Asset managers shift from Bitcoin to Ethereum amid volatile August, analysts say

Crypto markets swung hard in August 2025, with Bitcoin hitting a new all-time high before a whale sale sent it back near $113,000. Amid that, professional managers quietly shifted strategies, cutting exposure to Bitcoin and adding it to Ethereum and DeFi tokens.

- August 2025 was a volatile month for crypto, with Bitcoin swinging between $112,000 and $124,400 before a whale-driven sell-off pulled it back to $113,000, while Ethereum and DeFi tokens surged amid ETF inflows and staking yields.

- Finestel analysts say professional asset managers responded by cutting exposure to Bitcoin, boosting Ethereum and DeFi altcoins, and leaning on stablecoins for safety.

- Institutional and regulatory developments added clarity, reinforcing a more disciplined, yield-focused market.

Some months in crypto feel like a rollercoaster. And August 2025 was no exception. With price swings, regulatory updates, and whale-driven dumps, the month was anything but dull for traders.

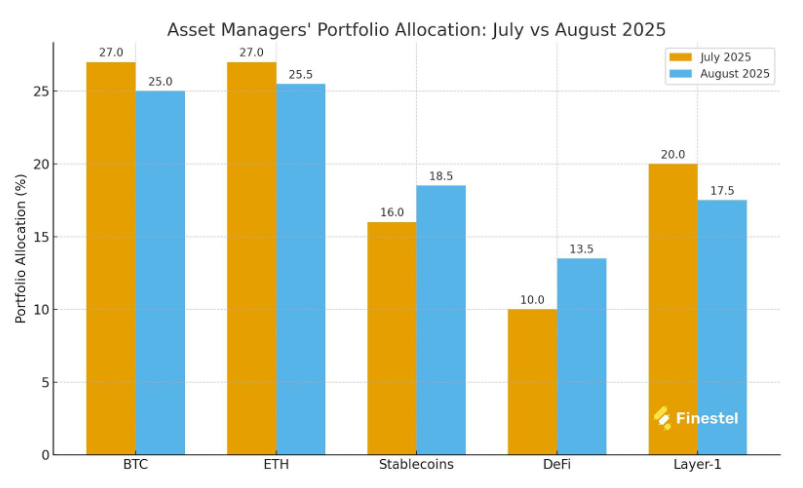

Finestel, a platform for crypto auto trading and client management, found that professional investors were quietly changing their strategies last month. In an analytical report shared with crypto.news, the firm revealed that asset managers mainly focused on cutting exposure to Bitcoin (BTC) at peaks, and instead adding it to Ethereum (ETH), DeFi tokens, as well as leaning on stablecoins for safety.

One big whale

Bitcoin, which began August in the $112,000-$119,000 range after weak U.S. jobs data and tariff news, saw optimism mid-month when Fed Chair Jerome Powell implied there might be a September rate cut.

And while that ballooned BTC to a new all-time high at $124,400 and briefly pushed the crypto market above $4 trillion, the rally still ended abruptly after a whale fat-fingered a 24,000 BTC sell, sparking $900 million in liquidations and sending Bitcoin back toward $113,000 by the month’s close. Despite those up and downs, Finestel noted that Bitcoin managed to close the month at a modest 2.5% gain.

Pretty expectably, Ethereum was the main outperformer last month, rising 12.8% to $4,600. Supported by ETF inflows, institutional staking at 29.4%, and expanding DeFi activity, ETH managed to steal the spotlight after BitMain’s Tom Lee announced plans to scoop up ETH for the company’s balance sheet.

As for DeFi tokens, Finestel says platforms like Pendle and Hyperliquid saw total value locked reach $6.75 billion and $3.38 billion, respectively, while the ETH staking yields between 5-10% became “irresistible for managers seeking predictable income.”

Altcoins had their moments too. For instance, Solana (SOL) climbed 15% to $200, while XRP (XRP) gained 10% to $3 amid its SEC victory, and Chainlink (LINK) soared by 18%. However, not all boats floated as memecoin lost favor as managers began rotating “into more compliant assets,” Finestel said.

During the same timeframe, stablecoins quietly gained their share, with market capitalization growing to $280 billion and portfolio allocations rising from 16% to 18.5%, the data shows.

Institutional and regulatory moves also defined August, with spot Bitcoin ETFs seeing $219 million in daily inflows, Ethereum ETFs adding $900 million weekly, and corporate treasuries like Google and Wells Fargo revealing crypto buys. In the U.S., for example, 401(k) approvals and new stablecoin rules opened the path for a big liquidity influx.

As crypto.news reported earlier, analysts at Bitwise suggest that even just a 1% inflow from 401(k) assets might lift its price to roughly $193,970. A 10% allocation shift, about $1.22 trillion in theoretical buying power, could — if the relationship scaled linearly — push prices toward $868,700.

The firm concluded that August was less about chasing upside and more about “building defenses, and staying adaptable.” Their recommended allocations for a historically bad September suggest Bitcoin and Ethereum at roughly 50%, stablecoins near 19%, DeFi and RWAs at 14%, and other Layer-1 altcoins around 17%.

And if July was full of life, August was more like a month of measured moves, the analysts said, adding that surviving in crypto requires adapting fast and letting data drive decisions.

You May Also Like

LMAX Group Deepens Ripple Partnership With RLUSD Collateral Rollout

Pastor Involved in High-Stakes Crypto Fraud