Urgent Bitcoin Whale Sell-Off: Is a $105K Retest Imminent?

BitcoinWorld

Urgent Bitcoin Whale Sell-Off: Is a $105K Retest Imminent?

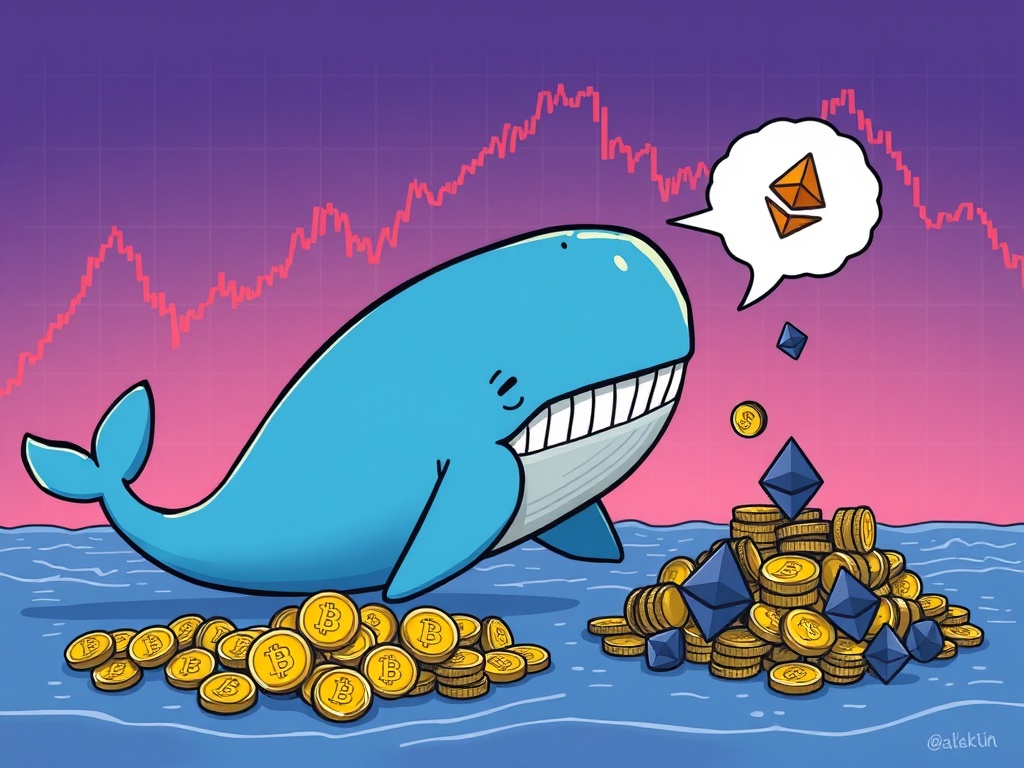

The cryptocurrency world is buzzing with a significant development that could impact Bitcoin’s short-term trajectory. Recent reports suggest that a major Bitcoin whale sell-off is underway, potentially paving the way for a price correction. Analysts are closely watching these movements, with some predicting that Bitcoin could retest the $105,000 mark.

What’s Driving This Bitcoin Whale Sell-Off?

According to a Cointelegraph report, a long-term Bitcoin holder, identified by analyst Ted, has been actively divesting a substantial portion of their holdings. This particular whale sold a staggering 32,000 BTC over the past two weeks. Such a large-scale liquidation from a single entity naturally sends ripples through the market, influencing sentiment and supply dynamics.

This isn’t just a simple sell-off; it’s a strategic move. The funds from this significant Bitcoin whale sell-off were immediately reinvested. The whale reportedly purchased 870,000 ETH, valued at an impressive $3.8 billion. This substantial shift from Bitcoin to Ethereum highlights a potential strategic reallocation of capital by a major player in the crypto space.

Is the Whale Eyeing More Ethereum?

The analyst further noted that this particular whale still holds over 50,000 BTC. There is a high probability that this remaining amount could also be converted into ETH. This potential continued shift could amplify the effects of the initial Bitcoin whale sell-off, creating further downward pressure on Bitcoin’s price while potentially bolstering Ethereum’s position.

