Bitcoin could crash to $50k in 2026 after October top, analyst warns

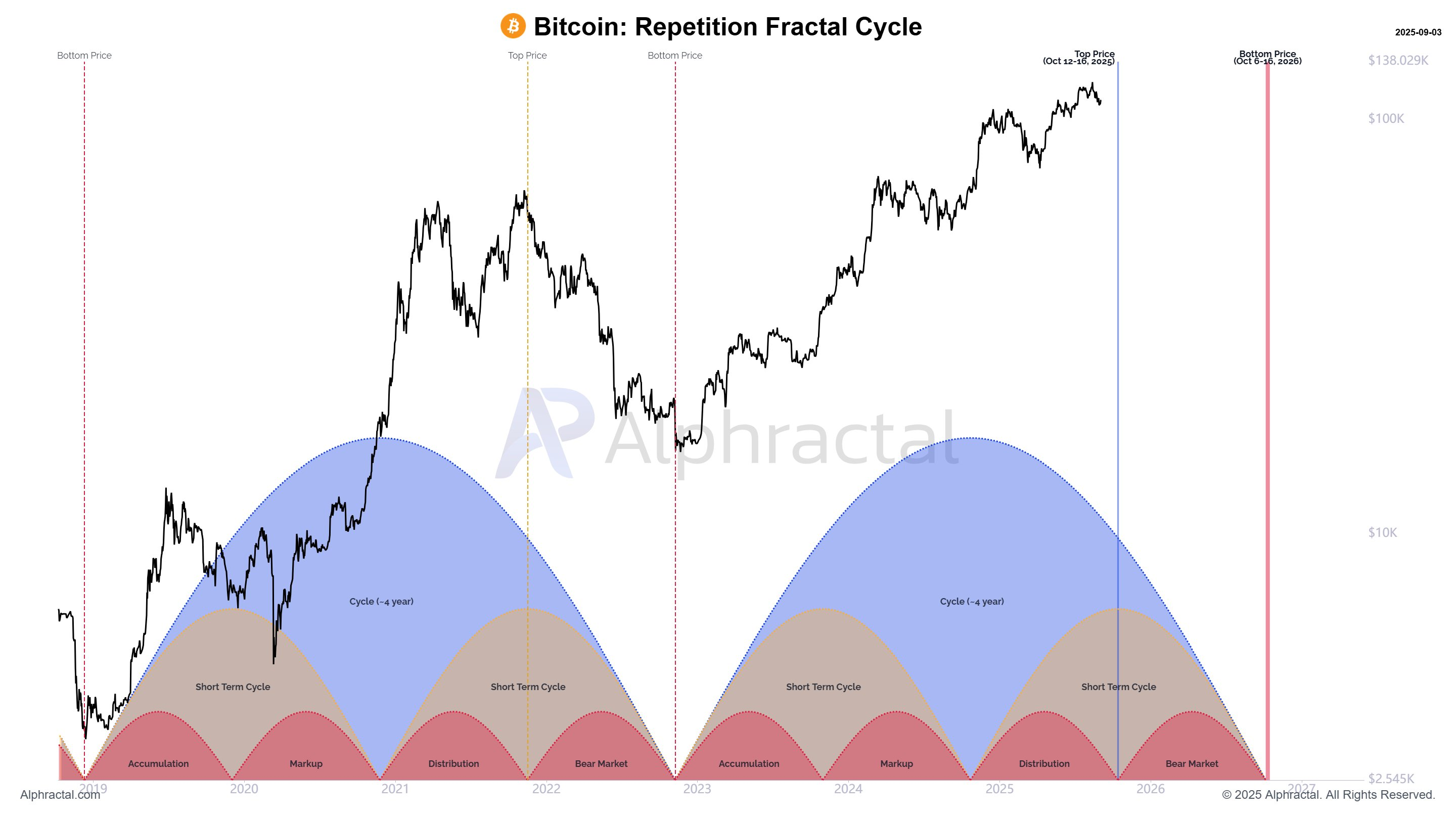

Analyst Joao Wedson warns that an October “judgment day” could set Bitcoin up for a crash to $50,000 next year.

- Bitcoin may be approaching a bear market that could send its price down to $50,000

- A long-term chart suggests that Bitcoin is nearing its top, possibly at $140,000

- Wall Street is likely to guide Bitcoin’s movements in the near future

Bitcoin (BTC) may be heading toward a “judgment day” in October 2025, according to a reading from a long-term pattern. On Wednesday, September 3, analyst Joao Wedson warned that the market is closing on its four-year cycle and approaching a bear market that could see it crash to $50,000.

While Wedson cautions against drawing a conclusion based on only that chart, which puts the market top one month ahead, he states that this may be possible. In this case, Bitcoin could dip to $100,000 before surging past $140,000 in weeks. After that, traders can expect a crash to $50,000 in the 2026 bear market.

Will Bitcoin crash to $50K in 2026?

Still, the real question is if the fractal remains reliable, Wedson asks, given the growing institutional demand and ETFs that are driving its price up. Still, there are potential headwinds that serve as a counter-narrative. Notably, macroeconomic pressures are still creating fears in the stock market.

Most of Wall Street is worried about the effects of tariffs on the stock market, while the Federal Reserve is concerned about their effects on inflation. Even Trump’s former ally, Elon Musk, as Wedson points out, warned that Trump’s tariffs would cause a recession in the second half of 2025, in a since-deleted post.

If stocks go into a bear market, Bitcoin will likely follow, especially due to the significant institutional exposure to the asset. If institutions start fleeing into safer investments, Bitcoin faces a significant liquidity crisis.

You May Also Like

The whale "1011short" bought 22,000 ETH, worth approximately $63.56 million.

Morning Update — 26 January 2026