Solana tokenized assets hit record $500M milestone

Solana tokenized assets have surpassed $500 million in value, marking a major milestone for a chain best known for hosting memecoins.

- Stablecoins dominate Solana tokenized assets, with USDC and USDT accounting for the majority of the $11.1 billion market cap across 17 tokens.

- U.S. Treasuries and institutional alternative funds contribute significantly, with Ondo Finance’s USDY and OUSG products, along with other alternative assets, adding hundreds of millions to Solana tokenized asset value.

Solana (SOL) has hit a major milestone in the RWA space, with tokenized real world asset value on the blockchain surpassing $500 million.

According to data from RWA.xyz, the majority of this value comes from stablecoins, which collectively hold over $11.1 billion in market cap across 17 different tokens on the network. Circle’s USD Coin (USDC) commands a dominant 70%+ share of Solana’s tokenized asset market, with a total value of $8.18 billion. Tether Holdings follows with $1.94 billion in tokenized Tether (USDT), capturing almost 17% market share.

Beyond stablecoins, tokenized U.S. Treasury debt represents the second-largest category of RWAs on Solana, totaling $304.6 million. This segment is primarily driven by Ondo Finance, whose two products—USDY and OUSG—account for a combined $249.4 million.

Institutional alternative funds contribute $135.2 million to Solana’s total RWA value, led by OnRe’s Onchain Yield Coin (ONYc) accounting for the bulk of the category.

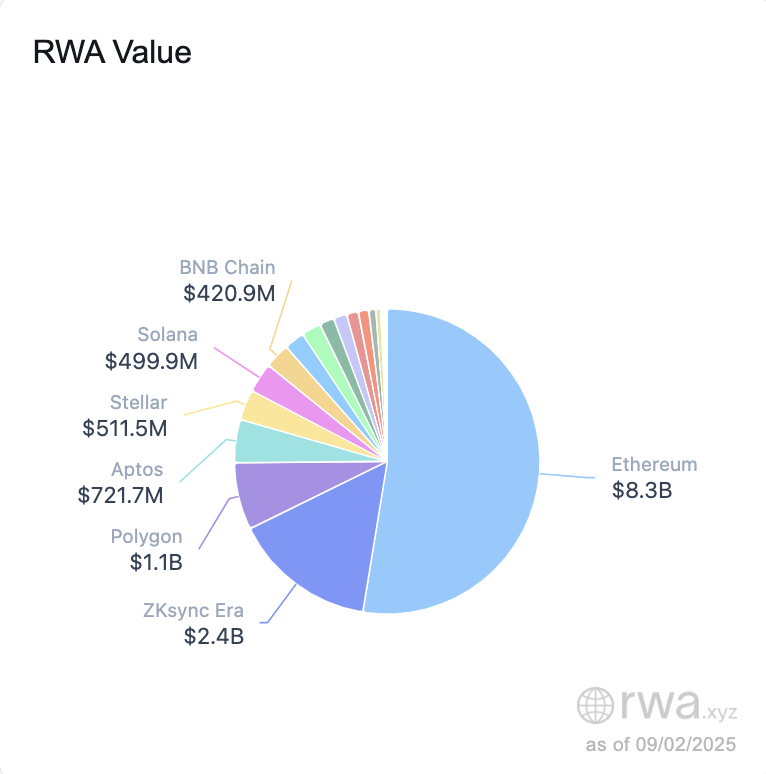

This growth positions Solana ahead of BNB Chain, which holds $420.9 million in tokenized RWAs, and nearly on par with Stellar, whose total RWA value stands at $511.5 million.

Solana tokenized assets gain traction among big banks

Although the value of Solana tokenized assets still represents only a fraction of Ethereum, zkSync Era, and Polygon, surpassing $500 million highlights its growing credibility as a platform for serious financial infrastructure — a noteworthy milestone for a chain best known for hosting memecoins.

Moreover, major banks and institutional players are increasingly turning to Solana for tokenization, drawn by its high throughput, low costs, and ability to handle large-scale operations. Partnerships like the recent deal between the Solana Foundation and R3—which counts HSBC, Bank of America, Euroclear, and the Monetary Authority of Singapore as clients—show that TradFi increasingly sees Solana as a faster, more efficient alternative to Ethereum for moving RWAs onto public blockchains.

You May Also Like

FCA komt in 2026 met aangepaste cryptoregels voor Britse markt

‘Groundbreaking’: Barry Silbert Reacts to Approval of ETF with XRP Exposure