Such large-scale movements by whales often precede significant market adjustments. While individual investors cannot match the scale of these transactions, understanding these patterns offers crucial insights into potential market trends. The market is currently dominated by sellers, a sentiment echoed by Cointelegraph’s analysis.

How Do Spot Bitcoin ETFs Impact the Market During a Sell-Off?

Spot Bitcoin ETFs have become a significant factor in market dynamics, often acting as a major source of demand. However, the market recently experienced a temporary headwind. With the U.S. stock market closed on a particular day, there was a noticeable lack of inflows into these crucial investment vehicles. This pause in institutional buying can, at times, exacerbate the impact of a significant Bitcoin whale sell-off, as there is less counter-balancing demand.

When large sellers are active and institutional buying is on hold, the market can feel the pressure more acutely. This scenario underscores the interconnectedness of traditional finance and the crypto market. Therefore, monitoring both on-chain whale activity and traditional market indicators becomes essential for a comprehensive understanding of Bitcoin’s immediate future.

Responding to the Bitcoin Whale Sell-Off: What Should Investors Consider?

Given the current market conditions and the ongoing Bitcoin whale sell-off, investors might wonder about the best course of action. It is important to remember that price corrections are a natural part of any volatile market. Here are some considerations:

- Monitor On-Chain Data: Keep an eye on whale movements and large transactions, as they often provide early indicators of market shifts.

- Understand Market Cycles: Bitcoin has a history of volatility, with periods of significant gains followed by corrections. This current situation might be part of a larger cycle.

- Diversification: Consider a diversified portfolio to mitigate risks associated with single asset volatility.

- Risk Management: Never invest more than you can afford to lose, and have a clear exit strategy.

- Long-Term vs. Short-Term: Differentiate between short-term price fluctuations and Bitcoin’s long-term potential as a store of value and digital asset.

While a retest of $105,000 might seem daunting, it could also present opportunities for those with a long-term perspective. The resilience of Bitcoin has been proven time and again.

Conclusion: Navigating the Waves of Whale Activity

The intensifying Bitcoin whale sell-off, coupled with a strategic shift towards Ethereum, presents a compelling narrative for the crypto market. Analyst predictions of a potential $105,000 retest highlight the importance of staying informed and understanding the various forces at play. While market headwinds from a lack of ETF inflows can add pressure, the crypto ecosystem remains dynamic and full of potential. Investors are encouraged to conduct their own research and make informed decisions, keeping a close watch on both whale movements and broader market sentiment.

Frequently Asked Questions (FAQs)

What is a ‘Bitcoin whale’?

A ‘Bitcoin whale’ refers to an individual or entity that holds a very large amount of Bitcoin, typically enough to significantly influence market prices with their trades.

Why would a whale sell Bitcoin to buy Ethereum?

Whales might sell Bitcoin to buy Ethereum for various strategic reasons, including diversification, a stronger belief in Ethereum’s future growth or utility, hedging against potential Bitcoin downturns, or optimizing their portfolio for different market cycles.

How do spot Bitcoin ETFs affect the market?

Spot Bitcoin ETFs provide an accessible way for institutional and retail investors to gain exposure to Bitcoin without directly holding the asset. Inflows into these ETFs typically increase demand for Bitcoin, potentially driving up its price. Conversely, a lack of inflows can remove a key source of buying pressure.

Is a $105,000 Bitcoin price correction definite?

No, market predictions are never definite. Analyst Ted’s prediction of a $105,000 retest is based on current whale activity and market conditions. However, the crypto market is highly volatile and influenced by numerous factors, so actual price movements can vary.

What should investors do during a Bitcoin whale sell-off?

During a Bitcoin whale sell-off, investors should prioritize research, consider their own risk tolerance, and avoid impulsive decisions. Monitoring market data, understanding the broader context, and adhering to a well-thought-out investment strategy are key.

Did you find this analysis helpful? Share this article with your network to help others understand the dynamics of the ongoing Bitcoin whale sell-off and its potential implications for the market!

To learn more about the latest crypto market trends, explore our article on key developments shaping Bitcoin price action.

This post Urgent Bitcoin Whale Sell-Off: Is a $105K Retest Imminent? first appeared on BitcoinWorld and is written by Editorial Team

You May Also Like

The Channel Factories We’ve Been Waiting For

How ZKP’s Daily Presale Auction Is Creating a New Standard for 1,000x Returns