Intel Corporation (INTC) Stock; Slides 2.12% as Intel Confirms Half of $11B Deal

TLDRs:

- Intel stock fell 2.12% to $24.40 after confirming receipt of only $5.7B from the U.S. government.

- The partial government funding covers a 10% stake in Intel’s domestic foundry business.

- Intel recently raised $2B from SoftBank and announced workforce cuts to 75,000 employees.

- The deal reflects U.S. priorities to secure domestic semiconductor production amid global supply chain challenges.

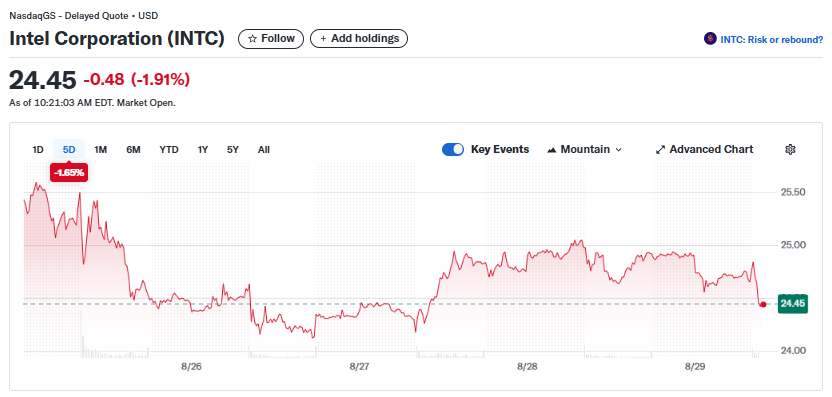

Intel stock dropped just over 2% in premarket trading on Friday, closing at $24.40, after the company confirmed it had received only $5.7 billion from the U.S. government, half of the initially announced $11 billion deal.

The government’s investment represents a 10% stake in Intel and is aimed at supporting its domestic foundry operations, a critical component of U.S. semiconductor production.

Finance chief David Zinsner highlighted that the government negotiated a 5% warrant if Intel’s foundry ownership falls below 51%, but he does not expect that scenario to occur. The deal is still being finalized by the Department of Commerce, with ongoing discussions to complete the funding.

Intel Corporation (INTC)

Intel Corporation (INTC)

Market Reaction

While government involvement initially sparked optimism, the partial funding tempered investor enthusiasm. Intel had previously seen modest gains, trading at $24.90 on Thursday, but premarket activity reflected market concerns over the company’s ability to fully leverage federal support.

Earlier this month, Intel also raised $2 billion from SoftBank through an equity stake and announced plans to reduce its workforce to 75,000, signaling ongoing restructuring efforts.

Strategic Focus on Domestic Foundry

The U.S. government’s investment aligns with a longstanding strategy of supporting domestic tech innovation for both commercial and national security objectives.

Intel’s foundry business is central to maintaining America’s semiconductor independence, a priority echoed in other federal technology investments over the decades.

The deal also highlights a wider industry trend of prioritizing supply chain resilience. Semiconductor companies like AMD, Apple, and Nvidia have accepted higher domestic production costs to secure operations within the U.S., emphasizing strategic stability over immediate cost savings. Intel’s partial funding offsets some of these premium expenses while strengthening its domestic capabilities.

Challenges and Future Outlook

Intel continues to face stiff competition from global rivals such as TSMC and Samsung. The company recently posted its first annual loss since 1986 and reported a Q2 2025 non-GAAP operating loss of $503 million. These pressures underline the importance of securing external capital and government backing.

While the partial $5.7 billion funding represents a meaningful step, investors are cautious, weighing both the opportunities and risks associated with federal involvement in corporate operations.

Analysts note that Intel must continue innovating and scaling its foundry business to regain market competitiveness.

Strategic Implications

Intel’s collaboration with the U.S. government underscores the intersection of public funding and corporate strategy in the semiconductor sector. Although the premarket stock dip reflects short-term caution, the partial deal signals Washington’s intent to secure domestic chip production and technological sovereignty.

The coming months will be critical in determining how effectively Intel leverages this investment to stabilize operations and compete globally.

The post Intel Corporation (INTC) Stock; Slides 2.12% as Intel Confirms Half of $11B Deal appeared first on CoinCentral.

You May Also Like

Moldova to regulate cryptocurrency ownership and trading in 2026

JuanHand: Double-digit loan growth likely ’til 2030