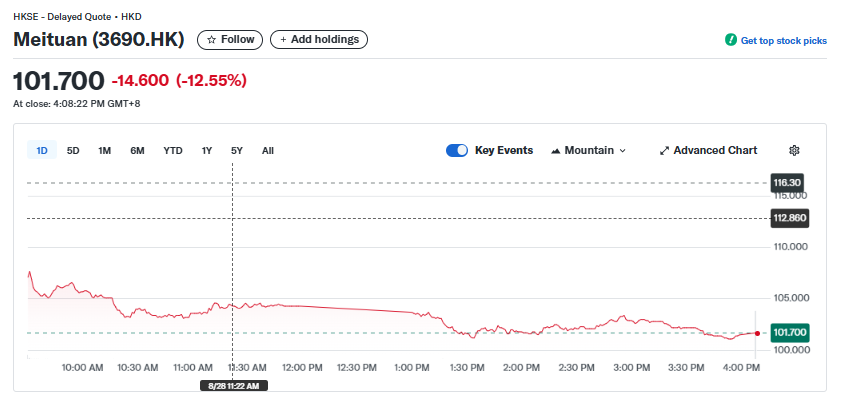

Meituan, the Beijing-based food delivery and local commerce giant, saw its stock drop 12.55% following the release of its Q2 2025 results, despite posting a year-on-year revenue increase of 11.7% to 91.8 billion yuan (US$12.8 billion).

Analysts had expected stronger revenue growth, and the disappointing earnings report sent investors sharply lower.

Net profit fell 96.8% to 365.3 million yuan (US$51 million), while adjusted net profit declined 89% to 1.5 billion yuan (US$209.7 million). Operating profit from Meituan’s local commerce segment decreased 75.6% to 3.7 billion yuan (US$517 million), with the operating margin dropping to 5.7%.

Meituan (3690.HK)

Meituan (3690.HK)

Costs and Competition Squeeze Margins

The company attributed the profit decline to several factors, including a 27% increase in cost of revenue, higher courier incentives, and rising delivery transaction volumes.

Meituan also expanded its grocery and overseas operations while boosting research and development spending by 17.2% and marketing expenses by 51.8%.

The financial pressure is compounded by intense competition from Alibaba’s Ele.me and JD.com. While Meituan and Ele.me continue to rely largely on gig-economy freelance riders, JD.com has taken a different path, hiring 150,000 full-time delivery riders to ensure service consistency and customer satisfaction.

Rival Strategies Intensify Market Battle

JD.com’s full-time employment model presents a stark contrast to Meituan’s gig-driven operations. JD.com has reported 25 million daily food orders using full-time staff, while Meituan processes 90 million orders daily via gig workers.

The divergence highlights how market disruption in mature sectors is not only a matter of pricing but also operational philosophy.

Investors are watching closely as the $37 billion Chinese food delivery market becomes increasingly capital-intensive. Both companies face high operational costs, yet late entrants like JD.com must spend disproportionately more to compete effectively, compressing margins across the sector.

Strategic Investments and Market Dynamics

Despite the challenges, Meituan remains the market leader, holding a 69% share of China’s food delivery sector. Its position demonstrates that even substantial financial outlays by competitors may not guarantee significant market share shifts.

However, the steep profit decline signals that sustaining growth in this mature market requires careful cost management and operational innovation.

The latest earnings report underscores broader lessons for investors and businesses: aggressive expansion in competitive sectors often comes at the expense of profitability, and diverse operational strategies can redefine market dynamics even when revenue growth continues.

Conclusion

Meituan’s Q2 results reveal the difficulties of maintaining profitability amid heightened competition and rising costs. While revenue growth signals continued consumer demand, the stock’s 12% drop reflects investor concern over margin compression and operational pressures.

Moving forward, the company’s ability to balance cost management, strategic investments, and competitive positioning will be critical in sustaining long-term performance.cation.

The post Meituan (3690.HK) Stock; Plunges 12% Despite 11.7% Revenue Rise appeared first on CoinCentral.

You May Also Like

USDC Treasury mints 250 million new USDC on Solana

The earliest statute of limitations for retroactive taxation on overseas income is 2017.