Bitmine Immersion accelerates ETH accumulation with $354.6M purchase

Bitmine Immersion has added 78,791 ETH to its treasury, bringing the total holdings to nearly 1.8 million ETH.

- Bitmine Immersion spent $354.6 million to acquire 78,791 ETH, raising total holdings to 1,792,960 ETH, valued over $8 billion.

- The company aims to hold 5% of Ethereum’s total supply.

- Tom Lee predicts ETH could hit $5,500 and potentially surge to $10,000–$16,000 by year-end.

- Strategic pivot from Bitcoin to Ethereum was announced in late June, backed by a $250 million capital raise.

Bitmine Immersion has added 78,791 Ethereum (ETH) to its holdings, spending approximately $354.6 million. The purchase brings the firm’s total Ethereum holdings to 1,792,960 ETH, valued at over $8 billion as ETH trades around $4,400. It also brings Bitmine closer to its stated goal of acquiring 5% of the total ETH supply.

This latest buy continues Bitmine Immersion’s aggressive Ethereum accumulation strategy. The publicly-traded company, under the leadership of Tom Lee, announced its strategic pivot from Bitcoin (BTC) mining to Ethereum accumulation in late June. That move was marked by a $250 million capital raise aimed at purchasing Ethereum as the company’s primary treasury reserve asset. The announcement led to a 3000% surge in BitMine’s stock price.

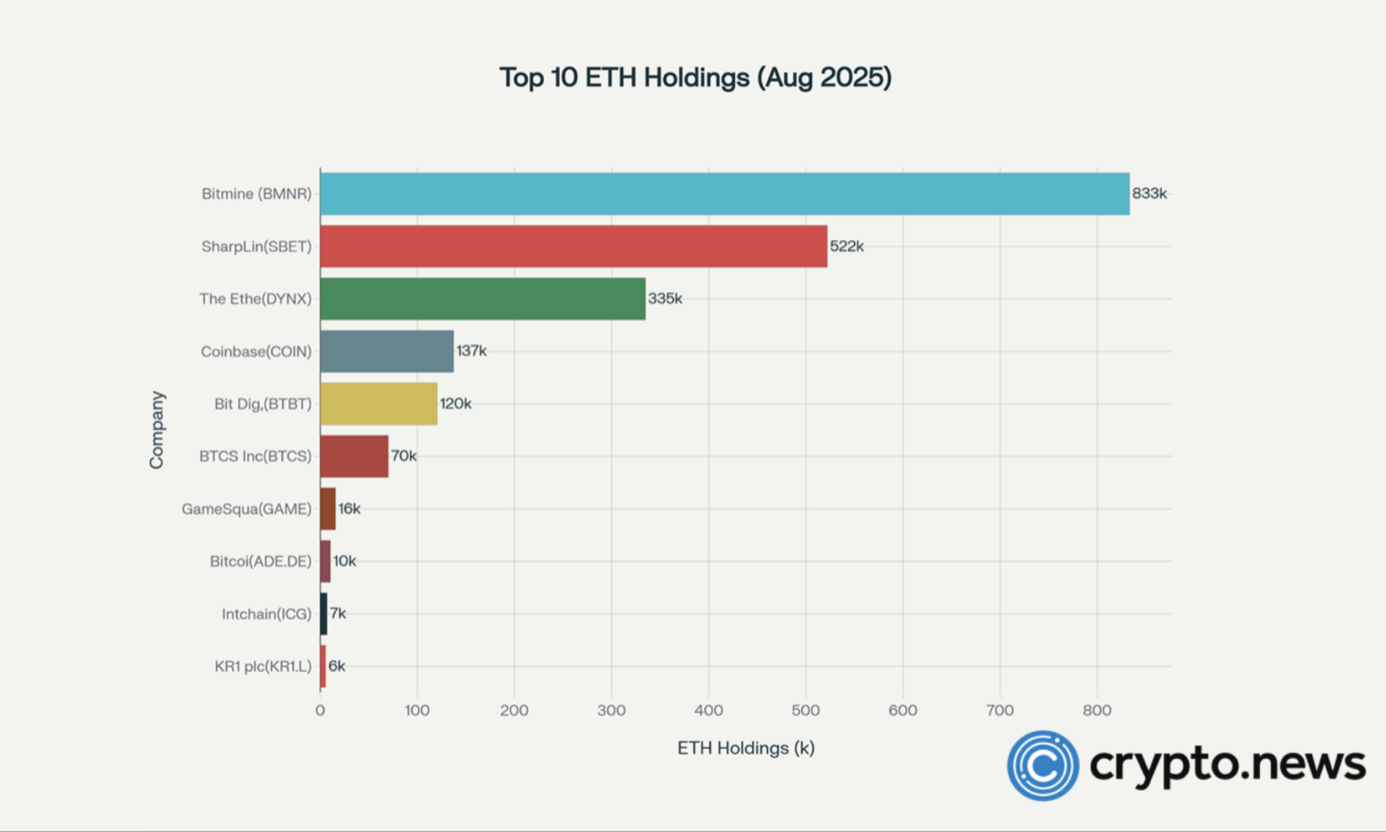

Bitmine Immersion leads institutional ETH accumulation

Bitmine Immersion’s pivot to ETH accumulation reflects the growing institutional interest in Ethereum this bull cycle. The trend contrasts sharply with the previous cycle, when ETH largely lacked significant corporate or institutional treasury backing.

Alongside Bitmine, other publicly traded ETH treasury firms, including SharpLink Gaming (SBET) and BTCS Inc. (BTCS), are seeing similar momentum.

Analysts suggest that ETH treasury stocks may offer more compelling valuations and operational flexibility than ETFs, as these companies combine liquidity, efficiency, and potential upside through capital structures not available in passive ETF products.

You May Also Like

Moldova to regulate cryptocurrency ownership and trading in 2026

JuanHand: Double-digit loan growth likely ’til 2030