Bitcoin Price Gets Rejected at $113k Again Amid Rising Odds of Fed Rate Cuts

The post Bitcoin Price Gets Rejected at $113k Again Amid Rising Odds of Fed Rate Cuts appeared first on Coinpedia Fintech News

Bitcoin (BTC) recorded a higher volatility on Friday, September 5. The flagship coin led the wider crypto market in higher volatility after the Bureau of Labor Statistics released key data on employment.

According to market data from TradingView, the BTC/USD pair surged during the late London session and reached its range peak of about $113k during the early New York session. The gains were, however, erased during the mid New York session as BTC price retraced to trade about $110,713 at the time of this writing.

Bitcoin Price Drop Amid Rising Odds for Fed Rate Cuts

Friday’s Bitcoin price gain and sudden drop were triggered by the announcement that the U.S. economy just added 22k jobs, way below the expected 75k jobs in August. The weak labor market data saw the U.S. unemployment surge to the highest level since October 2021.

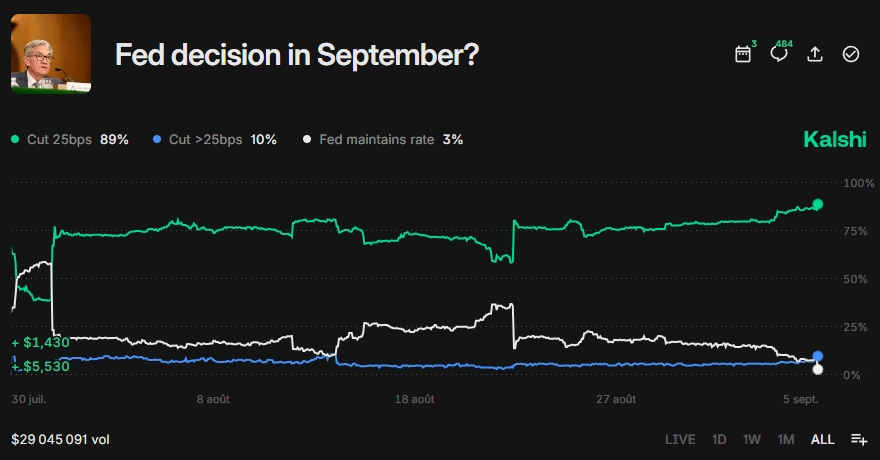

As a result, traders are expecting the Federal Reserve not to hold its benchmark interest rate on September 17, 2025. According to market data from Kalshi, the odds of a 25bps Fed rate cut in September surged to a new all-time high of 89%.

Most importantly, Kalshi traders are now predicting a higher chance that the Fed will initiate a rate cut of more than 25 bps in September than maintain its rate. A similar scenario was recorded by Polymarket traders.

Why Did BTC Drop Amid High Chances of Fed Rate Cuts?

The BTC price drop on Friday was partially influenced by the low demand from whale institutional investors. For instance, the U.S. spot BTC ETFs recorded a net cash outflow of about $227 million on Thursday.

Meanwhile, the recent Gold price surge to a new ATH of around $3,600 per ounce has sucked liquidity from the Bitcoin market. For example, El Salvador purchased $50 million worth of Gold during the past few days.

What’s the Midterm Expectation for BTC Price?

Bitcoin price was rejected at a crucial resistance level around $113k, thus likely to retest the support range between $107.5k and $108k again. If the buyers fail to defend this support level, which has been established in the past few days, further correction will be inevitable.

Crypto analyst Michaël van de Poppe has predicted that the BTC price is likely to retest the support area around $103k before rebounding to a new all-time high in the coming months.

You May Also Like

CEO Sandeep Nailwal Shared Highlights About RWA on Polygon

Uniswap & Monero Chase Gains: While Zero Knowledge Proof’s Presale Auctions Target Record $1.7B